What You Need to Know – coronavirus update

February 26, 2020

A fundamental part of being an investor is having a strategy for handling challenging times. It takes someone with a rationale mind, a steady hand, and an ample supply of knowledge and grit to be an investor in times of uncertainty.

And once again, we find ourselves in such a time. It is never easy and it’s not meant to be. This event will definitely test your will as an investor and we are here to help you navigate it every step of the way.

The current situation is particularly challenging as it is largely attributed to the coronvavirus. There is very little known information as it relates to the virus. Yes, there is a lot of news flow and speculation but on the whole, it is a low information event.

As a result, it is difficult to apply rationale and reason to this downturn. And if you can’t fully understand and evaluate the cause, how can you possibly understand and evaluate the likely outcome?

We’re not going to pretend to know what will happen from here as it relates to the coronavirus. As we said, there is a very low level of reliable information available concerning the coronavirus. We are not among the handful of specialized epidemiologists in the world that have the credibility to comment on how this will play out (and caution you that most investment professionals commenting on this are not either).

Instead, we are going to focus on what we know to be true.

1.) Diversified allocations provide protection

For Windermere clients reading this post, you will be well served to remember that we have worked together over the years to create a plan that includes a diversified allocation for your portfolio -meaning that you have a mixture of cash, fixed income, equities, and alternatives matched to your long term goals. In periods of stress for equity markets, other asset classes tend to hold their value or appreciate. This has been the case the past few days as bond yields have fallen (fixed income prices appreciate). The diversification will cushion the downward move in equities

2.) Liquidity stores provide protection

For Windermere clients currently living off their portfolios, we have structured your allocations to provide sufficient liquidity to cover at least 3-5 years of cash flow needs (from both cash and fixed income balances as well as portfolio income). What does this do? It prevents you from reacting. It allows you to live your life as planned. It allows you to be patient. It allows you to stay the course.

3.) Everyone has an opinion. No one has a crystal ball

Media has a job to do – never forget that. They are in the business of attracting attention and increasing click-thrus and viewership so they can sell more advertising. Flashing red numbers, prime time specials, and sensational headlines that spark fear and concern tend to get the attention they seek. Business news shows that one week ago were filed with analysts calling for record highs and upping price targets on countless stocks are now filled with analysts predicting an imminent “crash” and giving their opinions (not facts) on the situation and the virus.

We know for sure that everyone (including you and us) has an opinion. But no one can predict the future. Focus on what you know and don’t mistake opinion and panic for fact.

4.) History doesn’t repeat but it may very well rhyme

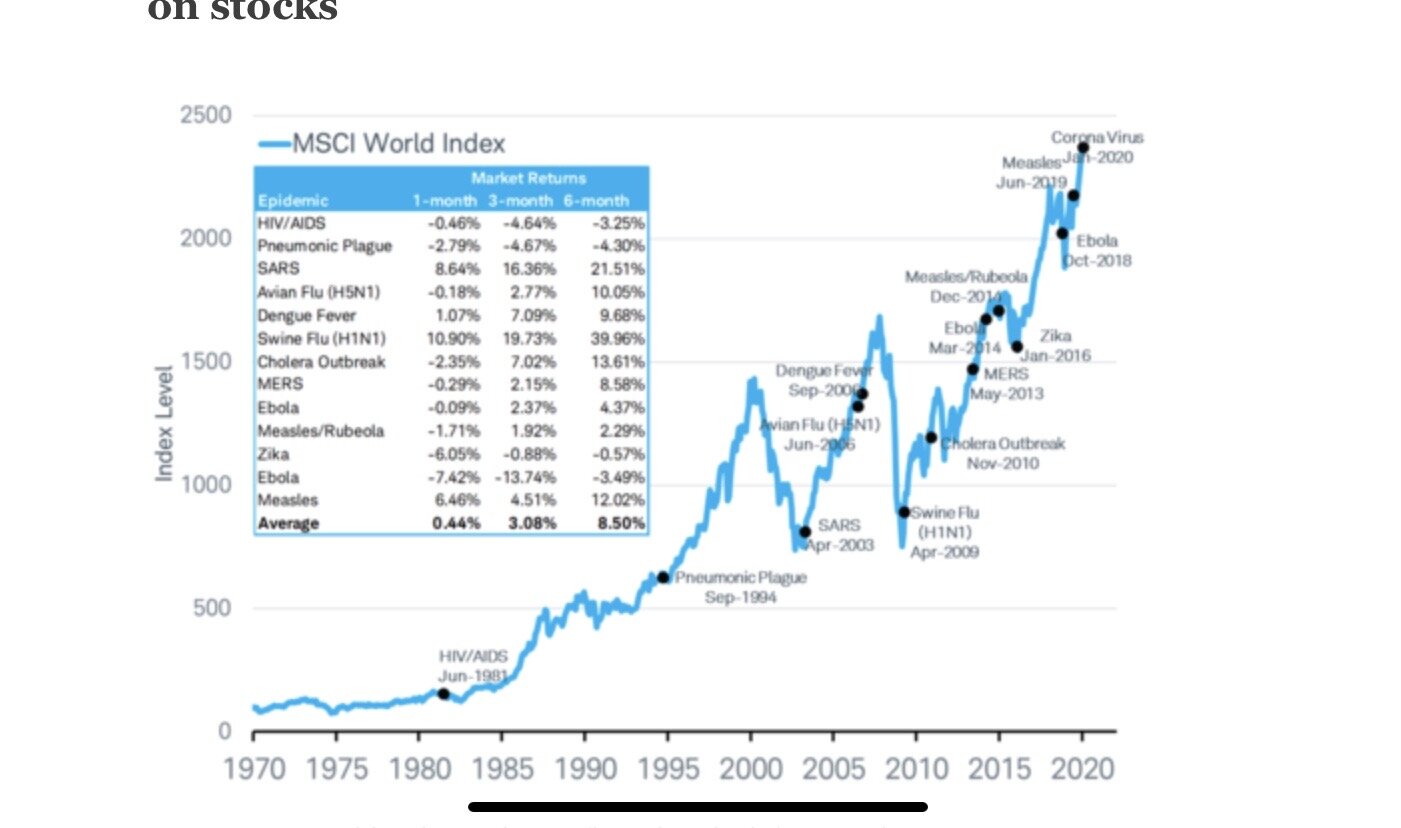

It’s a known fact that history doesn’t repeat itself exactly. However, it very well may rhyme, meaning that we can look to similar events for some context. The below chart shows how markets have reacted to past pandemics (note: we are not yet in that state for coronavirus but it may trend that direction).

As you will see, in these cases, the best action was no action – as it was difficult to predict a bottom and equally challenging to predict when the rebound would begin.

Are things the exact same this time? No. Facts have definitely changed. The world is far more interconnected now. Supply chains are globally linked. China represents 16% of global output, as opposed to 4% during the last outbreak (SARS). This article from Schwab outlines some other facts that are helpful in understanding the current situation .

In addition, this article does a nice job articulating what may give us a “V” shaped recovery that has occurred in prior incidents (namely, some level of containment), or what would give us more of a “U” shaped recovery (namely, some level of mitigation and containment combined).

5.) Investing remains a matter of choice

Investing has always been about choice – where do you choose to put your capital to meet your long term goals? For the vast majority of us (myself included), leaving all of our invested capital in cash and fixed income in today’s rate environment will not allow us to meet our goals. The returns are just too low, especially when inflation is taken into account.

As equity prices have fallen in recent days, so have interest rates. Low rates make it increasingly difficult to earn a sufficient return in asset classes such as cash and fixed income. While cash and fixed income may feel “safe” and comfortable in the short run (as the principal values may hold up), will real (ie: after inflation) returns ranging from negative to 3% get you to where you need to go in 5, 10, 20+ years?

Today and every day, you have a choice to make between the various investment alternatives. The one you choose is ultimately up to you but always remember, every choice you make comes at a price (whether it be increased volatility or lower expected returns over time)

6.) Volatility is normal – and not the only risk to focus on

Market action in 2019 and early 2020 has made many investors complacent. Equity markets are not meant to move in a straight line and volatility (ie: movement in price) is a normal part of the investing process. While these moves have been sudden and unnerving due to uncertainty related to the coronavirus, volatility is not the risk suggest you focus on. Permanent loss of capital is the risk that ultimately matters. The equity investments we hold are ownership interests in well-capitalized and well-diversified businesses. Could their operations and earnings be impacted in the short-run by this virus? Yes. Do we believe that these events will permanently impair their long-term potential to grow our capital? No. Do we believe these businesses may actually use this as an opportunity to borrow at lower rates or buyback their own stock, thereby improving their positions moving forward? Yes. Do we see this as a chance to selectively add to some of these businesses? Yes.

7.) Human toll should not be forgotten

The headlines related to this virus are almost universally focused on the economics – what is the impact to global growth, how much market cap has been lost in the markets, how is the global supply chain being altered, what companies are adjusting their earnings expectations, and countless others.

Let’s not forget the very real human toll of this outbreak. Over 2,600 people reportedly have lost their lives as of the writing of this post and approximately 80,000 have been infected. Countless others have lost loved ones, been unable to travel as planned, are concerned about families in impacted areas, and are at risk of losing their jobs or having their livelihoods directly effected.

This is not to minimize the financial impacts. They are real and they have been swift. But this is to say that it’s important to remember the human side of things and to seek some level of perspective and gratitude for all that we have.

Again, we understand and appreciate the uncertainty. We are processing it and coping with it right alongside you. When faced with something we aren’t able to fully understand or evaluate, it is most constructive to return to things we know to be true.

Invest on and as always, if you have questions, ask them. You were never meant to do this on your own.

Pam

Leave a note

Leave a Reply to Nick Cancel reply

You must be logged in to post a comment.

Thank you, this was a great read. A bit of perspective goes a long way!