Client Question: What are Multiples?

March 20, 2025

In recent weeks, clients have been consuming more financial news. This is understandable as when markets are volatile, the news media enjoys covering the ensuing drama and speculation. A client heard the term “multiple compression” and wanted to understand what that meant.

Multiple is another term for a commonly used valuation metric – the Price to Earnings Ratio.

Putting this into a formula you get: Multiple (ie: PE Ratio) = Price divided by earnings

Let’s look at the inputs to calculating a multiple:

Price is relatively easy to obtain as it is the market price of a stock on a particular date

Earnings represents the annualized earnings for the underlying company – either over the past year (which results in a trailing PE ratio) or expectations over the next year (which results in a forward PE ratio). Forward PEs tend to be the most useful as it brings in the upcoming expectations/value proposition for a company

If you rearrange the formula above, you can see that: Price = Multiple * Earnings

All else equal, if the price of a stock is rising (and earnings expectations are staying constant), it is the multiple that is increasing. This is a sign of optimism concerning a company as it means investors are willing to pay more per share of earnings. This dynamic is known as multiple expansion.

On the flip side, if the price of a stock is declining (yet earnings expectations are staying constant), the price change is being driven by the multiple falling. This is a sign of negativity towards a company or the market in general, as investors are wanting to pay less per share of earnings. This is known as multiple compression

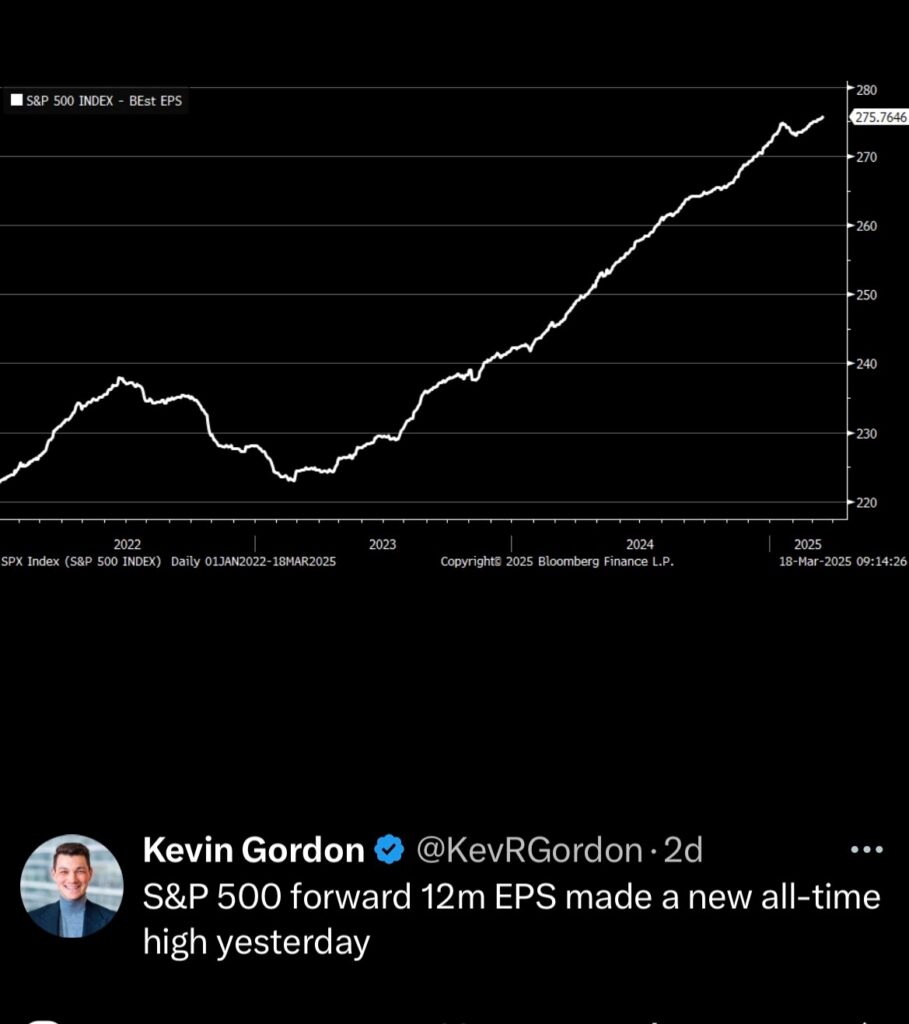

During this recent pullback, the change in the price level of many individual stocks, as well as the broad US equity indexes themselves, has been driven by multiple compression. How do we know that? Take a look at the below chart from Schwab’s Kevin Gordon.

As shown, earning expectations (the “E” in our formula) for the S&P 500 (the 500 largest US public companies) reached a new all time high last week. That component of the equation is higher than ever – and yet the price of the S&P 500 index (the “P) has fallen ~8% from its all time high. When the S&P was at its high (assuming $275 earnings per share), the multiple was 22.2. At its current level, with the same expected earnings, the multiple is now 20.6. And again, the multiple declining from 22.2 to 20.6 is known as multiple compression.

What can lead to multiples falling? Many of the factors we have been dealing with as of late (mostly at the macro level) – lower investor confidence, anticipated slowdown in earnings, preference for other asset classes, and fear. It can also be driven by company specific factors.

Multiple compression is the dynamic we’re dealing with as of late. Can we return to multiple expansion? Anything is possible – stay the course!

Leave a note