All Quiet on the Government Front

October 9, 2025

Another week has passed and the government shutdown continues. This has resulted in a very quiet flow of economic data as many of the key reports (such as the jobs report, CPI, and PPI) are calculated by government agencies that are currently furloughed.

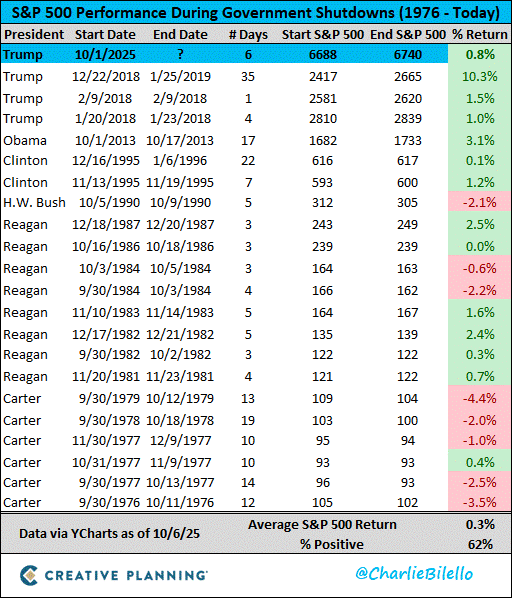

Markets seems to have shrugged off this information vacuum – at least for now. Equity indexes marched higher this week (hitting new all-time highs) and interest rates have stayed mostly stable. This is consistent with the market’s behavior during past shutdowns. As you can see in the below chart, the last 6 shutdowns all posted positive S&P 500 returns with an average gain of 0.3% since 1976.

The path forward for the shutdown remains unknown but the latest thinking is that it may resolve yet this month as the key October 15th payroll date approaches (withholding pay from critical workers (which will happen on this date) like military and air traffic controllers has been viewed as unpopular for both parties in past shutdowns and recent threats to not pay backpay is adding pressure to the discussion).

If this timeline does hold, it is possible that the economic reports may still be released before the next Fed meeting on October 28-29. Markets are pricing in a nearly 100% chance of a rate cut at that meeting. However, if the data takes a sharp and unexpected turn, the rate cut may be up for debate. Add in the quarterly earnings cycle that is set to begin in earnest next week and October promises to be an eventful month as always!

For now, the silence on the economic front has been somewhat nice, allowing markets to move off fundamentals and company-specific news. AI deals and expectations for a strong earnings cycle appear to be the catalyst for markets march higher. However, keep in mind the data will be released at some point and may cause the record-high tides to turn. As always, stay aware and retain your disciplined investment approach. As 2025 has taught us, anything can happen!

Onward we go,

Leave a note