Wait, is it good news or bad news?

March 10, 2023

It’s been yet another tumultuous week in markets. What caused the downward momentum this week? While one can never be certain, market prognosticators have largely pointed to Fed Chair Jay Powell’s comments in front of Congress, as well concerns over job market strength (non-farm payrolls will be released the day after I publish this).

Weeks like this always remind me of a tricky dynamic that can present itself in markets on occasion. At certain stages in the market cycle, good news in the economy/society is taken positively by markets (ie: good news is good news). And at other stages, good news in the economy/society is taken as bad news for markets. Wait what? Talk about confusing!

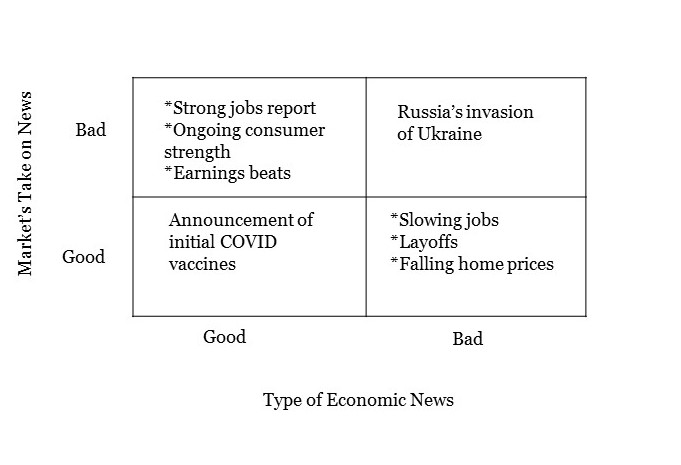

Here is a 2×2 matrix that may help

The easiest two quadrants to understand are when the type of news (and our interpretation of it) matches the market’s reaction. I chose two recent examples.

Good news, market takes it as good news (ie: goes up): the day the effectiveness of the COVID vaccines was announced. Arguably good news for society and markets agreed, rallying meaningfully on the news

Bad news, market takes it as bad news (ie: goes down): the day Russian invaded Ukraine. Terrible events for global stability and markets agreed and sold off in lock step.

Those two quadrants are easy to understand – but what do we do with the other two?

Right now, I’d argue we’re living in an investing world where we are flip flopping between the upper left and lower right (where good news is bad news, and bad news is good news). Markets are reacting positively to negative economic/societal news and are reacting negatively to positive economic/societal news. Why is this? It all comes back to the “i” words we are all growing tired of – inflation and interest rates. Let’s look at each one.

Good news for the economy (and society) in recent months has included items like a strong jobs reports, which shows strong levels of employment in the country and the ongoing strength and durability of the consumer (high levels of cash, ability to continue to spend). Both of these “good news” for the economy, right? What country wouldn’t want people employed and in strong financial health. The problem is fact patterns like these may be indicative of the fact that inflation will continue (lower unemployment leads to higher wages which leads to higher prices & ongoing consumer strength leads to ability to pay higher prices for longer). Markets fear this higher inflation will lead to more rate hikes (as the Fed tries to bring it back down) – and down come investment valuations.

On the flip side, markets are loving bad economic news these days. Weak job number? Cracks in the housing market? Falling car prices? Maybe not great for the economy but may very well serve as indications that inflation is falling and rate hikes may end – which markets love.

Markets moving in a non-intuitive way can be exhausting. I certainly can relate and am right there with you. We won’t always live in these two confusing quadrants. I find that markets are in the “good is bad/bad is good” mindset in times of transition and volatility. We are certainly in such a time right now. However, as things settle down and inflation abates and rates level out (yes, I believe this will occur – eventually), we can hopefully get back to the days when market’s reactions match our own emotions. Won’t that be a day to celebrate!

In the meantime, tune out the day to day noise. Focus forward. Manage your risk, your portfolio, and most importantly, your emotions.

Onward we go,

Leave a Reply

You must be logged in to post a comment.

Leave a note