Reality as Reassurance

July 20, 2023

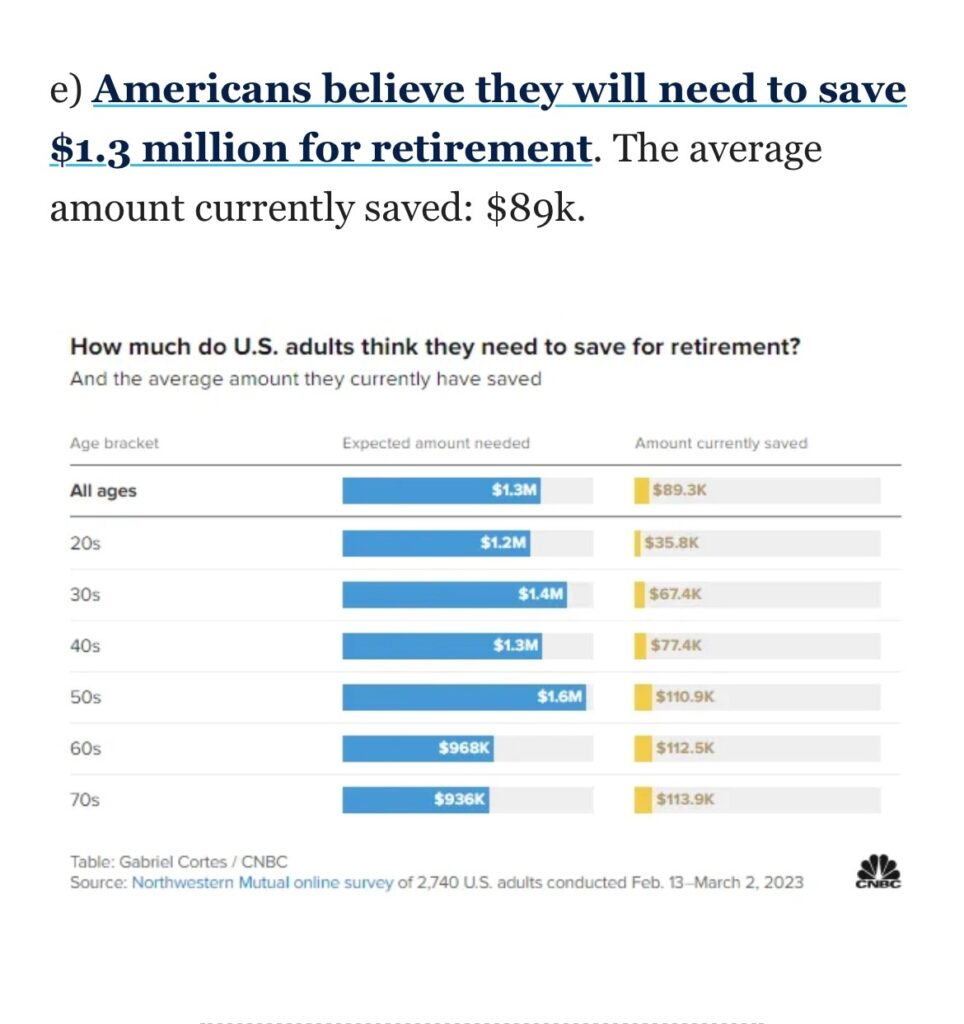

I was reviewing a weekly newsletter this week (yes, I read several others beyond the Friday Five!) when this headline caught my eye. It was sourced from this recent CNBC article on what adults in the US believe they will need to retire

Notice anything alarming about this summary graphic? Pretty much everything in the chart unnerved me – including the absolute value of the estimates, the relatively consistency of the estimates, and the considerable difference between retirement estimates and actual savings. However, what jumped out at me the most was the use of the word believe.

I get it – one can’t know the path of your life, finances, and investment markets with 100% certainty so there will always be some level of belief (vs. knowing) when it comes to any financial decision – including forecasting retirement. And of course, there are countless variables that impact any financials decision. In the case of retirement, there may be well over 50 items to evaluate in determining what your “number” actually is.

Yet, the fact remains there is a lot you can do (at any age) to move much closer to the “knowing” end of the spectrum than the “believing” (or worst yet “guessing”) end when facing a financial question. And yet, a meaningful amount of people don’t take these actions. Many treat retirement (and other financial decisions) as unknowable or insurmountable, choosing to proceed with life as usual and see where things end up. Why is this? I personally think a lot of it has to do with a reluctance to face reality when it comes to finances.

A recent blog post by one of my favorites Seth Godin was titled “Reality as Reassurance” and it seemed to hit on this concept perfectly. Here are a few key excerpts from his post (you can read the entire post here)

Culture makes it tempting (and easy) to insulate ourselves from reality. Credit card debt is an invisible burden, until it’s not. Ignoring the changes in our climate makes our days easier, but not our years.

It’s tempting because the reality we create for ourselves can provide a sort of shock absorber, allowing us to focus on how we’d like things to be, as opposed to how they are.

This is what I believe comes into play with many people and their financial lives. I encounter it in my practice when I meet with prospects, hearing comments like “I don’t really look at my accounts that often” or “I am not sure what I’m invested in,” or “I don’t have a financial plan in place.” I understand – it can be overwhelming and challenging to understand. However, by not engaging with our finances, reality is avoided but the resulting consequences of inaction may not be.

Seth goes on to argue that there are obvious pitfalls to avoiding reality – namely:

The problem with this avoidance is that we’re always concerned about reality butting in when we least expect it

And that’s just it – even if we don’t face reality when it comes to our financial lives (and key decisions such as retirement), they will eventually catch up to us. It’s just a matter of time.

If you find yourself delaying the inevitable and avoiding financial decisions, I encourage you to do the work necessary to uncover reality – dig into your specific situation, compile your current metrics, give thought to your future, ask yourself key questions, research important topics, partner with advisors as needed, reach key conclusions, and take action.

You may just discover that reality can be the greatest form of reassurance you’ll ever find.

Onward we go,

Leave a note