Best S&P 500 Sectors Over a Business Cycle

August 2, 2023

August is typically a challenging month for stocks and that is proving to be true yet again this year (at least as of August 2nd while I’m writing this note).

We did get relatively tame data regarding inflation and jobs earlier in the week and another jobs report will hit the wires shortly before this newsletter arrives in your inbox on Friday August 4 – and a slew of earnings releases in between.

Alas, the market will always move in both directions so instead of dwelling on the recent movements and data this week, I wanted to zoom out and cover an interesting topic (and one that is important for all investors to understand) – and that is, how to invest on a sector-basis during various stages of the business cycle.

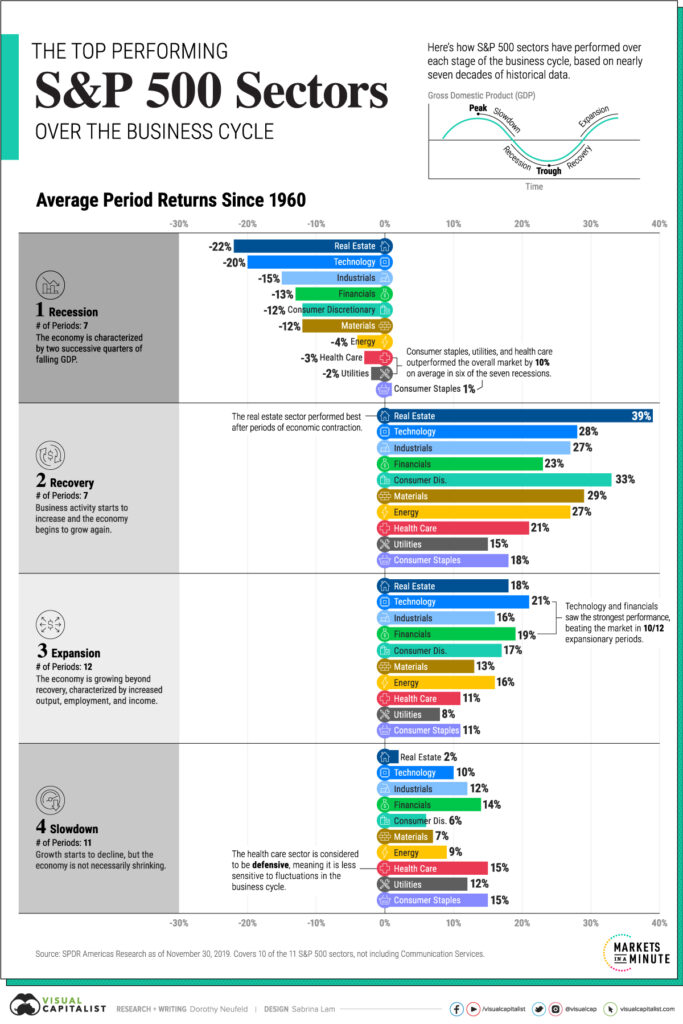

Before we dive into the infographic that summarizes a recent study in this area, let’s define the two components we’re looking at:

Stages of a Business Cycle

There are four common stages in any business cycle (after which a new cycle begins). They are:

Recession – Economy slows and growth falls right along with it. The layman’s definition is two quarters of negative GDP growth but that is actually not the textbook definition. But for brevity stake, know a recession is a broad economic slowdown where growth rates tend to be negative (as do people’s general demeanors!)

Recovery – Following a recession, you get a recovery. This is when growth starts to pick back up (as do people’s attitudes!)

Expansion – Expansion is where we all should want to live. Growth is accelerating (beyond recovery levels) and the economy is doing better and better, with growing employment, output, and income levels

Slowdown – While we may like it to, expansions can’t last forever. A slowdown is when growth starts to retreat but we are not yet at recessionary levels

S&P 500 Sectors

As luck would have it, I did a deep dive into the S&P 500 index this week. See that post for more information on the index but for this exercise, it’s important to know that the S&P 500 is comprised of 500 companies that operate in 11 different sectors. Those sectors (in size ranking from largest to smallest as of July 31, 2023):

Information technology, health care, financials, consumer discretionary, communication services, industrials, consumer staples, energy, utilities, materials, and real estate.

Since the S&P 500 is market-cap weighted, looking at the sector concentration allows you to see what industries are dominating the US economy at a particular point in time.

Sectors Over Business Cycles

When investing, many individuals choose to “buy the index” – meaning you invest in ETFs or mutual funds that track the performance of the index as a whole (there is approximately $17 trillion dollars tracking the S&P 500 so you are not alone if this is your approach!). Under this approach, you will earn the blended return of all sectors over your investment horizon.

However, if you wish to invest in individual stocks and/or individual sectors, it is important to consider how various sectors tend to perform at various stages of the business cycle – and equally important to discern where in the business cycle we are.

Visual Capital, one of my favorite follows on Twitter – opps sorry, I mean X (still getting used to that) – put out an infographic looking at how sectors perform during various stages of the business cycle. It was based on ~70 years of data. Here’s a link to the graphic if it’s hard to read below

If you consider the dynamics during the various business cycle stages – and how each sector earns its keep – the results do make logical sense. However, this is an “easier said than done” exercise. Why? Because it can be very hard to discern where exactly in the business cycle we are (or where we’re heading in the upcoming month/year) – and getting that wrong can lead you to pick the wrong sectors.

Take a recent example – 2023. Heading into this year, the general consensus was a recession – either the US was already in one or we’d be in one in no time at all. If that was your investing thesis, based on top performing sectors in a recession, you would have been overweigh Consumer Staples, Utilities, Health Care, and Energy – while underweighting Real Estate, Technology, and Consumer Discretionary. Here are the year to date returns for the sectors listed:

Overweight if you thought 2023 would bring a recession YTD performance -> Consumer staples: 3.5%; Utilities: (3.4%) Health Care: (0.5%) Energy: (1.5%)

Underweight if you thought 2023 would bring a recession YTD performance -> Real Estate: 5.1%, Technology: 46.6%, Consumer Discretionary: 36.3%

See the danger? First you have to get the business cycle identification right – and then you need to select the winning sectors for that predicted backdrop.

No one said it would be easy! But hopefully this graphic proves helpful in the future.

Onward we go,

Leave a note