Big Short Sequel?

November 6, 2025

If you followed the financial news this week, you undoubtedly heard the story about a US investor named Michael Burry, famously known for the bet he made against the US market prior to the 2008 financial crisis (focused on the complex instruments linked to the US housing/mortgage market). Spoiler alert – he was right (despite years of ridicule) and made millions. This trade gained him a great deal of fame and he was later featured in the Michael Lewis book (and subsequent movie) called the “Big Short”

Investors this week are wondering if Burry is setting up for a sequel to that movie.

Late last week, Burry posted on X for the first time since 2023 (four days before the 13F dropped)- “Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play.”

Then this week, Burry filed the Q3 2025 13-F for his firm (an SEC filing required to be issued by large investors to disclose concentrated positions). These documents are backward looking so the form was reporting holdings as of 9/30. At the top of the holdings list were two positions betting against the AI/momentum trade, notably $188 million of puts against Nvidia and $912 million of puts against Palantir. (It’s also likely no coincidence Burry filed the 13f 10 days before its due date to conveniently align with Palantir’s earnings release date).

While it’s been messaged Burry has short positions, he actually holds puts which give him the right (not the obligation) to sell stocks at a strike price (below the price at which the stocks are currently trading). Puts are typically bearish/negative views on stock as they are betting on the price falling (but in certain instances, they are used as effective hedges). Nvidia and Palantir have been “AI darling” stocks in the market, trading at 54x and 449x earnings respectively.

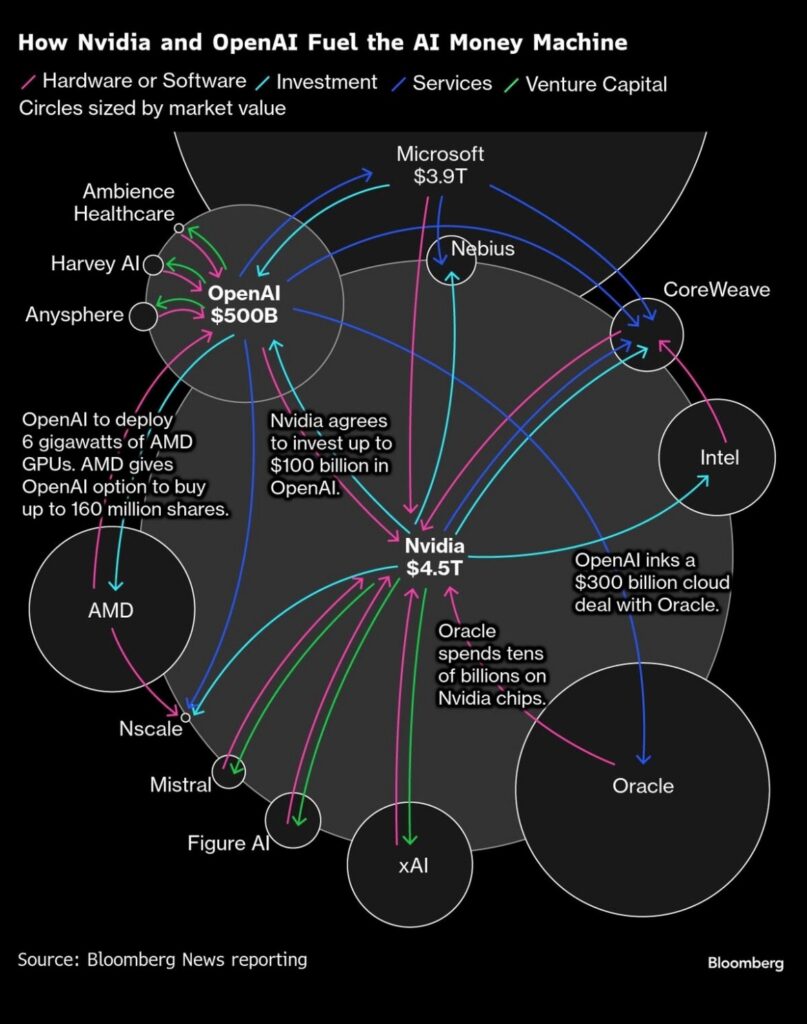

Burry also posted a few “visual aids” to support his position. One is a graph illustrating the circular nature of recent AI transactions

Burry is human. In 2023 he posted a simple “sell” message, only to retract it two months later as markets roared higher. He’s had other inaccurate predictions over the years so it’s far from a certainty that Burry’s latest trades will be “right.”

Nonetheless, he remains a respected voice in markets and his put positions against the AI darling trade in the US markets got quite a bit of attention, especially as concerns over an AI Bubble have been spreading.

I’m not here to comment on the merits of Burry’s trade or the likelihood that he will be “right” over his investing timeframe. No one knows how this will play out – not Burry, not talking heads on CNBC, not the CEO of Palantir (he blasted short sellers as his stock price fell), not the CEO of OpenAI (who lashed out at a podcaster who brought up the circular deal question) – No. One. Knows.

What I am here to do is share this discussion as I view it as very useful for markets and investors, including you and me. It encourages a discussion about the pace and degree of returns on the companies embedded in the AI trade and allows investors a chance to step back and consider various viewpoints.

To that end, I’ve read a lot of perspectives on the AI trade/bubble concerns in recent weeks and here are two I’d recommend you read if you have the interest in diving deeper than some 13f headlines

David Bahsen – Investment Conviction in a Time of “Revolution”?

David Einhorn – Greenlight Capital Q3 2025 letter

AI and its impacts on the global economy and our lived experiences are not to be underestimated. Markets have fully embraced that narrative in the past few years and they may be right. However, as you know by now, the future is uncertain and no one (not even markets) know what comes next with 100% certainty.

As an investor, it’s essential you consider the range of possible outcomes – not just the one dominating the narrative and driving your returns higher and higher – and take action accordingly. Actions such as rebalancing against your target allocation, trimming concentrated positions, diversifying across regions, sectors, trends, and cash flow streams, and securing necessary cash flow in low-volatility positions are always sound places to start.

Onward we go,

Leave a note