WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

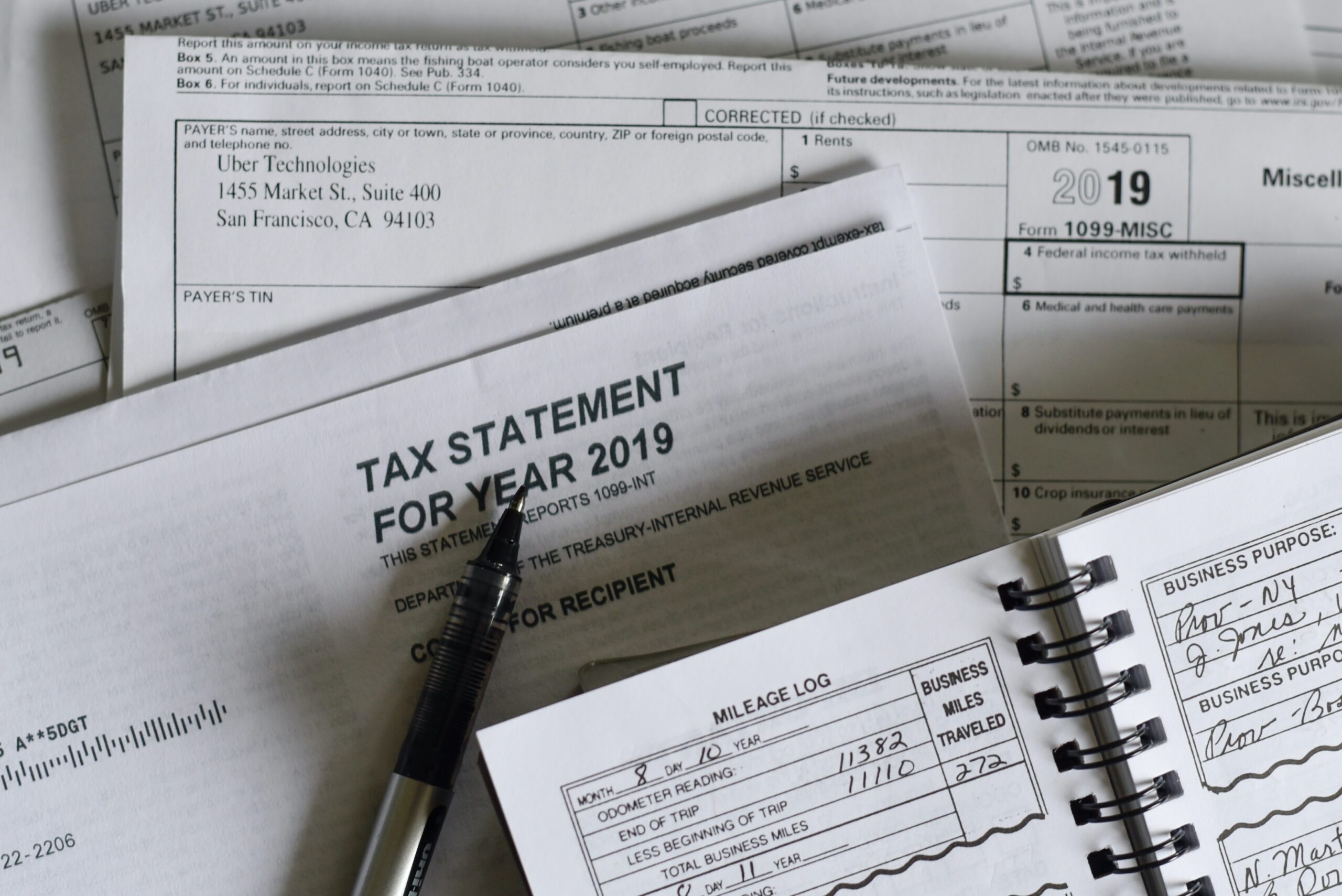

A new year can bring a lot of excitement – whether it’s setting resolutions, packing up the decorations and cleaning your house, reflecting on a fun holiday, or planning upcoming travel. But a new year also marks the return of a very important task – tax season! While the ultimate April filing deadline may seem […]

January 9, 2025

read more

Just when we thought we’d get a quiet end to the year, the Federal Reserve held their last rate announcement this week. While the rate announcement was in line with expectations (another 0.25% rate cut was confirmed, taking the current range to 4.25-4.5%), the commentary in Jerome Powell’s press conference and the data accompanying the […]

December 19, 2024

read more

We are fast approaching the end of 2024. I’ve talked with a few clients about some actions they can take before we turn the page to 2025. In case you are asking yourself “wait, have I done everything I’m supposed to?,” here is a quick list. (Note, I wrote a detailed post on year-end action […]

December 19, 2024

read more

With 19 days left in the year as I write this, it’s safe to say that we will be saying goodbye to 2024 in no time at all. As we start to look ahead, it’s fair to wonder what the new year will bring. Will we be concerned with the same things that held our […]

December 12, 2024

read more

I’ve written about life insurance in the past (you can one such post here). It’s a subject that comes up quite often with clients as it is yet another example of a financial topic that can be rather confusing and challenging to navigate on your own. This past week, I talked with two clients about […]

December 12, 2024

read more

And just like like, we are in the final weeks of 2024. Welcome December! It’s been a monumental year on many levels and for investors, it has been a year unlike any other. As of today, the three US equity indexes (DJIA, S&P 500, and NASDAQ) sit near record highs after rising 19.4%, 29.2%, and […]

December 5, 2024

read more

It’s no secret there is an increased amount of fraudulent activity in today’s digital world. I’m sure you have received spam emails, unwanted phone calls, strange looking texts, letters notifying you of a data breach, and a whole host of other fraud attempts. One area where fraud can be particularly devastating is investment accounts – […]

December 4, 2024

read more

I told someone this week that the days feel more like minutes as of late – time is just going by so quickly. I am sure you can relate so it may surprise you as well to know there are just 42 days left in 2024 (as of the date this is being published). With […]

November 19, 2024

read more

I worked with two clients this week to help them rebalance their employer plan accounts. Since many of you likely have similar accounts (likely in need of attention), let’s review the process. Employer plan refresher Before diving in, let’s clarify what I mean by “employer-sponsored retirement plan.” These are plans employees are offered by their […]

November 19, 2024

read more

If you’ve been an investor for one month, one year, or multiple decades, you undoubtedly know that investment decisions are never made up of one single factor. Instead, it’s more reminiscent of a puzzle, with various pieces of disparate sizes coming together to formulate an image. As I look out on the final weeks of […]

November 14, 2024