WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

If you have watched the financial news over the past few weeks or if you happen to be an investor in any software stocks, you are likely aware of this sharp and broad based sell-off in these names. The software segment of the market is down over 30% from its September 2025 peak, marking the […]

February 19, 2026

read more

On Wednesday, we received the January jobs number (that was slightly delayed due to yet another government shut down). Per that report, the US economy added 130,000 jobs in January. This headline number was above analyst expectations, which was all the more surprising given a few soft data releases in recent weeks that had many […]

February 12, 2026

read more

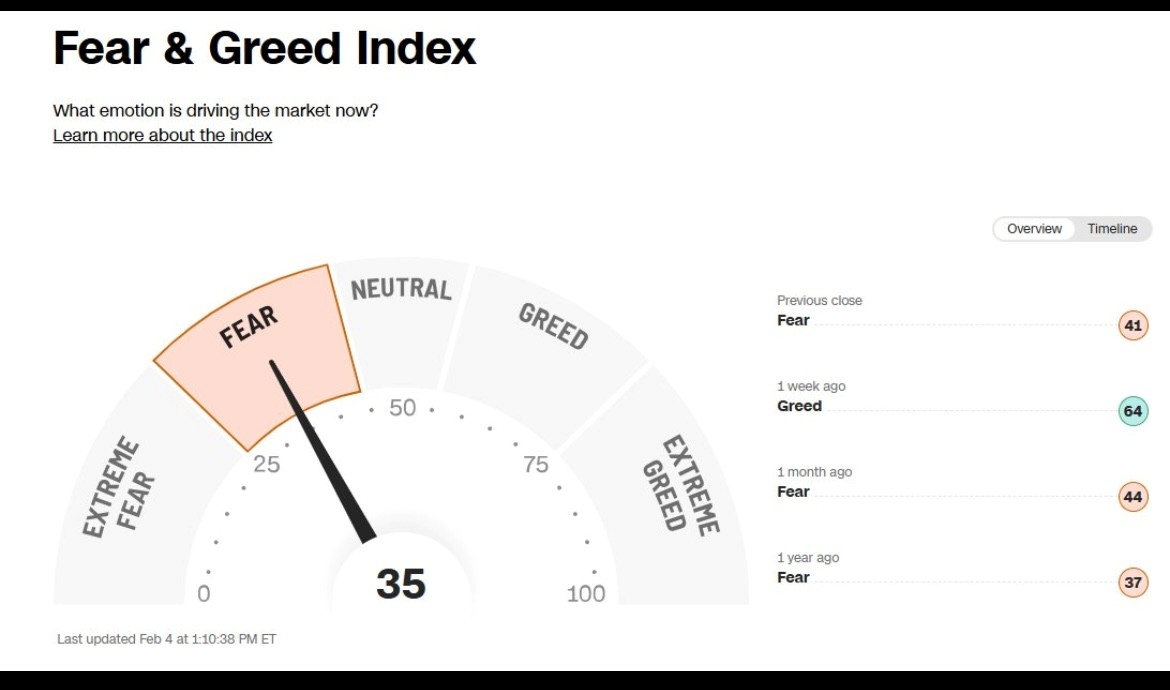

2023: 26% 2024: 25% 2025: 17% – these are the annual returns in the US stock market over the past three years. Historically speaking, these returns are nothing short of exceptional. And yet, if you read or watch any news story over the past few weeks, it is a drumbeat of negativity. Don’t believe me? […]

February 5, 2026

read more

If you feel as though markets and news are moving at the speed of light lately, you are not alone. Whether it’s the influence of 24/7 financial news, accessibility to news flow at all times (on our phones, watches, computers, etc), the activity from the federal government, other factors, or some combination of the above, […]

February 5, 2026

read more

The Federal Reserve Bank of the US held the fed funds rate steady at Wednesday’s meeting. The fed funds rate remain at 3.5-3.75%. This was the expectation in the market and as a result, the reaction to the news was relatively muted. Chairman Powell’s commentary focused on two distinct but closely intertwined topics (1) the […]

January 29, 2026

read more

It may have been a shortened trading week due to Monday’s holiday but there was no shortage of market moving news. Surge in Japanese Bond Yields – Tuesday morning brought two main events, the first of which was a surge in Japanese Bond yields. They rose across all durations, with the 10 year JGB yield […]

January 22, 2026

read more

It’s been an eventful start to 2026! Let’s look at a few things that happened so far this year: Venezuela – In early January, US launched a military intervention in this oil-rich country and took its President into custody. The US has now taken over Venezuela’s oil industry. The oil is heavy crude which requires […]

January 15, 2026

read more

Congratulations! You made it thru another year of being an investor! 2025 was quite the ride that ended up very well for most investors. International equity markets had a stellar year, as did many commodities. US equity markets held their own and fixed income posted impressive returns as well. All in all, 2025 was a […]

January 8, 2026

read more

The years sure do fly by! 2025 was no exception. A lot happened this year in the investing world (tariff tantrum, AI trade, AI bubble panic, ongoing Fed drama, and many more events). All told, it was a great year to be an investor, with most major indexes exceeding their long-term return expectations by meaningful […]

December 16, 2025

read more

The Federal Reserve was back in focus this week as the US central bank announced its December rate decision. This rate move has been a topic of much debate in markets ever since the last cut was announced. Markets were anticipating a cut, with 88% odds of such a move in advance of the meeting. […]

December 10, 2025