Busy July

July 25, 2024

There are weeks where not much happens…and then there are the first few weeks of July 2024! In addition to all that is happening in the world and political arena around us, the markets have had their fair share of excitement in recent weeks. Let’s take a quick look at what’s happened, what is coming up next, and what it all means as we start the second half of our 2024 investing journeys!

What’s Been Happening?

Great Rotation

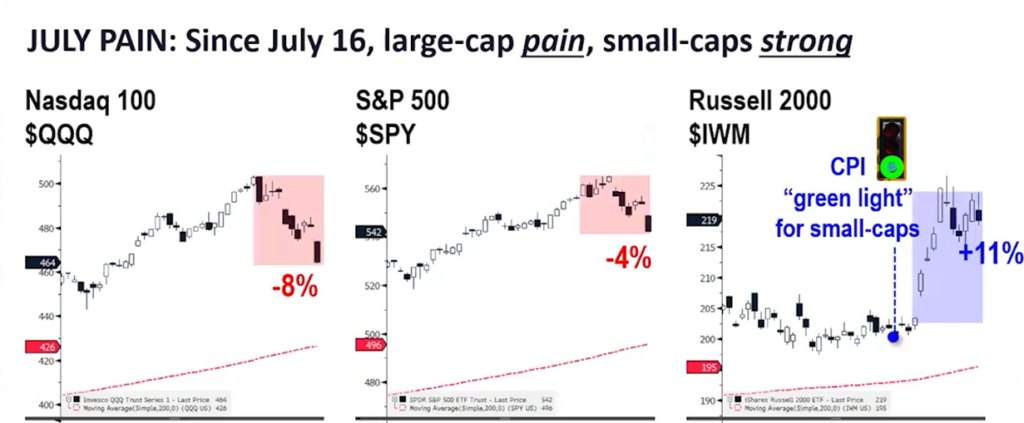

At the end of June, I wrote an article about the K-like bifurcation in the markets and economy. I noted that no trend line goes on for ever and eventually we may see a convergence. That has played out already in July. Media is dubbing this the Great Rotation (out of large cap growth into small cap) or the Tech Wreck (as there has been weakness in this sector after a very strong 1H 2024)

Without a doubt, there has been a stark difference in returns this month. After new all-time highs for the equity indexes in July, they took a turn in the other direction mid-month. The below chart shows the stark divergence post June CPI report in returns from Nasdaq, S&P 500, and Russell 2000 (small cap index) in recent weeks

What’s driving this rotation? Like everything in markets, there are a lot of theories but no one really know for sure. The most likely driver in my view is a growing confidence that the Federal Reserve will begin to cut rates in September. Lower rates favor small cap index which has a larger weight to rate-sensitive sectors like financials, real estate, biotech, nd industrials (49% in Russell 2000 vs. 24% weight in S&P 500). Rate cuts also take pressure of smaller-cap businesses as they can refinance debt and preserve cash flow (far less of a concern for larger cap businesses)

Great Expectations

July also brings us into another earnings season, where companies share their results for the past three months. Heading into this earnings season, expectations for earnings were relatively high. And while companies have been reporting great earnings (over 80% are beating) and reasonable expectations moving forward, they have failed to satisfy market’s high bar. Big tech names like Alphabet and Tesla fell into this reality this week as both stocks sold off meaningfully after releasing impressive earnings. With many other mega-cap tech businesses reporting next week, we will see if more companies become the victim of high expectations

US Keeps Going

Preliminary GDP for the US was released yesterday, revealing ongoing growth in the economy. US GDP rose 2.8% during the second quarter, ongoing evidence of the US’s resiliency. Consumer spending remained strong and markets took this to be good news. With inflation falling and labor slowing, markets seem to believe the Fed may have achieved the soft landing it was seeking – bringing down inflation while not crushing growth in the process.

Shhhhh

Many large public companies are in the middle of a so-called quiet period that surrounds their quarterly earnings releases. During this time, the companies are prevented from transacting in their own stock – meaning no buybacks. Buybacks can represent a meaningful amount of demand for stocks, especially after downward moves like we’ve seen, so the lack of such activity can lead to market weakness

Politics Enters the Chat

We’ve talked about the impact of elections on markets in the past and the evidence is clear – investing over the long term and staying invested, regardless of political party in control, is the winning approach. However, that doesn’t mean that some market participants don’t attempt to guess the likely outcome and take advantage of short-term trades. There seems to be more of this happening in recent weeks with the added volatility in the presidential race, adding to overall market gyrations.

What Comes Next?

As noted above, we will get more key earnings reports next week. We will also get some further data on inflation and the Fed’s July Rate decision before the end of the month. It’s also highly likely that market participants will continue to rebalance, perhaps trimming winners and rotating into some forgotten areas of markets (namely those that will do well as rates moderate or fall).

What It All Means?

We have been meeting with clients in recent weeks to review the first half of the year. In those discussions, we’ve been discussing how wonderful (yet very unusual) the first half was (dominance of a few sectors and one individual company, low volatility, continual upward trendline, etc). We’ve also discussed how blurry the line between being early and wrong can be – and noted that our positioning in certain asset classes and styles (value, dividend-focused, fixed income securities) would likely start to do far better as the year continued. This remains our expectation – that the leaders in the first half will take a well-deserved break and that other equity sectors and styles, along with certain areas of fixed income, will begin to participate on the upside. This broadening out is healthy and necessary – so we are excited to see early signs of this taking hold.

Onward we go,

Leave a note