Change is hard

September 14, 2022

As I watched the recent inflation release on Tuesday (and the subsequent jarring market decline), a common phrase kept coming into my mind over and over – “change is hard.”

How many times have I said or heard that saying in my lifetime? At least a few hundred – maybe more. Why do I always come back to this saying? Because it’s so frustratingly true. Whether the change is a perceived good thing or a definitive bad thing, it is always hard. Always.

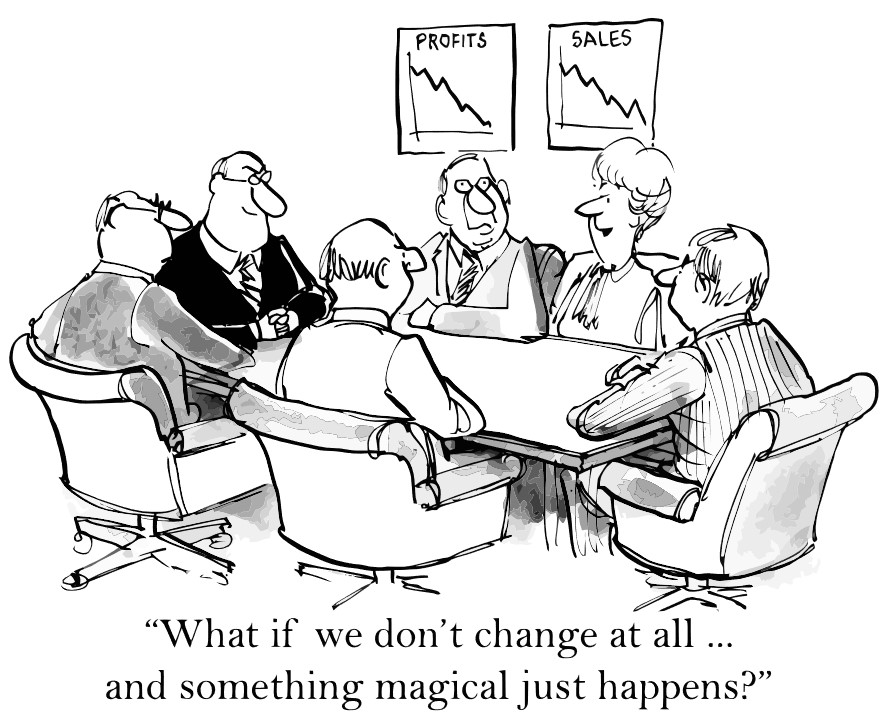

Change is hard for all of us – and markets are certainly feel the same way. The world and its underlying economies are all in a moment of unprecedented change and it’s proving to be very hard for markets and investors to handle. And whether we like it or not, markets do not have the luxury of waiting for a miracle (as this cartoon suggests!)

I realize it can be hard to think straight amidst the flashing red arrows and endless shock and awe headlines – but indulge me for a few minutes and take a giant step back to March 2020. Remember that time? It seems like a distant memory now but at that time, the world was facing a once in a generation pandemic that had the potential to derail the entire global economy.

In 2020, I always visualized that moment as a giant valley we somehow had to cross – COVID/unknowns on one side and the future (in whatever shape or form it would be) on the other. Governments stepped in (the US in the lead) and filled that valley – with both fiscal (think stimulus checks) and monetary (think cutting rates to zero and buying debt instruments on open market) policies – and science built a further bridge with quick development and release of vaccinations.

Two years later, we can all debate the merit of those actions and whether or not they filled that valley or perhaps built a mountain instead. But from where we all stood in March 2020, having some way across the valley (versus falling into it) was necessary to move us forward.

Now fast forward to 2022. We are dealing with the consequences of those actions and the changes in the world around us since that time. The pandemic impacted countless ingrained systems (including human behavior, shopping patterns, supply chains, shipping methods, and hundreds of others) and the impacts of that are playing out in never-before seen ways (see inflation & labor market data) – in conjunction with immense pressures resulting from a prolonged global conflict between Russia and Ukraine.

We find ourselves facing another valley of uncertainty. On this side, we have record-high inflation, fears of a recession, and a strong (for now) labor market. Waiting on the other side is the future – whatever that may look like when we get there. And in between – change.

Changes in monetary policy (via rate increases). Changes in valuation of asset prices as rates move. Changes in the labor market for participants. Changes in home prices and values. Changes in investor confidence. Changes in money flows. Changes in investment returns. Changes in elected officials in a few months time. Nothing but change. And as we’ve established, change is hard.

Is all this change necessary? In a word, yes. Much like something had to be done in 2020 to get us across the valley, we are at another “must act” moment. This time the top priority is ensuring price stability. Inflation can become a self-fulfilling spiral rather quickly, so the Federal Reserve is working very hard to slow spending (via raising rates) to reverse the trend. The recent reading showed much work remains to be done – and so we will likely be in the midst of change for some time.

So what’s an investor to do? Simply put – keep going. Change is hard – but it is also constant. Ever present. Unrelenting. Non negotiable. Change has always been a part of the world around us and a part of markets. Is this a particularly magnified period of change? Yes. Is it likely to feel unsteady and uncertain for a while? Likely. Will it eventually pass? Also likely.

Change is hard. But time and time again, what lies on the other side has proven to be worth the temporary pain. I have no reason to believe this time will be any different.

Onward we go,

Leave a note

Leave a Reply

You must be logged in to post a comment.

Well done.

Read the book, “Who stole my cheese?”