Client Question: Cash Sorting

March 22, 2023

There have been quite a few new terms floating around these days, given all the events concerning the banking industry. One of those terms is “cash sorting.” A client recently reached out to clarify what this terms means – and whether it was an activity they should undertake. Let’s take a closer look

Why is cash sorting top of mind?

Cash sorting, or moving cash from one account to another based on available interest rates, has become top of mind in the past year. While savers and investors have always had the ability to move cash between various accounts (such as their savings, checking, and brokerage accounts), it hasn’t been a priority for the past several years.

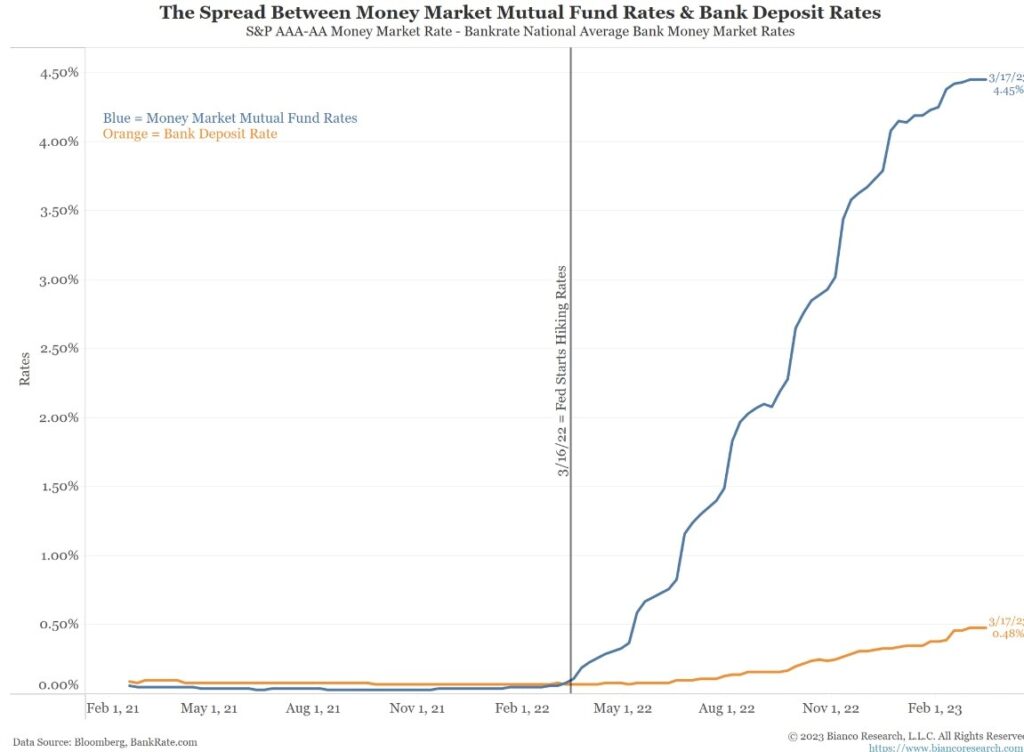

Why not? Interest rates across the various account were all very similar (and all near zero). If all accounts pay you the same, why go to the trouble of moving things around? However, over the past year, as the Federal Reserve raised interest rates at a breakneck speed in an effort to combat inflation, things changed drastically. The rate moves resulted in a sharp rise in short term rates available on cash equivalents, such as money market funds and short-term treasuries. However, banks were much slower to raise deposit rates, and as a result, the rate differential kept growing.

This chart is staggering. Look at how quickly the spread grew – and how wide it has become

Is this a new concept?

At Windermere, we have been having discussions about cash sorting (without using the specific term) for over a year. Initially, when rate differences were a few basis points or even a percentage point, clients were not all that concerned or compelled to take action. After all, it takes effort to move cash around and when the spread difference is minimal, it’s not really a priority. However, as short term rates kept on rising, that difference became too much to ignore (at current levels, the spread can be well over 4% between on demand bank deposits and cash equivalent yields (from money markets as an example)).

What impact is this having broadly on markets?

Cash sorting is arguably having a enormous impact on the financial system. One could argue that cash sorting is one of the root causes of the recent banking system instability. Bank customers have been demanding their funds from banks so they can move them to higher yielding accounts elsewhere. This “deposit flight” then put pressure on bank liquidity, forcing investment sales below par, resulting in depleted capital, which has shook confidence further and led to more deposit flight. Of course, cash sorting is not the only driver but it is definitely playing a role.

Should I sort my cash?

Absolutely. As noted, I have been working with clients on this for over a year. Cash is an important part of any asset allocation, as well as a necessary facilitator of daily living and the required cash flow. There is no reason you shouldn’t ensure you are properly deploying it to meet your goals.

Where should you begin? I’d suggest you take time to compile a list of your various cash balances (at your bank(s), in brokerage accounts, in separate money market funds or treasury securities, etc.). Then review the yields being paid on each and determine if there is any benefit from reallocating between accounts (or opening new accounts for use). Keep in mind there are factors to consider beyond yields – such as liquidity, methods you use to pay bills, minimum balances to avoid fees, and a host of other factors. If you have questions on your situation, please reach out. As is always the case, your financial journey (including your cash management strategy) is unique and must be treated as such. Happy sorting!

Leave a Reply

You must be logged in to post a comment.

Leave a note