Client Question: Credit Score Refresher

January 19, 2023

Last week, I featured a question from a client about accessing and reviewing your credit report. I thought a helpful follow-up to that could be reviewing credit scores. Here we go!

What’s the purpose of a credit score?

When a borrower loans you money, their main concern is whether or not you will ultimately pay them back. Since they don’t know you personally or have any insight into your likely behavior in the future, they need another way to evaluate you. They rely on the adage that the best predictor of the future behavior is past behavior. How do they do this? They pull your credit score – a numeric measurement of your past behavior when it comes to credit usage.

What’s the range of credit scores?

Credit scores range from 300-850, with higher being a better score. Any score about 800 is deemed excellent, resulting in an indicating of a low-risk borrower. Scores between 670-800, while not excellent, are still likely to allow for access to new credit. Scores between 300-670 may have difficulty accessing new credit as they are deemed high risk.

Credit scores may also dictate the rate of interest you are offered. If you have a lower score, you are deemed to be higher risk and financial institutions may charge you more interest to offset that risk.

How is a credit score calculated?

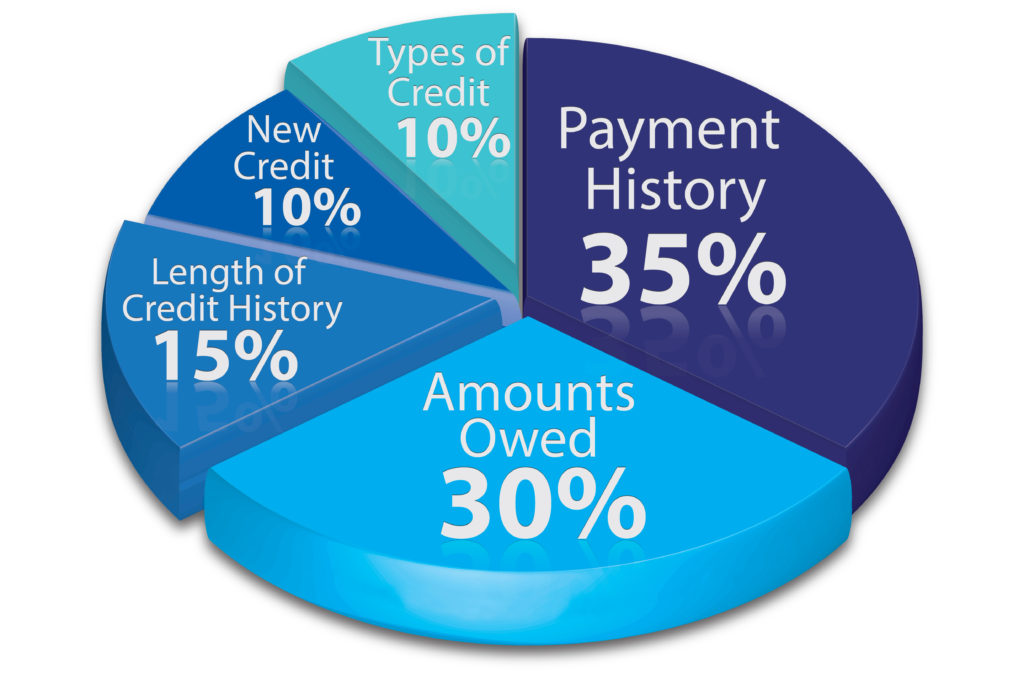

Credit scores are calculated based upon data in your credit report, which is a history of your interactions with credit in the past. The components, listed from largest to smallest weight, are as follows:

Payment history (35%) – the largest contributor to your score is your payment history. It looks at all debt you’ve had in past, along with other bills (utilities, cable, etc) and looks at the timing of your payments (on time or late). If there are late payments, the component will also assess how late they were, how many were late, and how long ago the delinquencies occurred. A “clean” payment history, with no late payments, is the best case here.

Amounts Owed (30%) – this category aggregates all of your debt outstanding. It also looks at your credit utilization on revolving loans (such as credit cards) which is a measure of your balance as a percentage of your available limit. A lower utilization rate is viewed more favorably since a high utilization rate can imply you are stretched (and therefore maxing out all available credit)

Length of credit history (15%) – this metric assesses the age of your newest and oldest account, as well as the average of all accounts and how long each outstanding account has been opened and when each was last active. Provided you’ve used credit well, a longer history is more favorable.

New credit (10%) – this section factors in any recent credit account openings as well as hard inquiries on your credit (which indicates you are may be searching for even more new credit). A meaningful amount of new activity can be viewed negatively as it thought to indicate you are actively searching for more credit (and may have trouble servicing it all)

Credit mix (10%)- the last factor is your credit mix. Scores are favorably impacted by a variety of debt – installment (like auto loans), revolving (like credit cards), and mortgages are a few examples. In general, a greater variety of credit is viewed favorably as you demonstrate responsibility in a variety of situations.

What isn’t measured?

You’ll notice that major components of your financial life (such age, employment, earnings, and investment balances) are not mentioned above. That is because they do not factor into your credit score. While lenders may capture this data in other parts of their underwriting process, the credit score doesn’t measure these. It is truly an assessment of credit you have and how you’ve handled yourself in the past.

How can I obtain my credit score?

I personally use the credit score services provided by my two credit card companies, American Express and Chase. They send updates when things change and allow me to keep tabs on my score. You can also check your score if/when you apply for credit as the lender has to share the results of their inquiry with you.

What should I do if I’m concerned with my score?

I’d suggest you start by going back to the data and pull your credit report. Look thru each section and see if there are errors. If there are, you will have to go thru the process with the various credit bureaus to address. And if the low score is driven by your behavior (late payments, too many inquiries, etc), improve those behaviors and your score should follow the same path over time.

Credit scores can be an intimidating topic for many but once you understand how they work and how you can adjust your behavior accordingly, you’ll realize there’s nothing to be worried about! Here’s to happy (and responsible) borrowing!

Leave a Reply

You must be logged in to post a comment.

Leave a note