Client Questions: Why Have International Markets Been So Strong?

November 6, 2025

For years (perhaps decades), the US market has consistently outperformed US markets. US stocks represent over 60% of global equities and one US company (Nvidia) now has a market cap that exceeds the value of the entire Canadian and UK stock markets.

However, a quick glance at global market performance in 2025 shows a changing story – at least for this year.

Thru October 31, YTD returns are as follows:

S&P 500 (common index of US equities) – 17.5%

MSCI EAFE (common index of developed international markets) – 26.6%

MSCI EM (common index of emerging international markets) – 32.9%

What has led to the outperformance of international markets in 2025? A major contributing factor is the move in the US dollar. The US dollar has declined relative to other currencies this year (even as it remains at elevated levels). The weakening dollar is a bit surprising as US rates have stayed “higher for longer” compared to other countries and may be related to the increasing debt load in the US and ongoing political uncertainty.

Trade policies have also played a role. Even though the tariffs may be seen (and are in many cases) a headwind for global companies, they have also lead to some investors (particularly foreign ones) reallocating capital and business transactions to other economies as a repudiation to America.

There has also been pronounced stand-alone strength in various foreign markets. Europe has seen declining rates which is a tailwind to equities. Germany has ramped up defense spending, boosting its economy. South Korea and China had benefited from their own AI build-out/technology strength.

Starting points also matter a great deal in investing and international markets began the year at valuations far below historical trends and well below those of the US market.

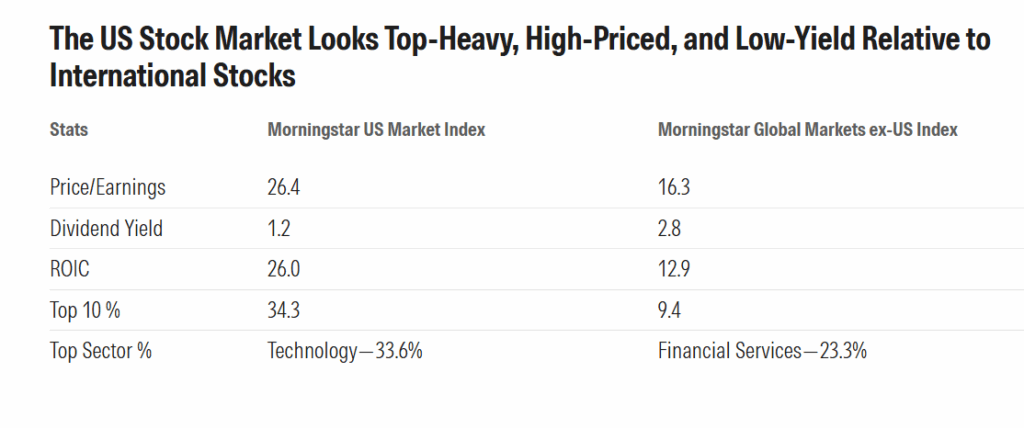

Will these trends continue? This table published by Morningstar shows the stark differences between the US and the rest of the world even after this year’s return differential.

US markets, increasingly dominated by technology companies with a foot in the AI trade, has led to massive concentrations, high returns on invested capital, lower yields and higher valuations in the US equity markets as compared to international markets. And yet, some may argue that the US markets have a consistent history of delivering innovation and growth unmatched elsewhere.

So does diversification make sense? Diversification is a well-known tactic for dealing with uncertainty. No one (despite what they may say) knows what comes next for the US or foreign markets in terms of AI, demographics, monetary policy, debt levels, and countless other factors. Diversifying your investments across a variety of areas (including geographical areas) can be a useful way to hedge against this uncertainty but as always, work with your advisor to find the approach that is right for you and your financial future.

Leave a note