Crisis of Confidence

March 27, 2025

Have you been feeling a bit down and more negative than usual? If this months Consumer Confidence Index reading is a reliable indicator, you are certainly not alone.

The US Conference Board’s monthly Consumer Confidence Index for March (which measures “consumer attitudes, buying intentions, vacation plans, and consumer expectations for inflation, stock prices, and interest rates”) showed a meaningful decline from the prior month and came in at a level that represented a four-year low. It also marked the fourth straight month of declines.

The index is comprised of the Present Situations Index (how people feel about today’s reality) as well as an Expectations Index (how people feel about the short-term outlook). While both declined, the largest decline was in the Expectations Index as people seem increasingly worried about what the future holds.

The write-in section of the survey revealed what remains top of mind. Here’s an excerpt from the release

“Comments on the current Administration and its policies, both positive and negative, dominated consumers’ write-in responses on what is affecting their views of the economy. Write-in responses also showed that inflation is still a major concern for consumers and that worries about the impact of trade policies and tariffs in particular are on the rise. There were also more references than usual to economic and policy uncertainty”

This Consumer Confidence reading is in line with other “soft data” released as of late – meaning data coming from surveys (inflation expectations, confidence, etc) as opposed to hard data (which are measurable numerical items like jobs created, inflation readings, and company earnings to name a few).

While these results can be discouraging (and arguably a bit of a self fulfilling prophecy), it’s important to keep in mind that they also have a history of being positive indicators for future equity returns.

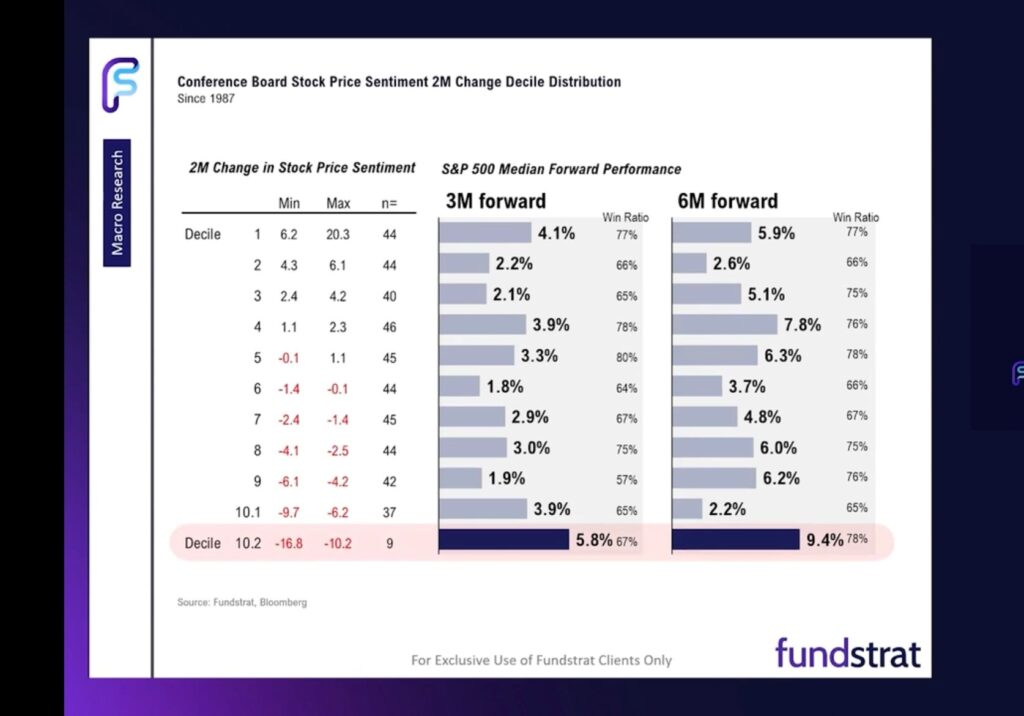

Take a look at the below chart that illustrates equity returns in the 3 and 6 months following various changes in stock price sentiment question in the Consumer Confidence Index. In the March 2025 survey, only 37% of participants thought the market would rise in the next year. This was down 10 % from February and 20% the high (right after November’s election). That decline ranks in the lowest decile of data tracked. When this has occurred in the past (9 occasions). the forward 3 and 6 months returns were 5.8% and 9.4% respectively.

Will this pattern repeat? That is impossible to know. But what is somewhat easier to know is that markets tend to price things in and move before investor emotions catch up. Markets price in negative events and index levels fall as a result. Investors look at their accounts and hear the scary news media stories, which in turns puts them in a negative state of mind and causes them to believe things will always be this way (or worse). That comes thru loud and clear in surveys. Simply put, investors tend to feel the most negative towards markets after they have fallen by a meaningful amount- not when they are at all time highs. As I always say, it’s one of the few marketplaces where people loathe a sale!

Could this time be different for one of the many factors we are all thinking (and perhaps worrying) about today? Of course. But there is also a non-zero probability that once again, a “crisis in confidence” will immediately precede a nice recovery period.

Onward we go,

Leave a note