Debt Ceiling Considerations

May 25, 2023

2023 is quickly becoming the year in which I discuss topics I never imagined would come up with such frequency, if at all… topics such as bank failures (see March 2023 publications) and now the potential of a US default. But in life it seems we should expect the unexpected!

The United States is a complex financial entity, with many facets and aspects of its monetary situation. However, one of its trait has dominated headlines in recent years – spending more than it is bringing in. This imbalance has resulted in an astounding level of debt – one that now exceeds the debt ceiling cap of $31.4 trillion that was put in place by Congress in December 2021.

The cap was hit on January 19th of this year and ever since then, the Treasury Department has been taking so called “extraordinary measures” to avoid a government default (ie: the time at which the US is no longer able to make good on its debts or pay its bills).

Those accounting measures are temporary and are expected to run out in the very near future. While the exact date in unknown, Treasury Secretary Janet Yellen has indicated the date is likely early June 2023 – which is now about a week away. While many think the US can make it until June 15th (when estimated tax payments are due, perhaps given the country a few more weeks after that), this is not viewed as likely by the Treasury Secretary.

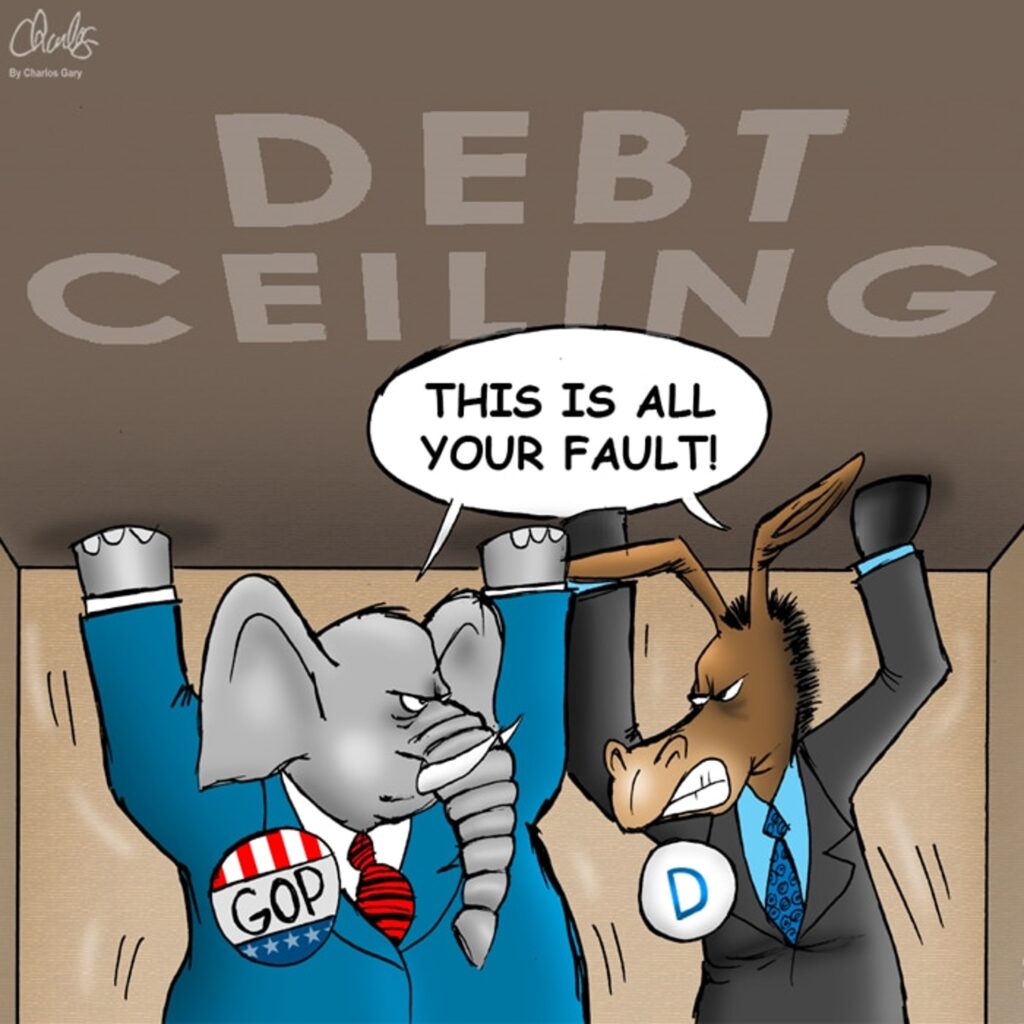

Without a doubt, balancing the budget and reigning in US spending needs to be a longer-term priority. But such an endeavor will take considerable time – especially with our highly divided government. So in the meantime, in order to avoid default, Congress needs to raise the debt ceiling. Democrats and Republicans have been in a standoff over what to do since the limit was reached in January. Very little progress was made up until a few weeks ago and as we enter the final week of May, it remains a very uncertain situation.

President Joe Biden and congressional Democrats have insisted that they will support only a “clean” debt ceiling bill that has no strings attached. Republicans have said they will support only a debt ceiling increase that is paired with significant spending cuts. The discussions have gone round and round and at this point, it has evolved into a game of “chicken” – who will blink first – or will the US be left to default on its debts?

In recent weeks, I’ve read countless articles and listened to many commentaries debating what will happen. Clients are asking me what will happen. In short – no one knows, myself included. Our government is impossible to predict with so many conflicting and competing interests and priorities.

If I was forced to give an opinion, I would venture to guess there won’t be a default. I believe a deal will be reached – albeit after an exceptionally frustrating delay and perhaps right before the deadline. Despite all their underlying motivations and personal lobbying, I am doubtful any politician will ultimately risk being associated with such an unprecedented act of letting the US default.

In support of my argument, this seems to be where markets are at (although there has been added weakness this week). Markets seem to be accepting of the bumpy road for negotiations but are estimating that a resolution will be reached. If markets viewed default as likely, we simply would not be at current levels. What levels would they be at? That’s also impossible to know since all assets price off the risk free rate (US treasuries) and without a viable market for them upon default, where would you even begin to price assets?

What will happen if I (and countless others) are wrong and the US defaults? Nothing good. A debt downgrade is highly likely in that case, which would be very negative in terms of how other nations would view US debt (a big deal given the role US debt plays in the global economy). It would also impact an incredible amount of borrowing arrangements given the fact that US treasuries are the most actively used and most liquid form of collateral in the world. And lastly (and hardest to determine), is the impact it would have on the US dollar and its role as the world’s reserve currency. As Rick Rieder (head of fixed income at Blackrock) said recently, while it’s not likely the US dollar will lose its reserve status, default and resulting actions would continue “chipping away at the impenetrable armor of the dollar.”

Given all of the above, what should an investor do? As always, your financial situation is unique and its worth having discussions with your advisor if you have concerns. In general terms, here are a few things to consider:

*Near-term maturities vs liquidity needs – if you have near term liquidity needs from your portfolio and hold short-term US debt instruments due to mature in early June, there is a chance payments will be delayed (if default occurs). This scenario likely applies more to companies or pension plans but worth mentioning just in case, even if the probability is very remote. (Bond market participants agree, with rates on treasuries maturing in early June pricing far above those for end of May/dates past late June)

*Money market “check in” – consider what money market fund you are holding. Also review what portfolio managers are doing in response to this situation. Refer to any white papers published by the fund managers (see our custodian Charles Schwab’s publication here). Prime money funds tend to hold mostly commercial paper (which has been outperforming treasuries given lingering default risk). Government money funds hold primarily US treasuries but the vast majority of those funds are also taking action, avoiding June maturities and pivoting into other securities. While most money fund managers are taking preventative actions, it’s worth reviewing your money fund and determining if you have unresolved concerns as the deadline nears

*Secure cash for any planned distributions – if a default occurs and rattles markets for an extended period of time, selling for a near-term distribution at those lower levels will be painful. As a result, if you have a known withdrawal need coming up soon, you may wish to consider moving to cash now. Better to not be caught in a downdraft right before a withdrawal if you can avoid it

*Check cash levels – a default could impact some government payments (like social security). Again, I don’t see this as very likely but anything remains possible. If those payments are your only source of income and if you don’t have any level of cash cushion, start to consider a back-up plan if the unthinkable happens (such as cuts in spending, use of a home equity line, or advanced portfolio withdrawals). Hopefully it will never come to this but it’s best to be ready in case the impossible to imagine actually occurs

*Be ready to deploy – as noted above, markets for the most part don’t appear to be pricing in a default. However, if the deadline gets closer or confidence wanes further – or a US downgrade occurs, even temporarily, we could very well see volatility and resulting price dislocations. Any cash available for investment – or cash you were considering adding to your investments for longer term growth – could be invested per your target allocation should such rapid declines occur. Be ready and stay alert

*Hang in there – Investing has been rather grueling in the past three years – a pandemic, a recovery, unnerving inflation, an exponential rise in rates, bank failures, bank takeovers, and now a possible US debt default. Phew, that is a LOT to process. And yet, if you are reading this, my guess is you remain an investor. You haven’t quit. You haven’t cashed out. You haven’t lost faith. Good for you! Keep staying the course. Like all “world ending” events that have come before this one, it’ll soon be in the rearview mirror. Stay the course.

Onward we go,

Leave a note