December 2023’s Inflation Report

January 11, 2024

We may have started a new year, but we are still talking about inflation!

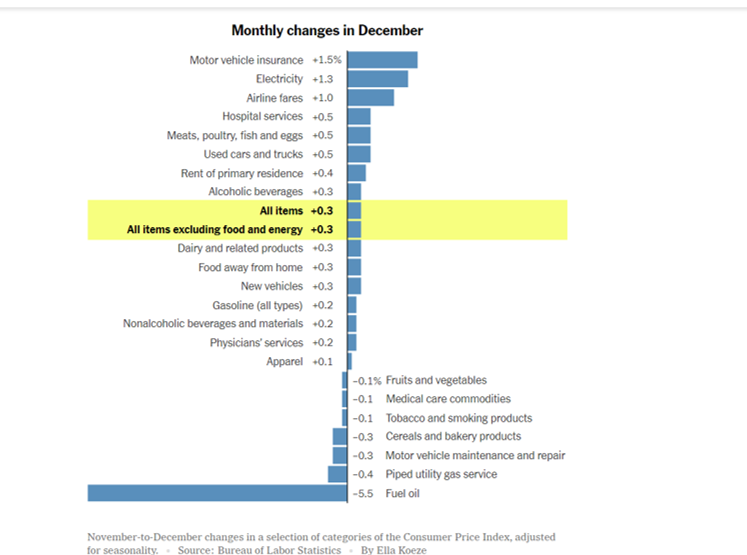

On Thursday, December’s Consumer Price Index (CPI) report was released. The report showed the prices rose 3.4% year over year (compared to 3.1% in November) – however, after removing volatile food and energy, Core CPI rose 3.9% month over month (a decline from November’s 4%). On a year-over-year basis, some of the largest areas of increase were services (like auto insurance and sporting event tickets)

The below chart shows the components of the monthly change in December (when CPI rose 0.3%) – which again shows services near the top of the list.

While a slight increase month over month does not allow for the straight downward moving trend line many may hope for, it was somewhat expected and markets took it in stride. The data shows that progress is still being made in the ongoing fight against inflation but that the data will remain bumpy.

One quote summed up this month’s report, the final in an excellent year in the inflation fight – “The progress on inflation since June 2022 has been remarkable,” said David Kelly, chief global strategist at J.P. Morgan Asset Management. “The bottom line is that the most likely path for inflation from here is not upwards or sideways but rather down.”

Again, inflation remains a key items of interest for the market as the trends in these readings will play a role in the Federal Reserve’s decisions regarding interest rates in 2024 and beyond. The Federal Reserve is balancing the need to keep prices from rising further with the need to not keep rates high for too long, leading to a slowdown in economic growth (or a recession). This month’s report likely didn’t change their plans to a material extent. In two words – good enough.

Onward we go,

Leave a note