Happy Anniversary (x3)

March 14, 2024

There is something about the month of March as major market events tend to occur during the third month of the year. There are three major market events that are celebrating anniversaries this month – do you know what they are?

Here they are – starting with the most recent in 2023 and going all the way back to 2009

1) Silicon Valley Bank collapse (March 10, 2023) – Looking back on 2023 and the outstanding performance of the equity market for the full year, it is easy to forget that just 2.5 months into the year, a major financial institution failed virtually overnight after a digital run on the bank (followed in quick succession by two other banks failing as well). The failure was sparked by a surprise fundraising attempt as the bank realized losses when depositors started to pull funds and the offsetting investment portfolio was underwater due to the sharp rise in rates. Remaining depositors lost confidence, pulled their funds, and the institution was taken over by the government within days

2)COVID shutdown (March 11, 2020) – Is it hard for anyone else to believe that this was FOUR years ago already? I’ll never forget seeing the NBA game cancelled minutes before tip-off (on the same day the World Health Organization had declared a global health pandemic and Tom Hanks announced he had contracted COVID in Australia). What followed was a shocking market drawdown and an equally remarkable market recovery largely due to staggering government stimulus programs – and a master class in inflation that we are still enjoying to this day!

3)Financial Crisis Bottom (March 9, 2009) – Fifteen years ago, the US equity market (as measured by the S&P 500) bottomed, ending the worst bear market since the Great Depression brought on by the financial and housing crisis that started in 2007. While things wouldn’t feel better in the economy for several months after that time, this day marked the end of that dark time

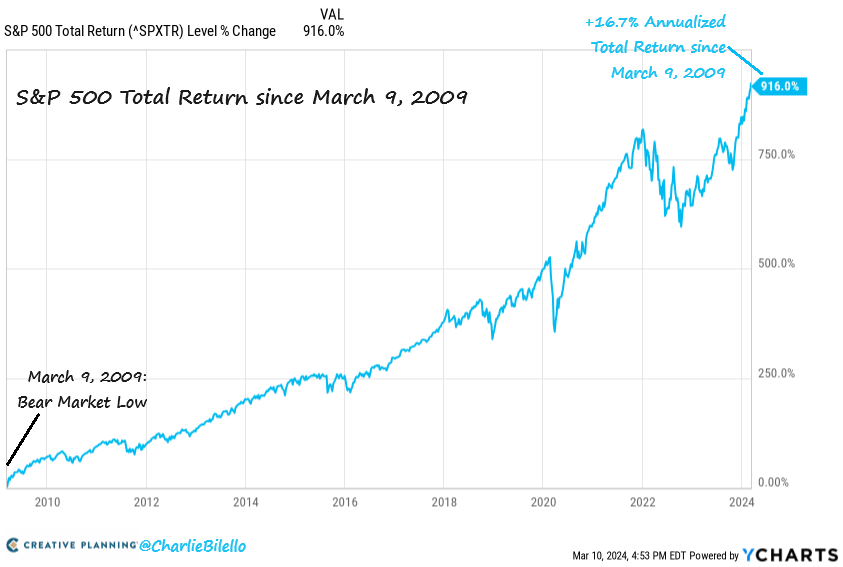

Why am I bringing up these three anniversaries? Take a look at this picture

In fifteen years, the US equity market has endured a financial/housing crisis, a global pandemic, and a banking crisis – not to mention three presidents, record-high inflation, record-low interest rates, business failures, business creation, prolonged global conflicts, and many other challenging events. The end result if you stayed the course? A 10x return (which equates to a 16.7% annualized return).

You can clearly see each of these anniversaries (and the related market shocks and swoons) on the chart above. It has not been a straight upward march but the trend line (and result) is clear. Time in the market matters far more than timing the market.

So, the next time you see red across the bottom of the business news channel, hear about a hot inflation print, read a story saying the end is near, or start to worry about what the future holds, please revisit this chart. Take a real look at it – the zig, zags, and ultimate trend. Take my past advice and “zoom out and breathe in.” Let this picture remind you that it is possible – and even probable – that everything will work out in the end.

Onward we go,

Leave a note