Hitting Pause

September 21, 2023

Markets were once again focused on the Federal Reserve this week as they released their September rate announcement. At that meeting, Chairman Jerome Powell stated that there would be no rate hike this month (the second such “pause” in 2023).

This was a well choreographed moved and as a result, it was not a surprise to markets. However, as always seems to be the case, there is more beneath the surface of these Fed meetings. This month was no exception as the tone and wording that accompanied this pause leaves the door open for future hikes and results in an uncertain path forward. Let’s take a closer look the details of this month’s meeting and what it all means for investors.

Fed’s Written Statement

Within the statement itself, there weren’t many changes – just slight updates. The Federal Open Market Committee (FOMC) noted that economic growth was expanding at a solid pace (a change from last month’s “moderate” pace). Its views on the labor market also changed as they mentioned slowing job growth (versus the prior statement of robust” job gains). And lastly, the FOMC held its ground on inflation stating that it remains elevated (despite recent declines). The statement reflected changes in the data released since its last statement in June but made it clear there is still work to be done.

Dot Plot

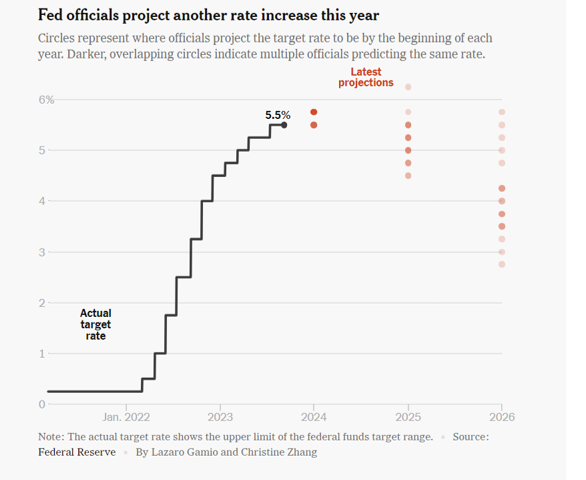

Markets sold off after the announcement and press conference, and many tied these moves not to the pause itself (as that was expected) – but to concerns about the future driven in large part by the “dot plot.” As a reminder, the dot plot outlines the projections of Fed members about where the policy rate is going to be in the future. The most recent dot plot (shown below) indicates a higher median rate for 2024 and 2025 versus last meeting, leading markets to reach a “higher for longer” conclusion.

Fed’s Summary of Economic Projections

The FOMC also released their expectations for various economic data along with the pause. This data showed a decline in growth (GDP projections) since June, as well as a decline in inflation expectations and a slight downtick in unemployment expectations since last meeting. Chairman Powell reiterated these beliefs in his statements, noting that while the Fed still sees work to be done to reach inflation target of 2%, the current policy is proving restrictive and achieving its goals of slowing inflation and curbing growth.

Press Conference

There wasn’t much news from Powell’s comments in the press conference, beyond what’s noted above. Despite the conclusions drawn from dot plot and accompanying information, Powell did reiterate that the Fed remains highly data dependent. He acknowledged progress in fighting inflation but cautioned that there is no end in immediate sight, stating “we’ve seen progress, and we welcome that—but you know, we need to see more progress before we would be willing to reach that conclusion.”

Powell also praised the economy but cautioned that good news can be bad news regarding growth/inflation dynamic: “It’s a good thing that the economy is strong. It’s a good thing that the economy has been able to hold up under the tightening that we’ve done. It’s a good thing that the labor market is strong. The only concern is…if the economy comes in stronger than expected, that just means we will have to do more in terms of monetary policy to get back to 2%.”

What does this all mean?

Investors have already been facing restrictive monetary policy for quite some time. And even if the Fed doesn’t hike again, it will remain restrictive due to the fact that the current level of Fed Funds is elevated (and exceeds inflation) and also due to the Fed perusing quantitative tightening (ie: reducing its balance sheet by allowing bonds to mature without replacement. This increases supply of bonds and thereby increases rates).

Given that backdrop, the question on the minds of investors and markets becomes “how much longer will we be facing these elevated rate levels?” That is where this week’s announcement became interesting. The pause was expected. The data dependency rhetoric has become second nature. Powell complimenting growth while reminding us of the inflation fight is almost routine. However, the question of “when does this end?” remains unanswered and unpredictable. Many believe this week’s meeting implied a “higher for longer” undertone. But keep in mind, if growth slows, inflation falls, unemployment ticks up, or some combination of those elements, the Fed may very well be surprised/forced to act like they were on the way up. Said another way, the minute higher rates seem a forgone conclusion is very likely the minute they are anything but.

Onward we go,

Leave a note