Jobs Data in Spotlight

August 7, 2025

Every month, the Bureau of Labor Statistics publishes a monthly jobs report. This data, obtained from phone surveys and online data, is a key indicator of how the labor market in the US is performing. This economic release can (and has) garnered meaningful attention in the past and does move markets – but the reaction and ensuing events last Friday were a true first.

Let’s back up a bit and look more closely at how the “jobs number” is derived and how precise of a measure it is.

Methodology

The monthly jobs numbers are based on a survey of more than a hundred thousand businesses and other employers across some 600,000 work sites in the country. The results are largely obtained via phone calls and online methods (like email). The responsible government agency – The Bureau of Labor Statistics (BLS) – asks employers various questions such as – How many people did you have on payroll during this period? How many hours did they work? How much money were they paid? All those answers get aggregated and the ending monthly jobs number is computed.

Keep in mind – the US economy is $30 trillion and contains about 160 million employees. This is a complex process and one that is inherently error prone and takes considerable time and effort. Due to that very fact, the numbers released each month are preliminary estimates – which can (and will) be adjusted in the future.

Revisions

Those adjustments in future months are known as revisions and they happen quite often – especially during eventful economic times or potential economic turning points (such as the one we’re in now with tariff and political uncertainty). The revisions happen for many reasons – delays in companies responding to the surveys, companies not replying if they went out of business, staffing constraints, the constant battle/trade-off between accurate data and timely data, and perhaps most importantly, changes in the labor market (like those from COVID impacts on employment dynamics and immigration policies) making past prediction models less and less accurate.

July’s Jobs Report

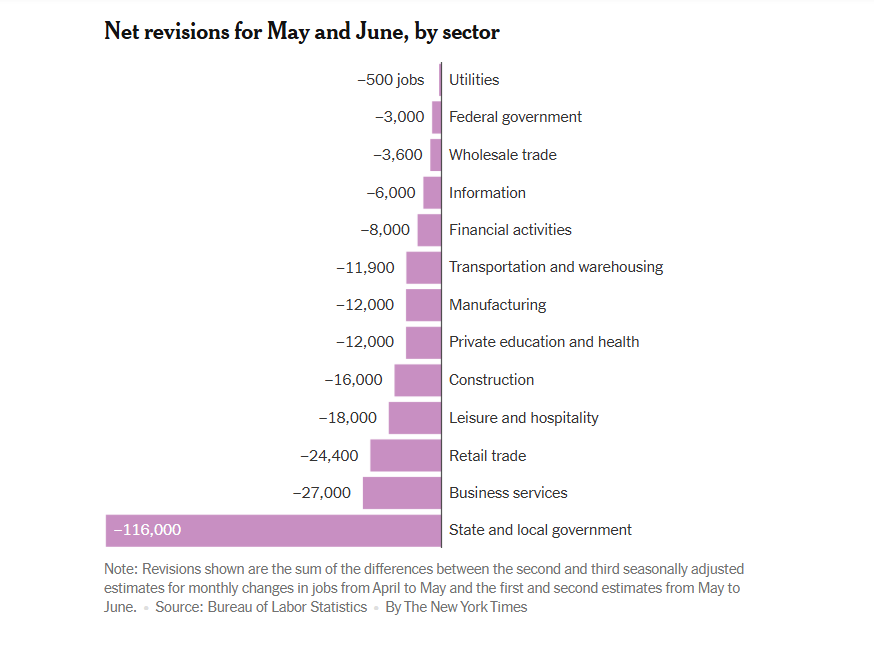

Back to last Friday. The July jobs report showed that the US economy added only 73,000 jobs in July, below expectations of 104,000. However, perhaps more importantly, both May and June reports were revised downward by a combined 258,000 – which is a historically large revision. As you can see in the below chart, by far the largest contributor to the revisions was government sector.

It wasn’t enough that we had a weak jobs number and major revisions to the prior months’ reports – we also got a major political move. On Friday after the report was released, President Trump fired the head of the BLS claiming (without evidence) that she “rigged” the numbers to hurt him politically. Trump’s aides were quick to come out and state that the President merely wants someone in the agency that will be focused on accuracy and able to communicate the reasons for revisions but the underlying message was quite clear based on the President’s own words surrounding the announcement.

There has been no evidence presented to support the claims that the numbers released were wrong. They certainly were not a perfect reflection of what’s been happening in the US (due to the major revisions) but they were the best estimates available at the time. And it’s important to note there is absolutely no evidence that the numbers were rigged for political reasons.

Now What?

Last month, the June jobs report had supported a narrative that the labor market remained in great shape – but that narrative has been refuted handily by the July report. Post revisions, the employment gains in May and June were just 19,000 and 14,000, brining the three month average nonfarm payrolls growth down from 150,000 before revisions to just 35,000. That is a meaningful change and one that brings into question the true status of the labor market.

As you surely know by now, a strong labor market is one half of the Federal Reserve’s dual mandate (the other being stable prices ie: controlled inflation). If the labor market is starting to weaken (or perhaps already has weakened), it may be time for the Federal Reserve to lend some support to the situation by lowering its benchmark interest rate. As Federal Reserve Governor Waller explained in his dissent at the July FOMC meeting, “when labor markets turn, they often turn fast.” That’s precisely the risk the Fed needs to be attuned to and may very well respond to at their next rate decision meeting in September.

While there has been a lot of attention surrounding this jobs report and the revisions of prior months, it’s important to keep in mind it is one data set. The Federal Reserve is going to assess all incoming data in the weeks ahead in determining the path of rates but this jobs report seems to be a strong argument supporting a rate cut. As always, there is never a dull moment and it’s likely to be an interesting end to summer for investors and markets.

Onward we go,

Leave a note