July Inflation Prints – Permission to Cut?

August 14, 2025

After a few weeks of talking about the July’s jobs report (the often forgotten half of the Fed’s dual mandate), its better half (inflation) was back in focus this week with the release of the Consumer Price Index and the Producer Price Index for July.

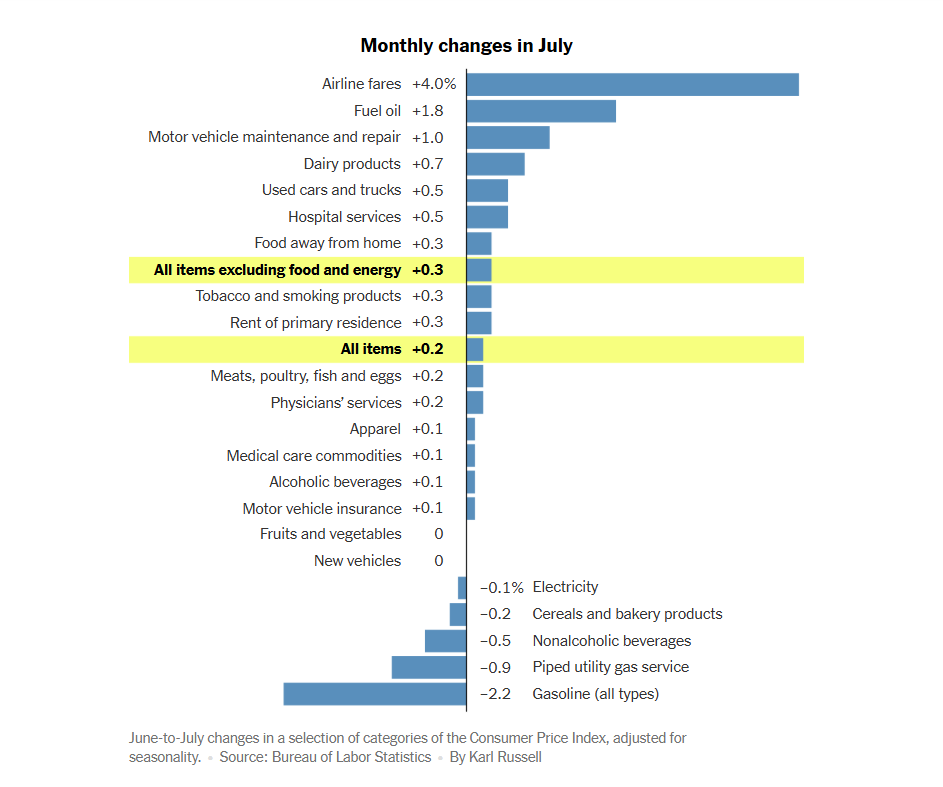

The releases were somewhat mixed. Consumer prices rose modestly. CPI came in at 2.7% annual increase, consistent with last year and rose 0.2% in the month. Core prices, which strips out the volatile categories of food and energy, rose by a higher margin for the month (0.3%) as well as the year (3.1%).

The consumer inflation metrics, while still increasing, were clearly better than the market had been anticipating as major equity averages rallied over 1% during Tuesday’s trading day. Why did markets react so well? The consumer inflation data seemed to suggest that the impact of tariffs the Fed has been fearing (and using as a reason to not cut rates to a large extent) have not yet shown up in consumer prices to a material degree. And if that is the case, it seems likely the Fed may have permission to cut in September. Lower rates = good news for equity prices.

Here’s a closer look at the consumer price inflation in July (note the usual suspects from recent years are back at the top!)

On Thursday, the Producer Price Index (PPI) was released and poured a bit of cold water on the celebration. PPI is a measure of wholesale prices and would therefore show the true impact of tariffs (consumer prices can hide the tariff impact if businesses chose to absorb them). PPI did show a larger increase, rising 0.9% in July as compared to the estimate of 0.2%. On an annual basis, PPI was up 3.3%, the largest 12 month increase since February. Excluding food and energy, core PPI rose 0.9% for the month. Services inflation played a large role (rising 1.1%).

A higher than expected PPI and a relatively tame CPI seems to support the premise that for now, businesses are absorbing tariff impacts without passing them along to consumers. However, as the long-run tariff picture becomes clearer and companies start to feel the impacts of lower margins, they may attempt to raise prices charged to consumers moving forward.

Markets did not celebrate the wholesale report as they did the consumer report, ending flat on the day. The swaps market still indicated a high likelihood of a September rate cut and its unlikely the Fed will continue to work against the market. However, the contradiction between the wholesale and consumer inflation prints does present a bit of a challenge as it could indicate simply a delay (and not an absence) of pricing pressure from tariffs.

As always, there never seems to be a dull week for markets. With Trump and Putin set to meet tomorrow, next week promises to be another interesting one. See you back here next week.

Onward we go,

Leave a note