Latest Inflation Report (August 2023)

September 14, 2023

A sure sign of the passing of time these days is the release of monthly inflation reports.

August 2023’s Consumer Price Index (CPI) and Producer Price Index (PPI) were released this week and the results were..well, mixed.

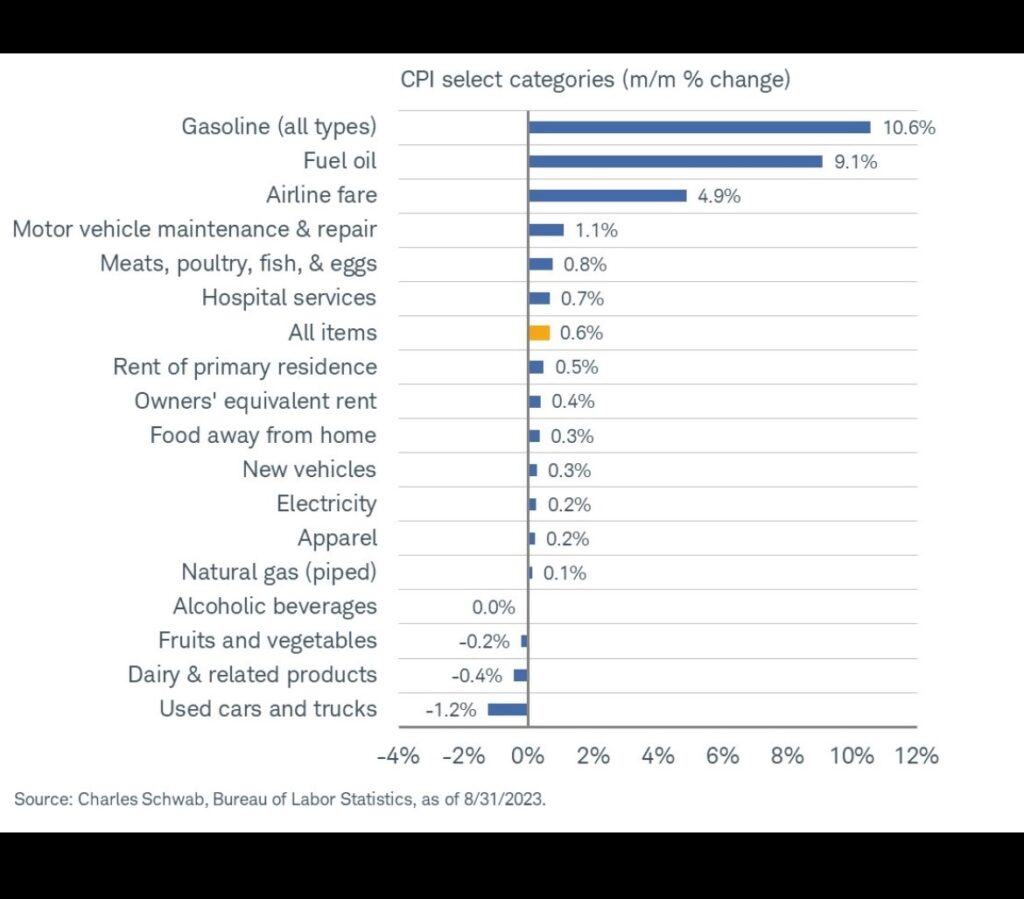

Let’s look at CPI first. Month over month, headline CPI rose 0.6%. The core metric (excluding volatile food and energy) came in higher than anticipated at 0.3% month over month, versus the consensus estimate of 0.2%. The year over year change revealed a 3.7% increase in headline CPI (slightly above the 3.6% estimated change and last month’s 3.2% increase) and 4.3% increase in core CPI year over year, in line with estimates and lower than last month’s 4.7% reading.

The monthly change in the headline number was mostly due to a rise in gas/fuel prices. The change in core was largely driven by two main categories – motor vehicle insurance (up 2.4% in the month, 29% annualized, which added 0.08% to the monthly change in CPI) and airfares (up 4.9% in the month, 59% annualized, adding 0.03% to CPI change). Below are more details on monthly changes in CPI.

Do these increases automatically imply that further rate hikes are coming? Not necessarily. Take for instance motor vehicle insurance – this is likely a “catch up” given the surge in auto prices over the past few years and it’s unclear that a rate hike will slow/mitigate this increases, at least not immediately. Rise in airfare could surely be lowered if rates were to rise (by the carry on effects of slowing consumer spending). However, recent guidance cuts from airlines such as American, Delta, Spirit indicate that softness is coming in that spending already.

The PPI report also showed an uptick in inflation for the month. The PPI, which is a wholesale measure of inflation, reporting what producers get for their goods and services, rose 0.7% in the month and 1.6% year over year. These changes were ahead of estimates and similar to CPI, were largely due to a spike in energy prices.

What do these reports mean for markets and investors? As Chairman Powell noted at the Jackson Hole Economic Symposium, the Federal Reserve is closely watching data releases and using that information to guide future decisions. These two inflation reports, in addition to a rate increase by the European Central Bank and stronger than expected retail sales, seem to indicate that there may be further cooling pressure (ie: rate hikes) needed. And yet, market participants continue to see a very low chance of a hike next week (97% odds of a pause at last glance) and remain unconvinced of a November hike (60% odds of a pause then as well). In the wake of this news, interest rates and volatility remained flat and equity markets were stable to positive. Once again, it seems that the Fed’s path is far from certain.

We’ll all just have to wait to see what comes next!

Onward and upward,

Leave a note