Mixed Emotions

March 20, 2025

Markets have been presenting quite a few mixed emotions these days. This up and down dynamic made for another interesting week. Let’s look at what happened.

Sentiment Shift Confirmed

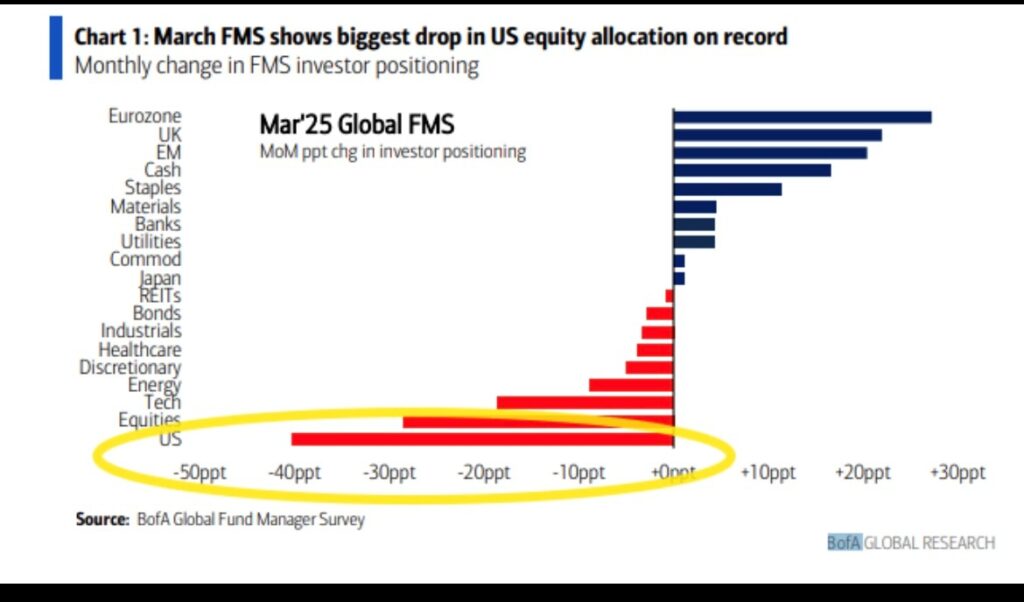

We’ve been writing about the fast (and steep) sentiment shift in recent weeks. More data was revealed this week to confirm how quickly investors have turned cautious regarding the US economy and US equities.

A Bank of America Fund Manager survey showed the largest monthly drop in US equity exposure since they began tracking this metric. A 40% decline! Staggering by any measure.

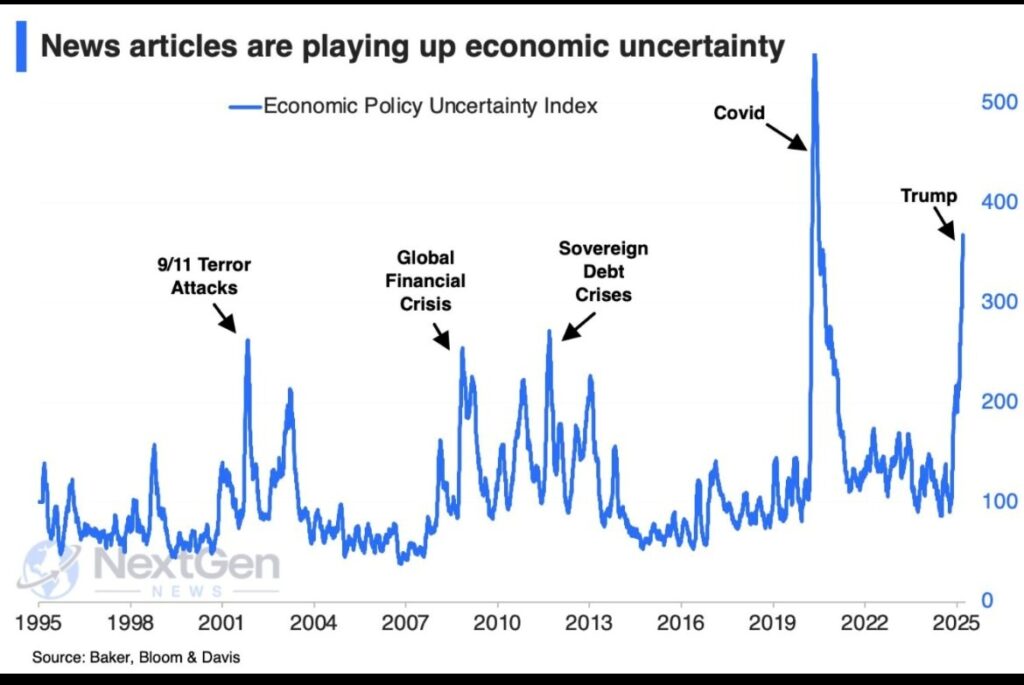

A look at the Uncertainty Index shows this ranks as the second most uncertain time (ranking lower than only COVID). Is this time truly more uncertain for investors than the global financial crisis or 9/11 attacks? If this indicator is accurate, it seems so.

The low level of investor sentiment and high level of uncertainty continue to put pressure on markets.

(Relatively) Quiet on the Administration Front

While there were some material news making events concerning the administration (avoiding a shutdown, conflicts with the judicial branch, etc) it was a relatively quiet week on the tariff front. President Trump did reiterate his plan to put reciprocal tariffs in place on April 2nd but there were also news reports of ongoing negotiations with China and Mexico ahead of that deadline. Markets as a result weren’t swayed on a daily (or hourly) basis regarding tariffs but it likely continues to weigh heavily on the uncertainty equation.

Federal Reserve Meeting

The main event of the week was on Wednesday, when the US Federal Reserve revealed their March rate announcement, electing to keep rates constant as had been widely anticipated. The associated commentary seemed to put markets at ease as the day brought the strongest rally of the week.

Fed Chairman Jerome Powell remained positive in his commentary but did have a more cautious tone. He noted that the labor market remained healthy, with wage growth remaining ahead of inflation, and that inflation had been holding steady (see tariff impact below). The Fed did take down its estimate of GDP (now at 1.7%) and more Fed members cited concerns over the potential of slowing growth.

However, even with that lower growth forecast, Powell remained confident in the data they are analyzing. But confidence and sentiment are starting to be of concern. “The hard data are still in good shape,” Powell said, pointing to indicators such as employment and consumer spending. “It’s the soft data, the surveys, that are showing significant concerns, downside risks, and those kinds of things.”

The Federal Reserve is picking up on some of the sentiment shifts noted above, as well as the lack of clarity about what may come next (using the word uncertainty 18 times in his commentary). Fed Officials also noted in their official post-meeting statement that “uncertainty around the economic outlook has increased.” Powell said they will watch the soft data as well and if the lower confidence starts to impact spending from consumers and businesses, they will see it very quickly.

Powell did not seem too concerned with tariffs at the present moment (saying, of all things, that the inflation from them could be transitory (the term that got the Fed in trouble as inflation spiraled post-COVID). He did caution they could get in the way of the ongoing inflation fight at some point, depending on the path taken, but did not indicate the Fed is taking action on that front at this time.

Markets’ positive reaction to the commentary was likely due to the Fed’s affirmation of likely upcoming rate cuts (two in 2025) and the potential for any softness to give the Fed cover to restart rate cuts even sooner. (Remember, rate cuts make borrowing cheaper and spur growth). Markets were also likely encouraged by Powell’s comments on inflation regarding tariffs and the fact that (for now) he is not indicating a need to hold rates up (or raise them) to fight resulting inflation.

Another week in the books. It was a mix of positive and negative news from the market’s perspective but it does appear (at least for now) that it may be trying to find its footing and “smile” on investors, at least for a little while. We will see what next week brings

Onward we go,

Leave a note