Navigating Choppy Waters

November 20, 2025

April wasn’t all that long ago but fortunately for us, we as humans tend to have very short memories. As a result, many of us have already forgotten the extreme market volatility we experienced just over six months ago. The recovery from that swoon has been remarkably quick (matter of months) and remarkably strong (S&P up over 40% from April lows) – both great traits for a recovery but also dangerous. Dangerous as it has perhaps once again lulled investors into the belief that markets only move “up and to the right.”

They do in fact go down and reverse from time to time, and that is what we’ve been experiencing over the past couple of weeks.

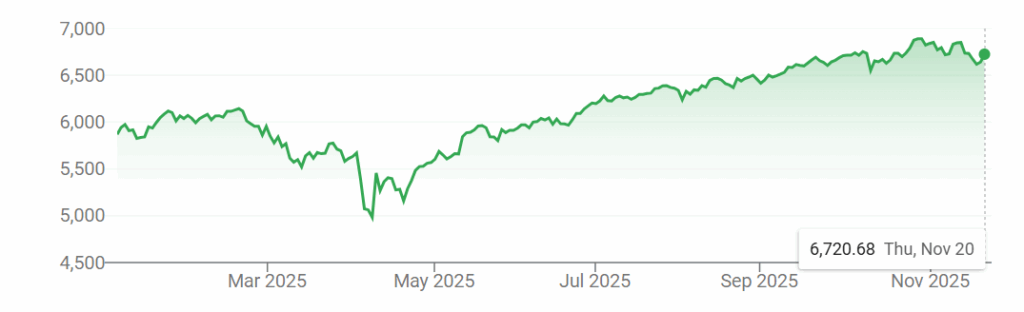

“Choppy waters” seems fitting but perhaps a bit overstated as the decline is not that large in context of the year (as of November 19 close, the S&P 500 was down ~3% in November and still up over 14% year to date). However, given how calm markets have been and the marked increase in volatility and negative/fear-based market commentary, it sure feels a bit rough out there. Pick your area of worry – concerns over the “AI bubble,” weakness in job growth, ongoing vacuum of economic data due to shutdown, questions as to the path and pace of Fed rate cuts – and there has been no shortage of worries for markets and investors.

As a result, I thought it was worth revisiting my two favorite strategies for less than desirable market days – zoom out and breathe in – as well as cover a few actionable steps you can take right now.

Zoom Out

I understand that market volatility is not at all enjoyable. I’m an investor right there with you. The 24/7 news cycle and non-stop doomsday headlines do not make it any easier to know when (or if) the selling will end. Turning off the news is one way to calm your nerves. Another great way to calm your nerves? Zoom out! Don’t just look at the past two weeks. Look at the entire year. Or better yet, the back 5, 10, 15+ years. Odds are, you will be pleased with the result. Here’s a simple example of what I mean.

A chart of the S&P 500 over the past month – bit choppy and not “up and to the right” *please note these charts were pulled mid-day November 20th (markets have moved again since but you get the idea!*

How about a chart of the S&P 500 for 2025 YTD. Better.

Chart of the S&P 500 since the mid 1990s. Much Better.

The chart of your portfolio may not look identical to this one but odds are they follow the same trendline of “up and to the right” over time. Take some time to zoom out if you need a pick me up!

Breathe in

It’s somewhat ideal that this market stress is coming right before Thanksgiving. No, not just because the market will close on Thursday and close early on Friday! There is perhaps no better holiday to use as a way to reset your nervous system and refocus your priorities. Sure, seeing your balance decline in your online brokerage account is not enjoyable. I get it (I have one too). However, that number on the screen shouldn’t dictate your mental wellbeing. Your family, friends, health, simple pleasures, favorite past times, dreams, experiences – this is what matters and what we should focus on (easier said that done at times). My guess is if you listed 10 things you are most thankful for, your exact net worth or portfolio number may not even make the list. Sure, your financial health and stability might, as may your desire to live the life you have planned on with the wealth you’ve accumulated. Not to worry – a slight market wobble doesn’t put those items at risk.

Actionable Ideas

Sometimes, in times of perceived stress, our minds just want us to take action of some kind. If you are feeling compelled to “do something,” here is a list you can choose from:

1.) Trim winners – even with many individual stocks off their all-time highs, many have posted exceptional mutli-year returns. If you find yourself with concentrated positions, now is a smart time to do some trimming. You may also use those appreciated shares for charitable donations

2.) Harvest losses – as luck would have it, we are almost to the end of another tax year so unrealized losses are not a terrible thing. Consider selling losing positions to offset gains (see #1 above)

3.) Rebalance – having a target allocation (providing you with guardrails around what percentage should be in each asset class) makes this a simple exercise. Evaluate what asset classed have pulled ahead this year and which have fallen and consider selling/adding to bring things back in line

4.) Check your return – even with the recent pullback, odds are your return for 2025 (and your annualized return over the past several years) remains in line (or in excess of the return you need to meet your financial goals (typically 5-7% depending on your exact goals and allocation). That’s the return that matters – not the return of the S&P 500, not the return your neighbors claimed to have earned, not the return you saw on the screen a few weeks ago. Anchor to what matters. Trust me, it will help and confirm your ability to reach your long-term goals

4.) Focus forward – dollar cost averaging is a proven strategy to build wealth over time. Now is an excellent time to formulate your savings and spending plans for 2026. If you are still employed, review the new limits for retirement savings and set a plan to fund as much as possible. If you are retired, determine your strategy for funding your spending and consider safeguarding upcoming distributions within your accounts to guard against future volatility. And regardless of your employment status, putting a budget/spending plan in place is a nice financial practice to employ

Markets will never move solely in one direction. It should get easier to see flashing red on the screen but it really doesn’t. Hopefully the simple practice of “zooming out, breathing in” continues to help you stay the course and navigate any financial waters you find yourself in.

In closing, I’m sending you and your families wishes for a very happy thanksgiving holiday. All of you and the work we do together ranks very high on my “thankful list” – and for that I will always be grateful.

Onward we go,

Leave a note