October Inflation Reports

November 16, 2023

Earlier this week, two inflation reports were published for October. Let’s take a look at what they said and the market reaction.

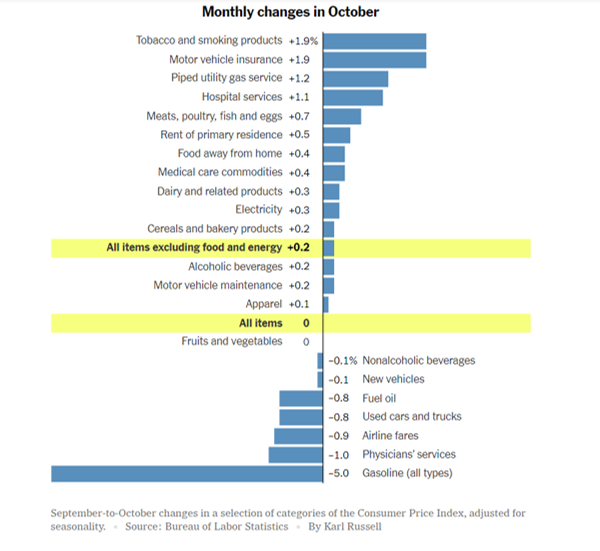

First up was Consumer Price Index (“CPI”). It came in at 0.23% month over month, compared to 0.30% consensus. Year over year rise was 3.2%, far slower than consensus of 3.7%.

Shelter slowed dramatically (0.30% increase) but perhaps more importantly, only 7 of the 31 Core CPI components showed any increase at all, indicating that perhaps inflation is hitting a wall.

Here’s a look at the changes month over month

Markets certainly approved of this inflation reading, taking it as perhaps another sign that further interest hikes will not be needed to slow economic activity. Equity markets rallied very strongly on the news and interest rates fell well off their highs, with the 10-year US treasury rate seeing its largest one day decline since March 2023.

The following day, Producer Price Index (“PPI”) was released. PPI declined 0.50% for the month, the biggest monthly decline since April 2020 and ahead of estimates of 0.10% increase. On an annual basis, PPI increased 1.3%, down from a 2.2% year over year increase in September.

While we remain a long way from the Federal Reserve’s 2% long-run inflation target, these reports for October were certainly encouraging and show real progress is being made. As for what comes next, that’s the fun part – we just have to wait and see!

Onward we go,

Leave a note