Pick Your Square

June 21, 2023

I subscribe to a few research services. I always value other people’s ideas and thoughts on the market and these services do a great job of challenging my thinking and presenting new perspectives.

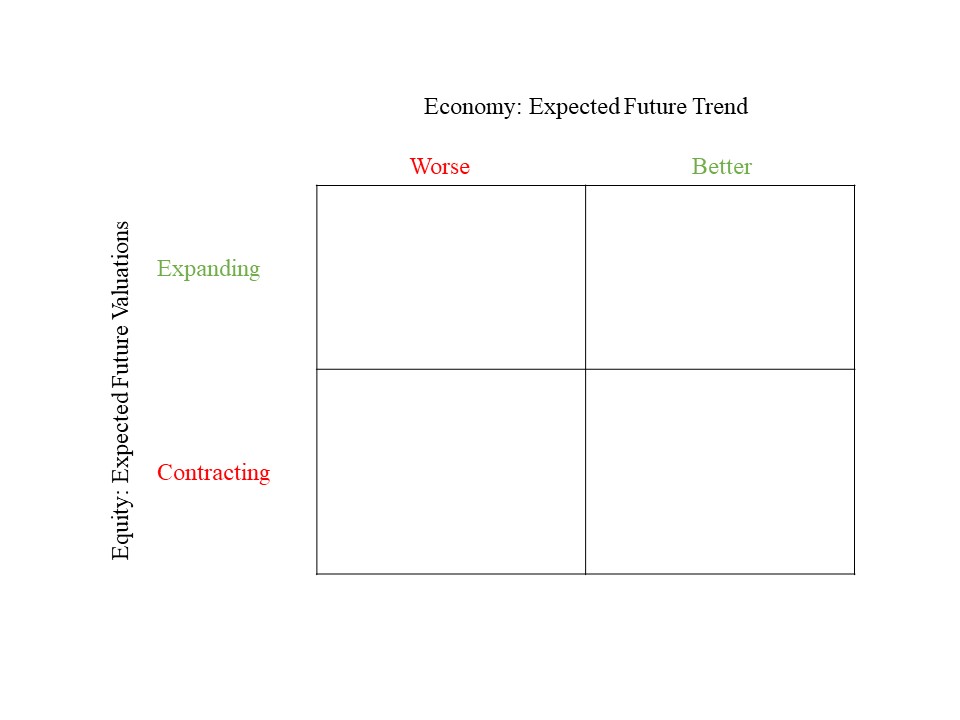

One research firm I am particularly impressed by- FS Insight – does an excellent job of simplifying the market into digestible ideas and at times, graphics. On a call earlier this week, they presented this four-by-four matrix (who doesn’t love a four by four matrix?) They were using it to allow people to gauge their current disposition, by assessing forward expectations for both the equity markets as well as the economy

Let’s look at each square:

Lower left (contracting equity market/worsening economy) – this is perhaps the most populated square of 2023. As the Federal Reserve aggressively raised rates to fight inflation, many market participants were convinced that the economy would tip into a recession and that equity valuations would plummet in lock step (with rising rates and slowing earnings). This square had many saying “cash pays 5%, forget investing in anything else” and is where the consensus view has been positioned since fall of 2022 (as evidenced by most 2023 S&P 500 forecasts being below or near 2022 lows)

Upper left (expanding equity market/worsening economy) – this square is characterized by a belief that the economy is going to slow or enter into a recession (with the persistent pressures brought on by higher rates, signs of slow down in the labor market, persistent high rates, etc) but that the equity market will move upward nonetheless (due to earnings being “good enough,” productivity gains, increasing fund flows back into equity markets, markets bottoming before recession appears, etc)

Lower right (contracting equity market/improving economy)– to reside in this square, one would believe that the economy will do better than anticipated in coming months (perhaps with the Federal Reserve achieving it’s goal of a soft landing and the US avoiding a recession). However, you would also believe that equities (especially after their recent run) will retreat despite an improving economic backdrop

Upper right (expanding equity market/improving economy) – this is where the optimistic equity investor resides! Those in this square are of the mind that the economy will continue to improve (avoiding a recession) and that is upside for equity investors

Now, knowing the landscape and your four options, which square would you pick as of today? Has your answer changed since the start of 2023? Has you answer changed in the past few weeks?

Hit reply and let me know!

And if you’re curious, I’ve been an upper right resident throughout 2023 (and well before that) – moving closer to the center of that square as time has progressed. Of course, there have been weeks and months this year where I was tempted to deviate “down and to the left” Yet I remained confident in my strategy and the trendlines in the data. That thesis (simplified) was that the US economy and its underlying companies and consumers were resilient, well-positioned, and fully capable of enduring the inflation-fighting cycle we’ve been in. And while cash at 5% plays a key role in portfolios, there was meaningful upside available in equity allocation of portfolios (likely well in excess of the risk-free rate after 2022’s returns).

As of mid-June 2023, my square of choice has treated me and my clients well. We shall see what the rest of the year brings and if it requires me to change my location at some time but for now, upper right remains my square of choice.

Onward we go,

Note: All commentary above is as of the date of this post and is for education and informational purposes only. Windermere and its principals do not intend for this to serve as investment advice and are not responsible for any actions taken based on this article.

Leave a note