Q1 2024 GDP Report

April 25, 2024

Most Gross Domestic Product (GDP) reports come and go without any mention. The Q1 2024 GDP estimate (released this week) was not one of those releases. The report had a major impact on markets.

Some of you may be asking, “what is GDP again?” Let’s review. GDP is the way we measure the US economy and its growth. As you can tell by the definition, this is a rather challenging thing to measure with a country as complex and vast as the US. As a result, it is very prone to error and backward looking revisions. However, we need a way to estimate growth, so we are left with this metric.

GDP is made up of four main components added together:

*Personal Consumption Expenditures – also called consumer spending, this is the goods and services people buy, such as clothing, groceries, health care, cellphone services, etc.

*Investment – This is business spending on capital expenditures/fixed assets, such as land, buildings, and equipment as well as investment in unsold inventory. This category also picks up the purchase of homes by consumers

*Government Spending – As the name implies, this represents spending by federal, state, and local governments

*Net Exports – US exports minus US imports

For Q1 2024, GDP, adjusted for inflation, increased at a 1.6 percent annual rate in the first three months of 2024, down from 3.4 percent at the end of 2023, the Commerce Department said Thursday of this week.

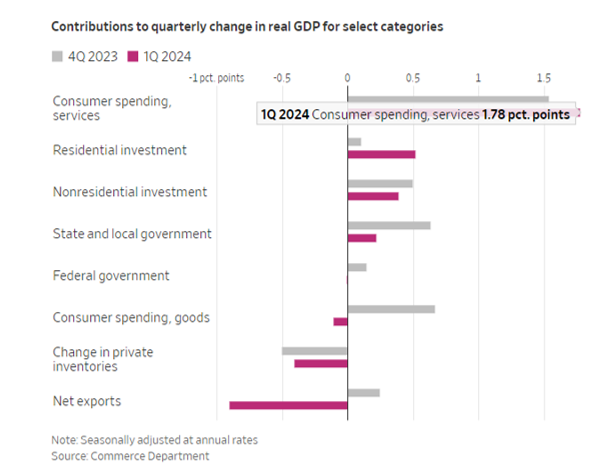

The “math” was as follows (contribution to the total 1.6% GDP growth shown):

Consumer Spending 1.68% – spending on goods fell while spending on services increased. Consumer spent less than in Q4 2023 but it remains meaningfully positive

Investment 0.56% – business spending was up but inventories fell offsetting the growth from this component

Federal spending 0.21% – down from prior periods

Net exports (0.86%) – exports fell and imports rose, leading to net exports turning negative

Here is a handy chart showing the contributions from Q1 2024 and Q4 2023 from the Wall Street Journal

While the GDP report had some bright notes (ongoing strength from consumer and business spending), markets reacted very negatively. Why?

The common explanation was a fear of a potentially dangerous dynamic of slowing growth and ongoing/persistent inflation (known as stagflation). This is dangerous as it results in a situation that the Federal Reserve cannot address with interest rates. If you have slowing growth, the typical way to help that is to lower rates and spur economic growth. But if you have ongoing inflation, lowering rates will cause that to persist (or increase). This one report should not be a definitive sign of such a dynamic but it clearly worried some market participants.

There are of course counter-arguments to this reaction. Namely that this GPD print showed ongoing strength in consumer and business spending and that the weaker numbers were largely driven by large shifts in business inventories and international trade, which often swing wildly from one quarter to the next.

Another important fact to keep in mind is that during this time of rapid structural change in the US, there are increasing amounts of economic activity that are likely being missed in this sort of data. It also important to not lose sight of the fact that immigration and productivity gains from things like flexible working and artificial intelligence have likely raised the sustainable growth rate, despite what the current data may reveal.

All in all, it is one data point in a string of data points the market will need to digest and interpret throughout 2024 and beyond (the next of which is Core PCE released by the time you read this post). You know the drill – don’t be distracted by one report or one day in the markets. This is all part of the process.

Onward we go,

Leave a note