Same Country, Varying Experiences

October 23, 2025

Each month, Rick Rieder, head of Fixed Income for Blackrock, hosts a monthly investment call that is always very informative. Him and his team present exhaustive data on several market trends and concepts. One that caught my attention this week was a discussion of the ongoing divide between certain age and income groups within the country. While there is no clear solution to this ever-growing segmentation, it’s important to remain aware of the situation and its impact on the economy.

Rieder started by highlight three present-day characteristics of the US economy that have been supporting its resilience and growth:

- Service-oriented economy – in past decades, the US was a goods focused economy. Not anymore. We are now a service oriented economy which has helped our growth as an economy based on services is not at cyclical and rate sensitive as one based on goods

- Consumption supported by wealth, not income – you’ve likely read the headlines that most spending is coming from the wealthiest Americans. This is due in large part to the fact that the majority of US spending comes from accumulated wealth – not current wages. This stands in contrast to the 1980s, when baby boomers were in the workforce. At that time, wages and the strength of the labor market were critical to the US economy. Not so much today

- Wealthiest generation (70)+ is set up for success – Today those over 70 hold over 31% of the nation’s net worth. This cohort is not sensitive to interest rates – in fact, they prefer them higher as they are savers not borrowers. This cohort is also immune from any labor market forces as they are largely retired

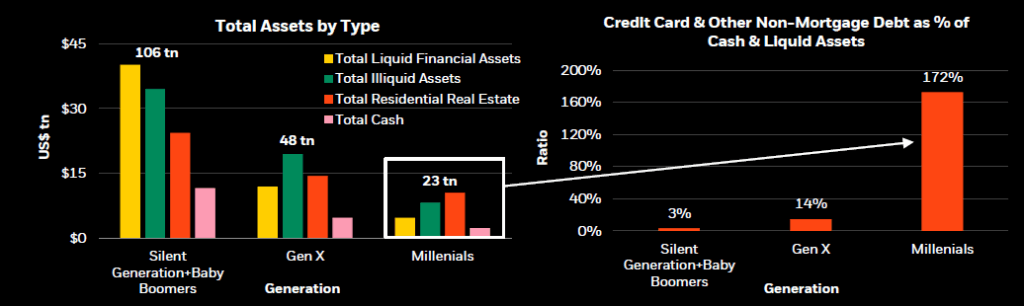

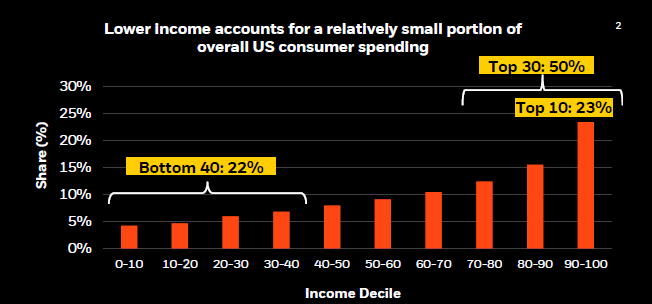

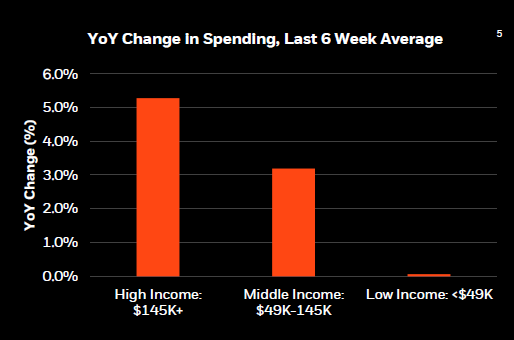

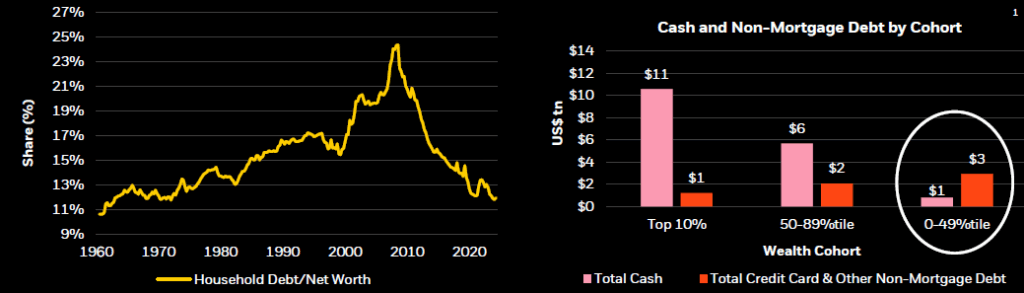

These dynamics are critical and distinguish today’s US economy from that of the past. These charts further illustrate the sharp differences between the generations and income cohorts.

Older Americans have higher assets, lower debt, and as a result, are less rate sensitive

Older Americans spend more – and typically are spending accumulated wealth, not wages

Lower income Americans make up a relatively small percentage of spending

Wealthier Americans keep spending but lower income spending has flatlined

Lastly, household balance sheets are in great shape but those with lower net worths are clearly struggling

What does all this mean? The disparities are striking and clearly reveal that lower income Americans will benefit greatly from lower rates. This appears to be the Fed’s likely path and with any luck, that will ease some of this pressure. However, considerable work remains to be done to close this gap.

The good news from the above is that the US economy remains strong and structurally resilient, which is driving ever higher levels of wealth and income for its citizens. The bad news is that wealth and income are not distributed evenly. Definitely something to be aware of – both as an investor and as a citizen of this country.

Onward we go,

Leave a note