Scoring the Week’s Events

February 1, 2024

Ahh January. This month always feels like it lasts forever doesn’t it? The post holiday season let-down, the cold weather, winter storms, 31 days long.. you get the idea! Yet it is a very important month as it can the set the tone for the following eleven months. It turns out this is very much the case when it comes to markets and investing (see more on this at end of this post)

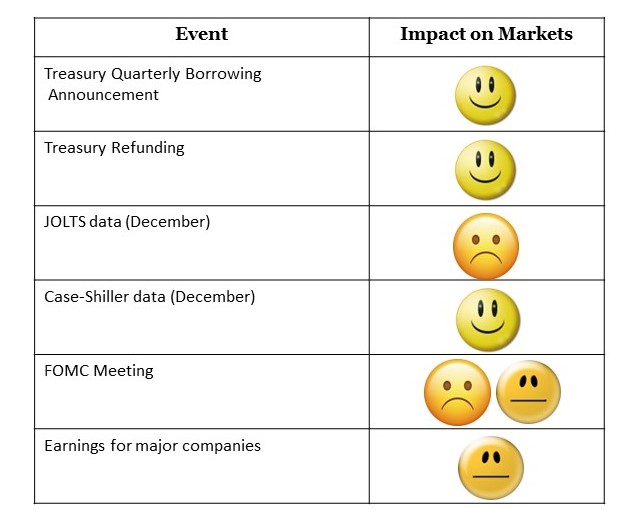

During this final week of January, there were quite a few events that were consequential to markets. Here is a quick summary scorecard of how they all turned out (please note that they are graded based on market impact – not necessarily personal/societal impact)

Treasury Quarterly Borrowing – The Treasury announced that it expects to borrow $760 billion in the January-to-March quarter, which is $55 billion lower than its October estimate. That means a lower supply of new Treasuries, helping to lift bond prices and lower bond yields. Lower borrowing was viewed as a good sign by markets

Treasury Refunding – Treasury announced an increase in upcoming debt issuances on Wednesday but largely met market’s expectations. The increase was in line with the one announced last November and the Tresury noted that it still did not expect further increases “for at least the next several quarters.” While the level of debt remains an important concern, the refunding was well received by markets

JOLTS data – On Tuesday, JOLTS (job openings) came in a bit higher than anticipated. Total job openings were 9.026 million in December which proved to be a negative surprise to markets. More job openings implies ongoing strength in labor market and competition for workers, which could lead to ongoing inflation (and a longer time before rate cutes) – not what the market wants to see.

Case Shiller data – Housing data released this week showed a 0.2% decline in home prices (on a lag, November 2023 change). This is the first drop since January 2023 and is encouraging in the flight against inflation

FOMC meeting – This was a confusing event for markets. Part of the meeting went as expected and telegraphed as the Federal Open Market Committee (“FOMC”) announced that interest rates would be held steady this month. However, the messaging of Fed Chairman Jerome Powell led to a bit of confusion (and sadness) for markets. The Fed removed the language from their statement that said further rate hikes may be required, which was a very meaningful and welcomed change. However, Chair Powell’s comments was very cautious when discussing rate cuts and he seemed to dismiss the potential of a March cut (which the market was better was a 62% chance going into the meeting). Markets took this as bad news and sold off into the close. In my view, Powell is walking a very thin line – cut too soon, and inflation could rise. Cut too late, and unemployment may skyrocket and the economy may falter. Inflation remains the key variable in all of this (as labor markets are holding their own) and the good news (that markets seem to have ignored in my view) is that it is falling – and likely to continue to do just that. Powell was cautious and hedged his bets – but he has to do that to keep investors from getting ahead of themselves and front-running the upcoming cuts. Markets took this as a bad news event but in my view, it was pretty much as expected

Earnings – Earnings for the week were a mixed event for markets. While most companies met expectations (and even exceeded them) for the quarter and year, future expectations were very elevated and some companies did not given forecasts that cleared those bars. It has been a mixed results earnings season but that is in large part due to the run-up before earnings.

Note: This post is being written late on January 31, so there are still a few events to come this week (more earnings and jobs data). You can grade those for yourself but rest assured, markets will react and adjust as the future unfolds in real time!

Before signing off, let me elaborate on the note above that January’s performance can set the tone for the rest of the year. The following analysis was done by FundStrat, a research firm we follow.

Over the past 74 years, when the prior year return in equities is over 15% and January is positive (this combination has happened 13 times), the full year median return is 16% and the full year return is positive 92% of the time. The only exception was 2018, when the Federal Reserve was pursuing a very aggressive tightening cycle, which doesn’t appear to be at all likely in 2024. Will history repeat? That remains to be seen but for now, take comfort in knowing the odds are in our favor.

Onward we go,

Leave a note