Sea Change

January 26, 2023

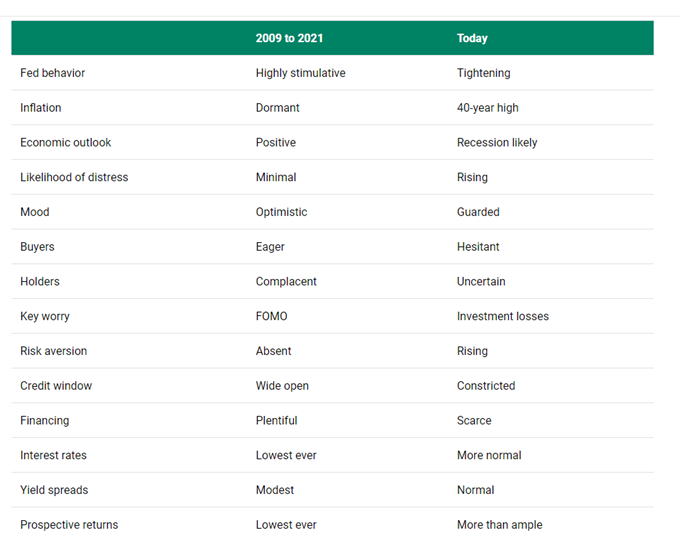

I’ve been meeting with clients to review 2022 reports this week. During some of those discussions, I’ve been referencing a chart from a renowned investor that really captures the powerful shift in markets over the past year.

The chart is from Howard Mark’s most recent quarterly memo. (Howard Marks is a legendary investor and his memos are exceptional (Warren Buffett calls them a must read)). His most recent memo was entitled “Sea Change”

He defines Sea Change: a complete transformation, a radical change of direction in attitude, goals . . .

The memo, which you can access here, outlines two times in history when markets have undergone a complete transformation and makes the case that we are in the midst of the third such occurrence now.

I won’t review all his reasoning and detailed analysis here. However, I will share this chart with you as it shows just how different today’s investing landscape is than that of just twelve months ago (an environment we had gotten very used to over the past decade).

Take some time and read each line. Hopefully you see how accurate the assessment is of today’s environment and the shift that is underway. The main stimulus of course is the rapid rise in rates – and the likely policy path from here.

At first glance, some may be discouraged by words such as constricted, uncertain, and guarded. However, I am actually encouraged by the overall message.

The tailwind from falling and low (to no) interest rates has decidedly turned. The froth and mass hysteria driven by “fear of missing out” mentality and incredible fund flows into markets at any price has washed away. Investors (and lenders) are now in an advantaged position compared to borrowers (due to higher rates). Returns can be earned across the risk spectrum (from cash to equities) – not just in assets far out the risk curve. Focus is on the rationale building and preservation of wealth over time – not on the “get rich quick” offers from years past. Much of the bad news noted above (recession risk, slowing growth) may very well already be priced into markets.

Sea change for sure. Undoubtedly, there remain many unknown risks beneath the sea’s surface and the tides may be rough in spots. But from where I sit, it is an easier market to navigate than the one we were faced with just twelve months ago.

Onward we go,

Note: All commentary above is as of the date of this post and is for education and informational purposes only. Windermere and its principals do not intend for this to serve as investment advice and are not responsible for any actions taken based on this article. Consult your financial advisor before taking any actions as it relates to your own investment portfolio

Leave a note

Leave a Reply

You must be logged in to post a comment.

hate to admit it. I am going to print this

tombeug says:

Your comment is awaiting moderation.

January 27, 2023 at 2:11 pm

hate to admit it. I am going to print this