Think for Yourself

June 19, 2024

To say the first (almost) six months of 2024 have been an interesting time in the markets would be an immense understatement. Virtually everything that has transpired (zero rate cuts, 15%+ return in S&P 500, 10-year interest rate well above 4%, massive concentration in returns among large cap tech stocks, etc) was NOT the consensus view at the start of the year.

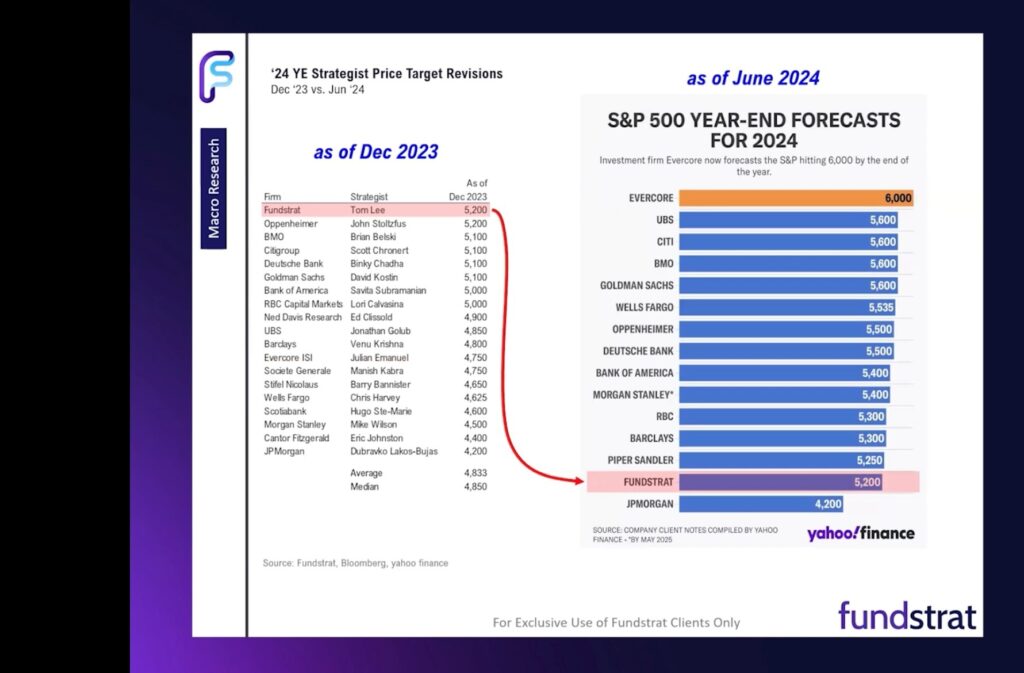

In fact, I can vividly recall in mid- December 2023 a strategist we follow closely via paid his firm’s paid research (Tom Lee of Fundstart) set a 2024 year-end price target for the S&P 500 of 5,200. At the time, he was the street high estimate, a full 1,000 points ahead of a very prominent strategist from JP Morgan. Tom spent many TV interviews deflecting ridicule and fielding questions from news anchors asking how he could actually believe such a level would be reached.

Well, let’s take a look at the chart Tom Lee shared last night. As you can see, in the past week, there has been a flurry of price target revisions as the S&P 500 has blown past Tom’s estimate.. The index sits at an all-time high of 5,487 as of the date of this post.

The “outlandish” estimate from Tom Lee is now tied for second last. Sure, the year isn’t over, but this chart sums up what I think may be a very real threat as we enter the second half – group think.

Here is the definition of group think:

When I start to see everyone pile on to one side of the teeter-totter so to speak (especially when it’s the side that has been working – in this case, the bullish argument led by AI mania), I can’t help but get a little concerned. Keep in mind, as Warren Buffet famously said, “be fearful when others are greedy and greedy when others are fearful’.

This is not to say that we don’t remain very constructive on both equity and fixed income markets. We were bullish to start the year and have had an overweight to US equities focused on technology and communication services. We were were of the mind that fixed income would hold its own (at short/intermediate durations) as coupons would more than offset principal declines if rates rose. These views have both proven to be wise and we continue to believe over the long-run, this positioning will be beneficial to the compounding of wealth.

However, when everyone coalesces around a singular point of view, I believe it becomes increasingly important to stay in your lane and avoid blindly following the group. Simply put – don’t forget to think for yourself.

Not sure where to start? Here are a few items you may consider as you resist the urge to follow the herd:

- Review YOUR portfolio – it doesn’t matter what your neighbor is doing or what the CNBC panelists say they are buying. Your portfolio is your reality. Review your allocations and rebalance back to target (both at asset class and sector level). Also check for any position concentrations and scale those back as needed.

- Evaluate savings plan – the market is at all time highs. Don’t let that deter you from adding to your savings. If markets do what they should, more all time highs will be reached in your lifetime. Revisit your savings plan and put available cash to work steadily over time (in accordance with your plan) and let the market take care of the rest. In my view, it’s never too late

- Know what you own – outsized moves in certain parts of the market have led to major concentrations in passive investments like market-cap and sector ETFs. Evaluate concentrations not just at individual stock level but also across your ETFs/mutual funds. Know what you own and ensure that any single stock won’t dictate your path forward

- Consider cash alternatives – Money market funds have been an excellent “wait and see” position for years now, paying well over 5%. Even though the Fed hasn’t cut rates yet, it is likely these cuts get closer with each passing day (which will bring down money market yields in lock step). Emergency funds/needed cash reserves should stay in money markets regardless of rates but other short-term savings/fixed income allocations may be better served by adding some duration at this stage

- Reframe your returns – it is very easy to compare your return against a headline on the news or a rate of return someone throws out at a dinner party. But at the end of the investing day, what matters is whether your return meets or exceeds the return you need to earn to meet your goals over the life of your plan. Don’t let the group or the noise distract you from your path

It’s an exciting time to be an investor and the returns for staying the course for the first six months of the year have been immense. Yet, as the fever pitch grows and everyone crowds thru the bullish-view door, just remember to keep a clear head, a strong focus, a steadfast ability to think for yourself.

Onward we go,

Leave a note