Trendlines move in both directions

June 15, 2023

Stay the course. How many times have I given that message to clients (and myself), both in these weekly posts and in general conversation? Thousands of times I am sure! And a large majority of those have come in the past three years as all investors have been thru a lifetime’s worth of challenges.

Truth be told, staying the course is not always an easy thing to do. To keep my mind calm and to avoid emotion taking over, it helps me to have an arsenal of “remember this when times are tough” lessons and mantras that I can go back to when in the midst of a challenging market.

I accumulate these lessons bit by bit as they reveal themselves to me and inevitably, when I go back to them, I am reminded that things are very rarely as good as we hope or as bad as we fear.

I came up with another one of these lessons this week as the latest inflation data was released and the Federal Reserve paused rates. It’s simple – but true. Trendlines can (and usually do) move in both directions.

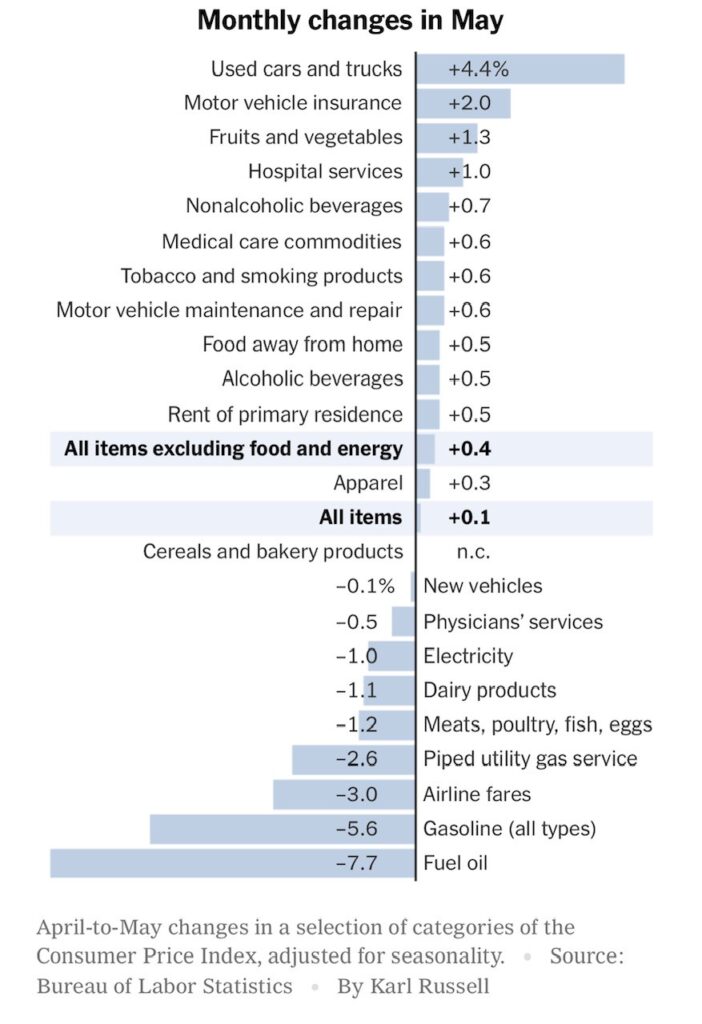

Let’s start with inflation. Earlier this week, inflation data for May 2023 was released. The Consumer Price Index (CPI) rose 0.1% in May (below the 0.2% expected and the 0.4% increase in April). The contributors are shown below with the main increase categories (used cars and housing) on notable lags. The key message – inflation is coming down.

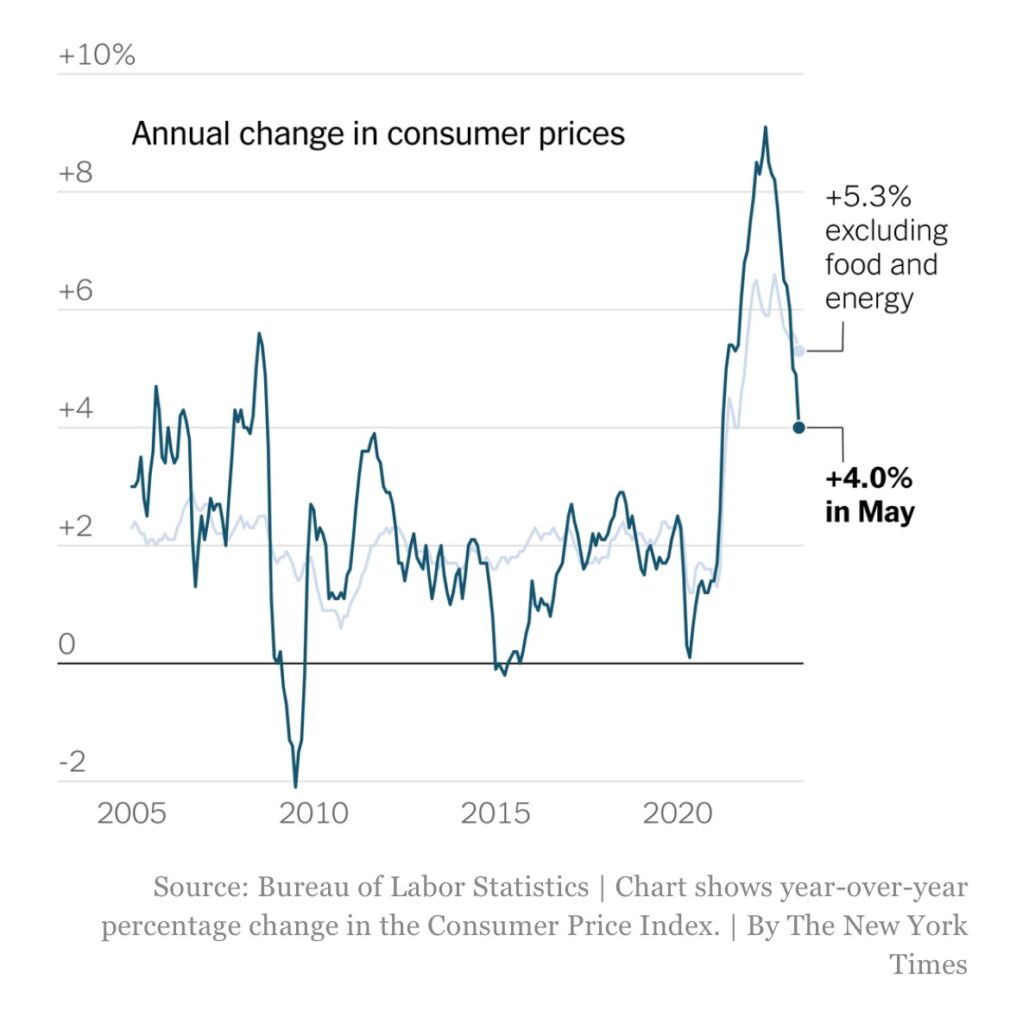

Then there was the year over year change, which fell to 4.0% in May, the slowest year-over-year comparison in over two years.

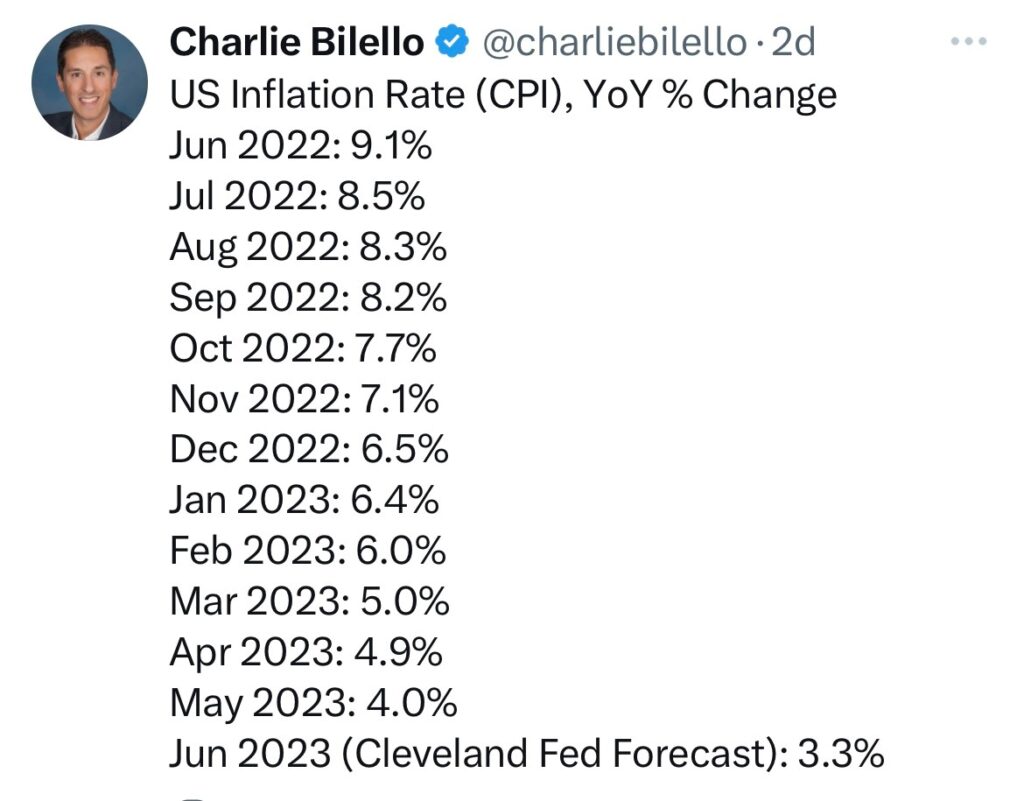

If you think back to a year ago, when year-over-year comparisons were over 9%, there was very little belief in falling inflation. It was assumed (by many – both in messaging and in how money was invested) that the trend line would continue moving higher. Maybe not forever – but certainly for as far into the future as many could see. And yet, take a look at this data. Nothing but declines in the year-over-year change ever since the high point last year.

The trendline didn’t only stall out – it completely reversed course. The trendline can move both ways, even when the majority of market participants would have you believe otherwise.

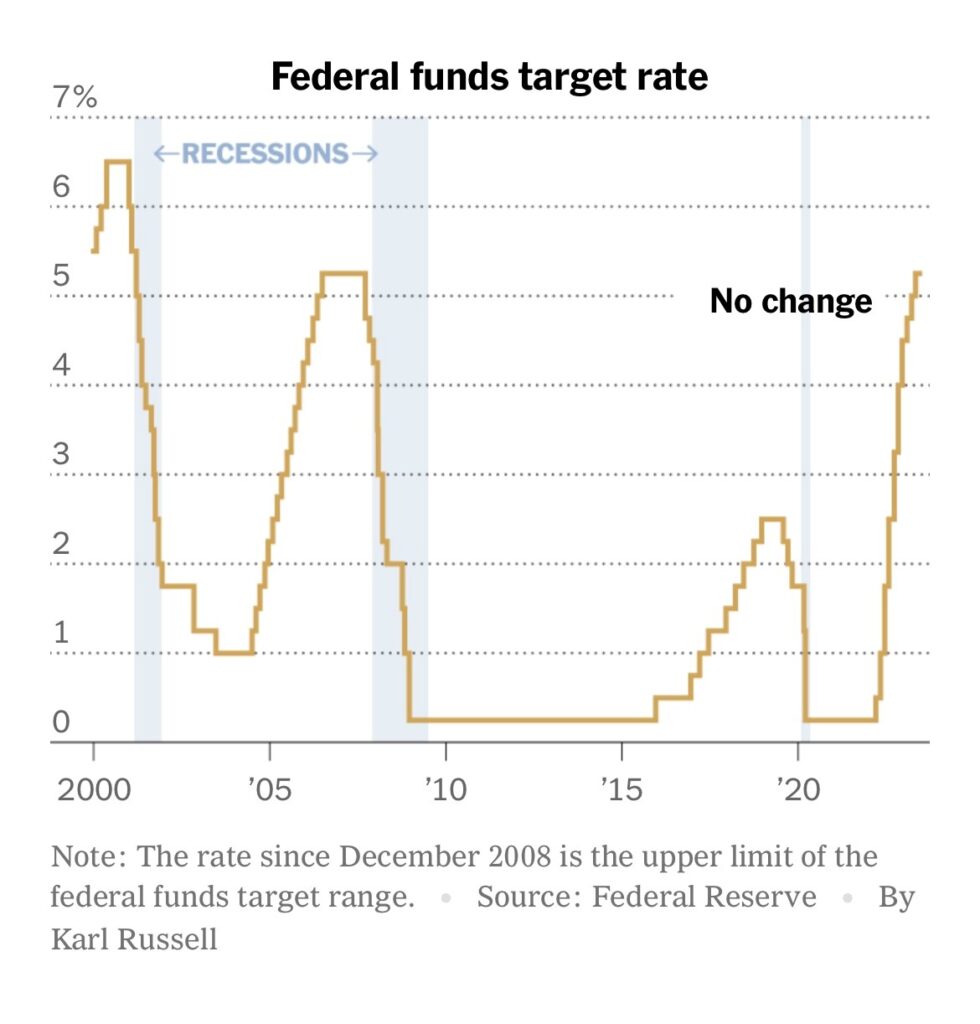

Now let’s look at the Federal Reserve. No, they didn’t reverse the trendline in rates at this meeting. Instead, they opted to pause, leaving the Fed Funds rate at 5-5.25%. Many market participants believe that the Federal Reserve will raise rates again in this cycle, as their dot plot shows a majority of members believing that two rate hikes remain.

Time will tell what they do in the coming months, but take a look at this longer timeframe chart of the Federal Funds Rate dating back to 2000.

Notice anything? You guessed it – the trendline moves in both directions. Take notice of the rapid decline in 2008 – followed by the stairstep up from 2015 until the COVID shock of 2020 and decline back to zero – and the subsequent rapid ascent to the recent landing we find ourselves on in June 2023. At the start of 2023, many believed (and invested as such) that the stairs would “go to heaven” and fed fund rates may very well increase indefinitely. This pause – whether it is a “pause and hike” or a “pause and raise”, at the very least shows that no trend last forever.

Trendlines can (and usually do) move in both directions. I’m logging this mantra in my “stay the course” archives and will revisit it next time market commentators are seemingly convinced that an intractable trend (good or bad) will last forever. It surely won’t – and we’ll all be ready for that plot twist.

Onward we go,

Leave a note