Welcome 2024!

January 4, 2024

Happy new year! I trust that you had a great holiday season and are ready for a wonderful year ahead.

The calendar turned to a new year only a few days ago and already the markets and business media are off and running with their 2024 predictions. Countless money managers and economists are filing the air time with their projections regarding where markets are likely to go this year, expressing their view with a level of conviction that makes you believe them. Surely they can see into the future, right? This happens every year – and in most years, the consensus drumbeat (and most of these commentators) end up being wrong.

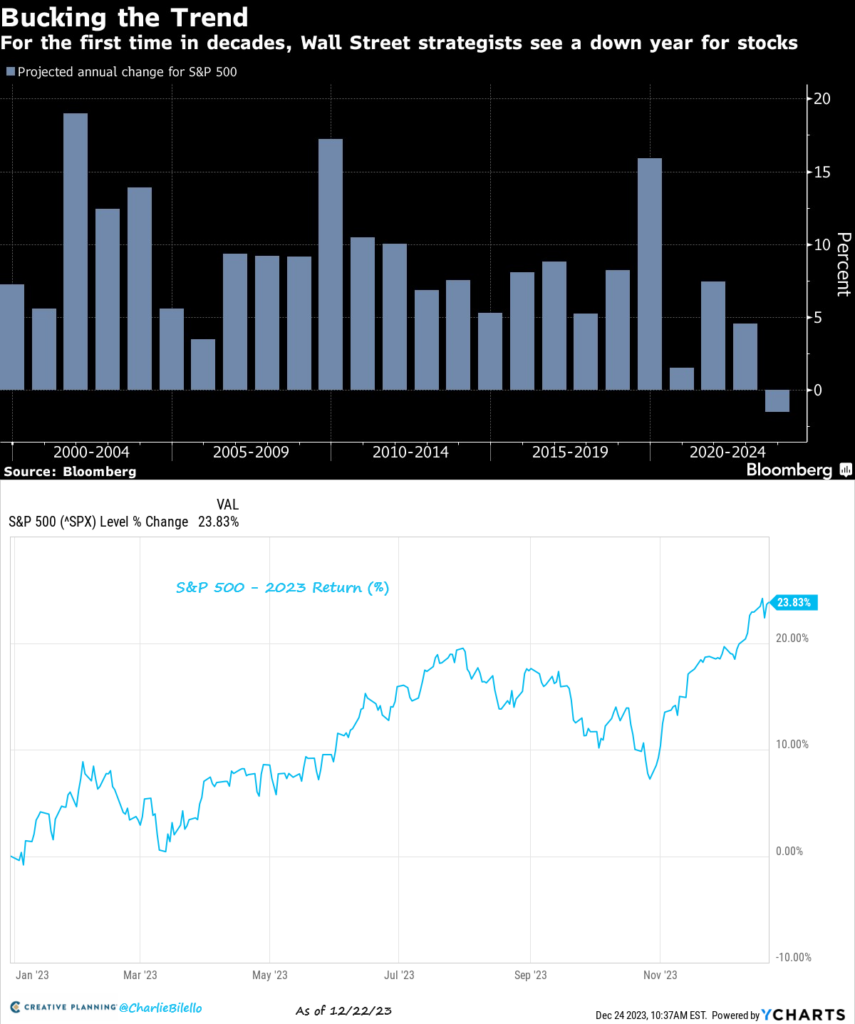

This was especially true in 2023. At the start of 2023, the consensus message was a recession is coming, inflation will never abate, stocks and bonds can’t do well in a rising rate environment, and a 5% return in cash is a great alternative to all other investments. And what happened? Equity markets (as measured by the S&P 500) rose 26.3%. Bond markets (as measured by the Barclays agg) rose 5.5%. And cash returned it’s promised 4-5%.

If you prefer a visual representation…

All that to say, predictions are very challenging to get right – but that doesn’t stop them from coming every year!

The predictions I’ve heard for 2024 are a bit more varied than at the start of last year but as has always been the case, most of them will end up being wrong (and this likely includes whatever idea you have in your head, as well as the predictions I have in my mind as well).

So what are investors such as yourself supposed to do as a new year begins?

First, try to take these predictions in stride. Review them, evaluate the inputs, and line them up against your existing investment framework. You may learn a thing or two! And second, spend your time working through the steps outlined below (ones we use on a constant basis when managing client portfolios). I promise you these will be a far better use of your time than watching too many “what’s ahead in 2024” segments!

1.) Review your target allocation – I know, I know. This is pretty “boring” advice but it has been proven time and time again to be one of the best tools to long-term wealth accumulation. How are you supposed to manage and adjust your portfolio as the market moves without some guideposts? Without knowing where you’re going, all roads will get you there.

Take a fresh look at your target allocation (ie: your desired weights to various investment types like cash, fixed income, and stocks). Does your target allocation still meet your needs from a risk and return perspective? Given the (likely) increase in your portfolio last year, what future rate of return do you need to meet your goals and should your allocation be adjusted to meet it? Are you approaching a pivot point (like retirement) that warrants a change? Have the movements in interest rates changed the expected future returns for various asset classes? Markets are going to move every day. Having a long-term plan and a resulting target allocation set with intention and rigor allows you to have a constant frame of reference – so don’t overlook it

2.) Complete a detail review of your portfolio against today’s economic backdrop – With your target allocation in hand, start by comparing your actual portfolio allocation. If there are any signs of material drift (example: an asset category’s weight is higher than target), ask yourself if there is a reason to be in that position in today’s market, or should you adjust via rebalancing? Then, review your portfolio at a more granular level. Do you have any concentrated positions that should be addressed? How do your sector weights compare to the market weights? Is today’s economic environment supportive of your sector allocation and style exposures (ie: quality, momentum, growth, etc)? How have your mutual fund and ETF managers performed versus the market? Given the movements in rates (and the likely downward movement of short-term rates this year), are any adjustments needed to your holdings? This step takes a considerable amount of effort but as always, you need to know what you own and why you own it

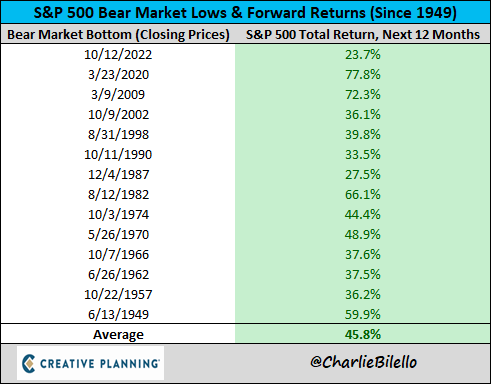

3.) Secure needed cash flow and focus forward – One of the most important elements of compounding wealth over time is staying invested, no matter how painful it may feel. This is NEVER easy. 2023 looks great in the rearview mirror – but remember March, when we were facing bank failures and worried about carry-on effects? Or how about 2020, when the world shut down and markets collapsed in a matter of weeks? No one know what the future will bring, but for all of history, markets have worked themselves out, starting at the exact time when consensus is “this time is different and this is the end” (see returns off bear market lows chart below as proof).

The time to prepare for the storm is now – not when it hits. Some things we do to help clients with this include the following (confirm any actions with your own advisors):

a) Confirm full funding of an emergency savings/cash reserve account that stays invested in cash & cash equivalents like money market funds

b) Consider establishing a home equity line. This is an available line of credit (against a home) that you only draw upon (and pay interest on) when an emergency arises. As the ability to get it is based on earnings, it is best to apply while you are gainfully employed so it is there in the event of a job loss or other unexpected occurrence

c) Secure 1-3 years of needed cash flow stream. The amount and duration will vary by person but the idea is that you will always be secure in knowing that you can maintain your lifestyle, regardless of any market downturn. This can be done via a combination of income-generating investments, as well as allocations to cash, cash equivalents, and short-duration fixed income (all investments that typically hold value in a downturn).

All of the above actions – and a few others – put a needed buffer between you and the sale/panic button during a downturn. If you have the cash flow you need – no matter what the market does – you are far less likely to panic sell at the exact wrong time. Take action now, and thank yourself later

Onward we go,

Leave a note