Wild Wednesday

June 13, 2024

This past week, Wednesday June 12th was a big news day for markets. It doesn’t happen often that a monthly inflation report (Consumer Price Index) and a Federal Reserve Rate announcement happen on the same day, but that is in fact what occurred this week. The result? Happy markets and happy investors.

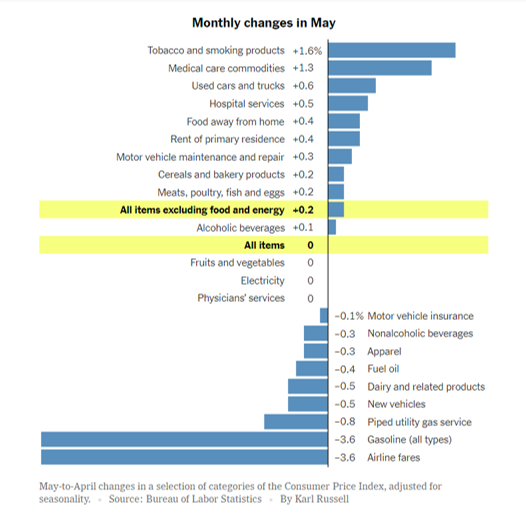

Let’s start with the CPI Report, which provided an update on inflationary trends during the month of May. Month over month, CPI was flat (better than the 0.2% expected) and 3.3% year over year, better than the 3.4% expected. Major categories like energy and core goods were down, as was a recently “sticky” item (car insurance). Shelter remains elevated due to its persistent lag in the data. Here is an illustration of all the contributors to the month over month flat result

Markets reacted well to this report, with interest rates falling and equities rising (mostly in the growth/small cap areas that are most rate sensitive). It was confirmation that inflation may in fact be cooling, which should allow for interest rates to decline.

Then came the Federal Reserve Rate decision. To no one’s surprise, the Fed opted to leave rates unchanged. As is normal practice, Fed Chairman Jerome Powell held a press conference after the announcement.

Once again, Powell remained focused on the dual mandate of job markets and inflation, noting there had not yet been enough progress on inflation to warrant any easing in rates. He emphasized that more data would have to be observed and did acknowledge that today’s inflation report was a positive development (but not enough to change the likely path for now).

Most of Powell’s answers seemed to be summarized by this sentiment – “why do we need to cut rates now?” He kept referencing the strong growth in the US economy and the persistent strength in the labor market – all happening with rates at their current elevated level. If the economy is holding up well and jobs aren’t being impacted, why does anything need change in the immediate future and risk rebound inflation? This stands in contrast to the set-up in countries that have cut rates already (Bank of Canada and European Central Bank).

While there is a risk of waiting too long and letting the economy and job market soften, there is also a risk of moving too soon and reigniting inflation. The later seems to be the risk that concerns the Fed the most. This may be logical given how quickly inflation got away from them the first time. Powell summed up this focus by saying “if the economy remains solid and inflation persists, we’re prepared to maintain the current target rate”

The data accompanying the Fed’s decision revealed some additional thinking, notably a forecast for just one rate cut this year (down from three cuts in March) and an increase in both long-run inflation (2.6% up from 2.4%) expectations and the neutral rate of inflation (some Fed officials noted it at 3%, even 3.75%, not just the 2% level typically referenced). All of these data points combined emphasize the uncertainty in the rate path, driven by concerns over inflation. Interest rates backed up slightly on this news yet equities continued to rally. It seems the market is believing the inflation report more than the Fed as of today. We’ll see if that dynamic continues as we close out the second quarter in the weeks ahead.

As if that wasn’t enough action for a Wednesday, June 12th was also an exciting day at Windermere as Ken Evason celebrated his 75th birthday! Happy birthday Dad!

Onward we go,

Leave a note