Wild Week

August 8, 2024

So much for a quiet end to summer. Markets had other plans. Starting after last Friday’s job report, markets took a sharp turn downward and reached levels of volatility only seen twice before (during the global financial crisis and COVID). While we currently sit just down ~1% in most equity indexes (as of Thursday afternoon), it was a far different story on Monday morning. You may have been looking at the market news with your eyes covered!

What caused the drastic moves? No one knows for sure (despite what CNBC guests would have you believe!), but the likely contributors (in some combination) were:

Growth scare – July payrolls were released on Friday August 2. The report was weaker than anticipated, with 114,000 new jobs and an unemployment rate of 4.3%. This was widely viewed as a sign that the economy is starting to break and brought into question the Fed’s plan for a soft landing (ie: bringing down inflation with high interest rates without pushing the economy into a recession). This scared markets into thinking US growth was falling at a pronounced rate and that a recession was coming (if not already here)

Unwind of margin (namely the yen/carry trade) – in my view, this is likely the most dominant factor in the severity of the sell-off. This is a complicated combination of events but here is a high-level summary.

For years, Japan offered interest rates that were far below other countries (due to their need to promote growth in their slowing economy). A very considerable amount of invested capital would borrow Japanese yen (at these zero to negligible interest rates) and use those funds to buy high-growth assets (such as US equity markets, tech stocks, etc). This is known as leverage or margin – and it works very well as long as what you buy keeps going up (which it has) and your debt can still be serviced (which it could be due to low rates).

Last week, the Bank of Japan surprised markets by raising interest rates. This move required those borrowing yen to repay their loans – quickly. In order to do so, they had to first sell their equity positions. This is a classic margin unwind trade – when loans are due, you sell what you can sell (not what you want to sell necessarily) to repay your debt. The disorderly action in the market overnight Sunday in Japan bled over into US markets early Monday and seemed to indicate some level of panic selling and the scale of it (ie: on pace with COVID and the Great Financial Crisis) indicates forced sellers. The decline in Japan’s stock market (the second largest in history) also clearly shows the involvement of the yen-carry trade in the US market sell off in my view

Reversion to the mean – markets never go up in a straight line for ever. After periods of exceptional performance, it is highly normal for a slight reversion to the mean. Areas of the market that have done the best are selling off more than the laggards. This is healthy market action, even if it feels painful in the moment. As we’ve talked about in the past, momentum works in both directions and the momentum trade results in an “staircase up, elevator down” feeling in markets that has been present this week

Uncertainty globally and at home– markets do not like uncertainty. The turmoil in the middle east and the ongoing changes in the US presidential election are likely underpinning certain levels of volatility

As noted above, since Monday, markets have calmed down. Equity markets sit at levels that are only down ~1% on the week (as of Thursday) and fixed income yields have retreated (the US 10 year reached 3.6% on Monday as investors fled to safety – it has backed up to nearly 4% as of Thursday). Volatility has dissipated. After this volatile and wip-saw action, you may have three questions on your mind (I know they are on mine)

1.) Is this normal?

Yes. While the reasons for it and the pace of it may be unique, market corrections are normal.

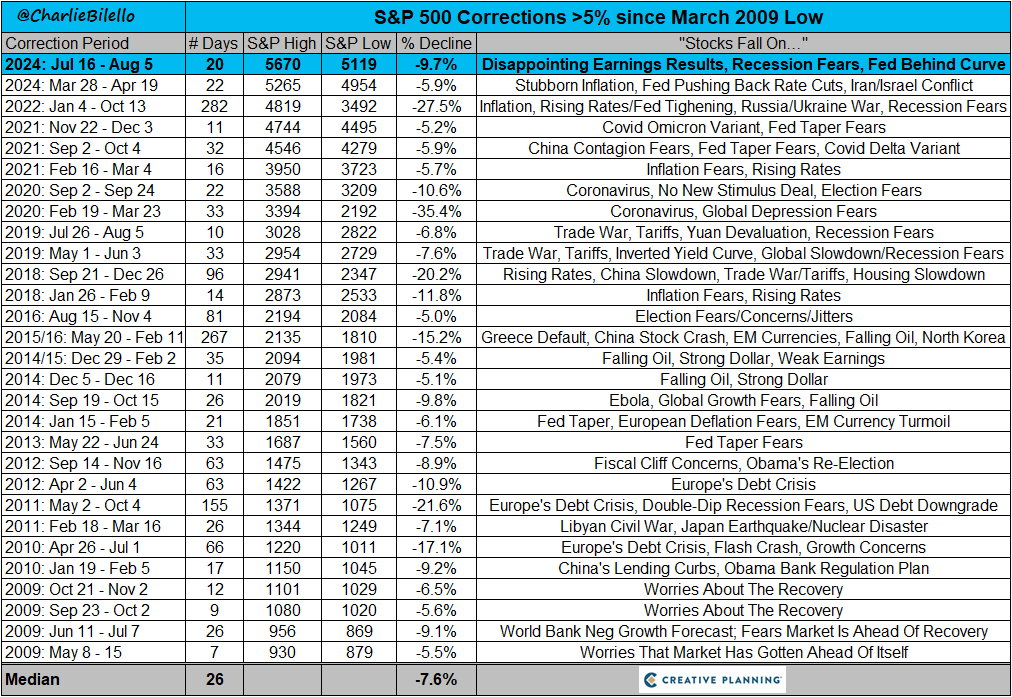

As Charlie Bilello wrote this week, volatility is a feature of equity markets, not a bug, and without it they would offer no higher reward than sitting in cash. The price of admission for receiving the S&P 500’s long-term total return of 10% is suffering through many drawdowns along the way.

The current drawdown from July – August (info above as of 8/6/2024) on a closing basis is just the latest in a never-ending series of tests, and it’s actually a mild one at that. The median intra-year drawdown since 1928 is -13%.

2.) Will markets stabilize?

Yes. It seems as if they already have to a large extent (see above). Yet downward moves can and will still occur. The yen carry trade may continue to unwind and investors may remain fearful and continue to sell investments in coming weeks. Growth may continue to be called into question (although Thursday’s ADP report was strong enough to tame those fears). Global unrest will continue – and the US election remains months away. But again, as illustrated above, these periods happen and will happen again. It’s the price you pay for long-term returns.

3.) What can I do when market volatility occurs?

Funny you should ask. Our other post this week addresses that very topic

I know weeks like this are hard. I know how it feels – I am human and an investor just like you. While I know corrections happen, they are always jarring and while you can understand it in reverse, it is impossible to predict in real-time. Will we get thru this one? Yes. Will it happen again? Yes. Is it worth it in the end? Yes.

Onward we go,

Leave a note