View from the Chair: Windermere’s Market Perspectives (February 2018)

February 5, 2018

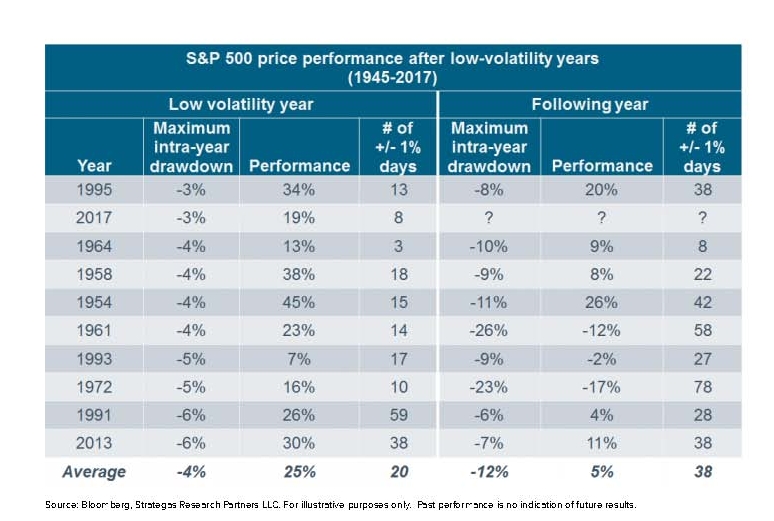

Market pullbacks. We certainly didn’t miss them when they were seemingly on vacation in 2017 – a year in which the S&P 500 rose 19% and did so with only 8 days of +/- 1% moves and a maximum intra-year drawdown of 3%.

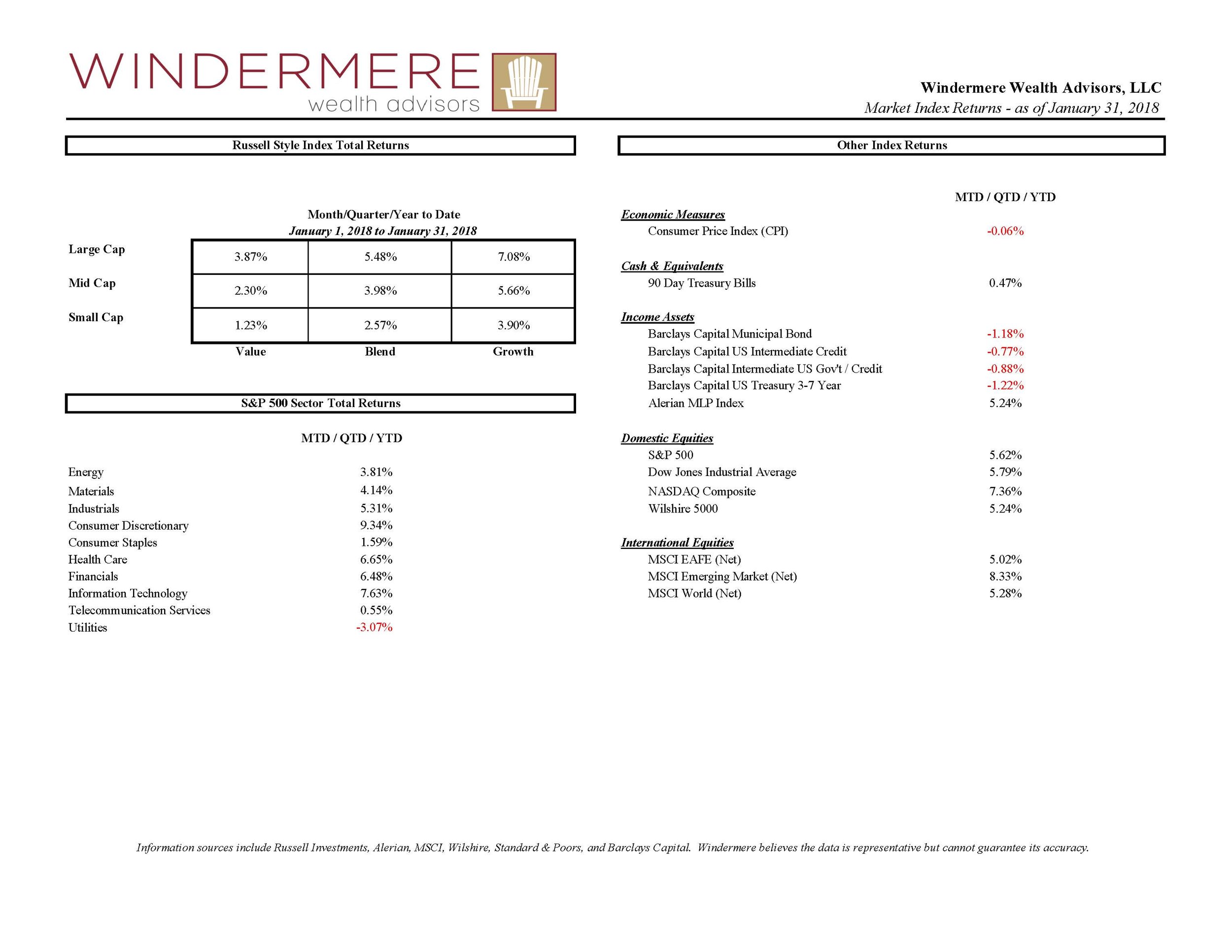

January 2018 seemed to indicate that we were in for another year of the “good life” as shown in the market returns for the month.

However, last week was a reminder that markets do in fact move in both directions and that market pullbacks are indeed a part of the investing process.

For the week ended February 2, 2018, the US stock market capped off its worst week in almost two years, with the S&P 500 falling 3.9% and the Dow falling 4.1%. While markets are still positive for the month, this sharp reversal was jarring. Monday’s market has brought mixed action with some ongoing selling pressure.

In times like this, it is very common (and easy) to feel anxious and to question your investment approach. Simply put – it becomes a “glass half-full or empty” exercise:

Glass half-empty: Pessimistic tone. Thoughts include: “We need to take action now. What should we sell, we need cash, let’s get out, I should have done this weeks ago, the commentator on CNBC just told me markets are down big – I need to do something”

Glass half-full: Optimistic tone. Thoughts include: “Markets move both ways, including this move, we are still in a major bull market based on known data and analysis, this gives me a chance to rebalance and look for fundamentally sound companies that are now priced in my range”

How do you know which is the correct view to have (and convince your mind of that fact?). By focusing on analysis and ignoring rhetoric. By distinguishing between what you know for sure and what you only assume to be true. Let’s do that together:

What we know for sure:

Interest rates – They are moving higher. This is not a surprise. This has been the intention of the US Federal Reserve for years (they are no longer buying US debt and have been raising US rates steadily). What has been surprising is the rate of that change. The US 10-year yield rose from 2.40% at year-end to 2.85% on Friday, a 16% change in just over a month. Rates improving globally and the US dollar weakening have lowered demand for US debt, which brings rates up. It’s possible they will decline from here before moving up once again. We know rates are heading up longer-term, not down

Inflation – For several years, inflation has been negligible. Advances in technology and the lack of skilled labor has kept wage growth low and prices of goods dampened. Friday’s job report showed private-sector wages rising 2.9% year over year, sending a signal that perhaps inflation is emerging. We know near-zero inflation is a thing of the past

Earnings – For Q4 2017 (with 50% of the companies in the S&P 500 reporting actual results for the quarter), 75% of S&P 500 companies have reported positive EPS surprises and 80% have reported positive sales surprises. If 80% is the final number for the quarter, it will mark the highest percentage since FactSet began tracking this metric in Q3 2008. We know earnings are growing

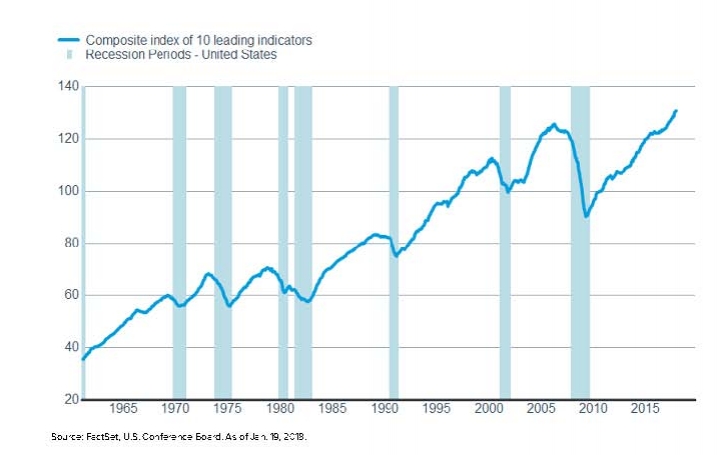

US recession indicators – US economic growth continues, no sign of a recession on the horizon, as measured by the Index of Leading Economic Indicators. We know there are no major recession warnings signs as of today

Global growth – Synchronized global growth remains. Every one of the world’s 45 major economies tracked by the Organization for Economic Cooperation and Development (OECD) is growing this year and expected to post another year of growth in 2018, per OECD forecasts. We know global growth is strong

Rising rate impact on bonds – There is an inverse relationship between interest rates and bonds. As rates rise, the value of bonds fall. Take for example a 10-year bond. For every 1% rise in rates, the value of the bond falls approximately 10%. While cash can be reinvested at higher and higher rates, the decline in principal can overwhelm the increased interest with a sharp rise. We know rising rates hurts most bond investments

Rising rate impact on stocks – Recall what a stock is – ownership in a business, priced at the present value of future cash flows, discounted with an appropriate interest rate. As rates rise, so does the discount rate and valuations of stocks also decline – unless the future cash flows (earnings, growth, dividends) grow at a similar, or faster, rate. As noted above, earnings are coming in very strong, supporting this argument. We know rising rates acts as a headwind for equities, but that it can be overcome by accelerating earnings

Smooth rides don’t last – Historically, low volatility years have been followed by more volatile years. As the below chart from Schwab shows, low volatility years are followed by more volatility – and a rising market on average. Of course, history may not repeat but it does provide some context. We know volatility is normal course

So there’s what we know. What can we only assume? That list is endless and could fill up 100 blog posts. To name just a few: the level at which this pullback bottoms, the timing in which that occurs, where rates move from here, what asset classes will win the year, which stocks will fall, and thousand of over items that no one really knows for sure.

Given all of this, where do we come out? Our view is that this is a glass half full/optimistic moment. The facts we outlined above support ongoing growth in our equity asset class, both US and international. This pullback gives us the opportunity to trim selected securities that have experienced outsized gains and look for other securities that are exhibiting strong fundamentals and “sale” prices. And perhaps most importantly, we manage client portfolios (like yours) with diversification – so you have asset classes working for you in these pullbacks, such as cash, short duration fixed income, dividend paying equities, and liquid alternatives.

We are taking action on your behalf as we see fit. There is nothing you need to do – other than focus on the facts, dismiss the “noise,” and reach out at any time. We know it can be unsettling but let’s stay the course – together.

Invest on,

Pam

Leave a Reply

You must be logged in to post a comment.

Leave a note