View from the Chair: Windermere’s Market Perspectives (March 2018)

March 8, 2018

Predictability and consistency. Who among us doesn’t thrive under such conditions? Most of us like things we can count on. We enjoy feeling as if we are in control of what comes next. We don’t like unexpected surprises (good or bad).

2017 was such an environment for investors. A welcome calm passage in the investing sea. Investors could wake up each day and rest easy that markets would steadily climb and volatility would stay at bay. Investors rejoiced in a year with a sub-3% maximum intraday move in the S&P 500. Investors all-but forgot about 10% corrections, with the prior one having occurred over two years ago. Investors began to ignore the virtual certainty that 2017 was an aberration – not a new normal. And then the tides turned

Markets reversed course in late January/early February 2018. And while many investors knew it would come (and that such moves are all part of the long-term investing process), we believe this time felt different as we seemed to be operating under the rule of “opposites”

1.) Good News is now bad? – Most market corrections are caused by fears of too little growth (ie: bad news) and the resulting recession and/or deflation. This time, it was the opposite. It appeared to be fears of too much growth (ie: good news) that was the problem. With January job numbers and wage growth surprising on the upside, fears of higher growth (and resulting inflation) sent equity markets reeling and interest rates rising.

2.) Ignore fundamentals? – Most pullbacks are caused by a shift in fundamentals – such as an economic recession that causes companies’ earnings to fall. However, this correction was again the opposite. Fundamentals held steady during this time and actually improved as yearly earnings were announced. It seemed sentiment and market technical were actually the ones in charge

3.) Volatility is a leader? – Typically, a sharp decline in stock prices will be followed by a rise in volatility. This time, the opposite held true – volatility surged, which then caused equity prices to plunge. Why the change? Two words – Short Volatility. After a year of extreme calm in the markets, “short volatility” had become a very popular trade (so crowded it overtook the long bitcoin trade in January 2018). Essentially, with this trade, you are betting stocks will rise and volatility will fall and you win as long as those conditions hold. When volatility reappeared in late January, millions (if not billions) looked to exit this strategy. How do you exit a short volatility trade? You buy volatility. And what happens when there are countless buyers of volatility (ie: demand far above supply)? Volatility rises. This surge in volatility caused stocks to sell off, which then brought volatility up, and the circular reaction was off and running

Will these “opposites” subside and allow markets to return to a normal course? Yes, we believe that to be true and have already started to see markets prove us right. But volatility and a less-linear track are the new reality. Tightening of monetary policy and concerns surrounding fiscal policy (such as the recent proposed tariffs) will keep markets on their toes. However, we see several areas of strength underpinning markets, including:

- Earnings: Earnings are incredibly strong – and keep in mind, a stock is your share of future earnings/cash flows (discounted at prevailing interest rate, see next point). 2018 year over year earnings are expected to grow by 18.8% ( per Thompson Reuters). Q4 2017 earnings reports were exceptional, with 74% beating on profits and 78% beating revenues (a record high since tracking began in 2008), as measured by FactSet

- Interest rates: Rising rates are a headwind for stocks. As rates rise, future earnings and cash flows are discounted back at a higher rate, thereby acting as a drag on prices. However, we believe that although rates may be rising, they have a long way to go to overcome earnings growth. We’ve seen a ~0.40% rise in rates, compared to a projected ~19% growth in earnings. That’s math we believe equity markets can handle

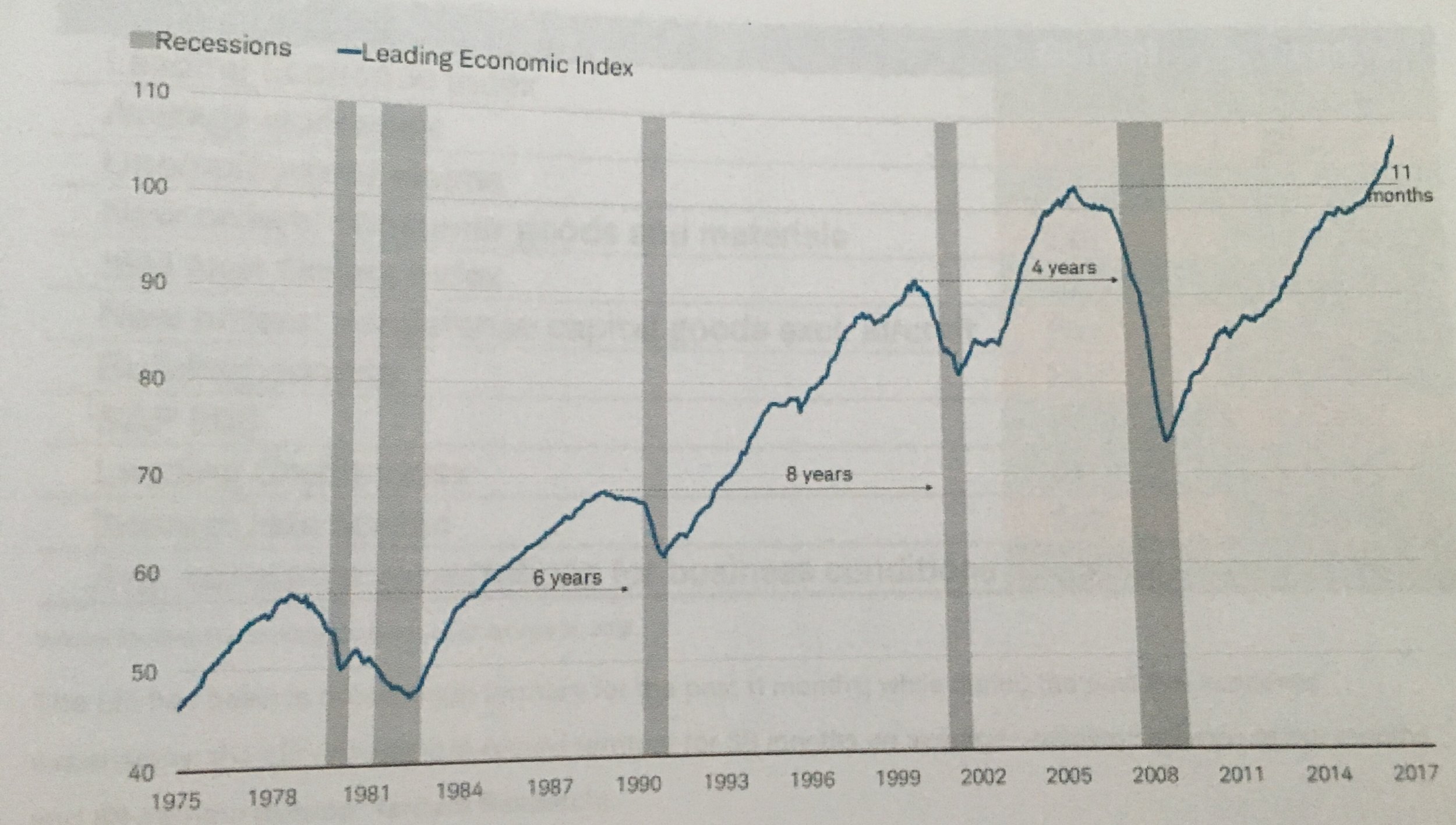

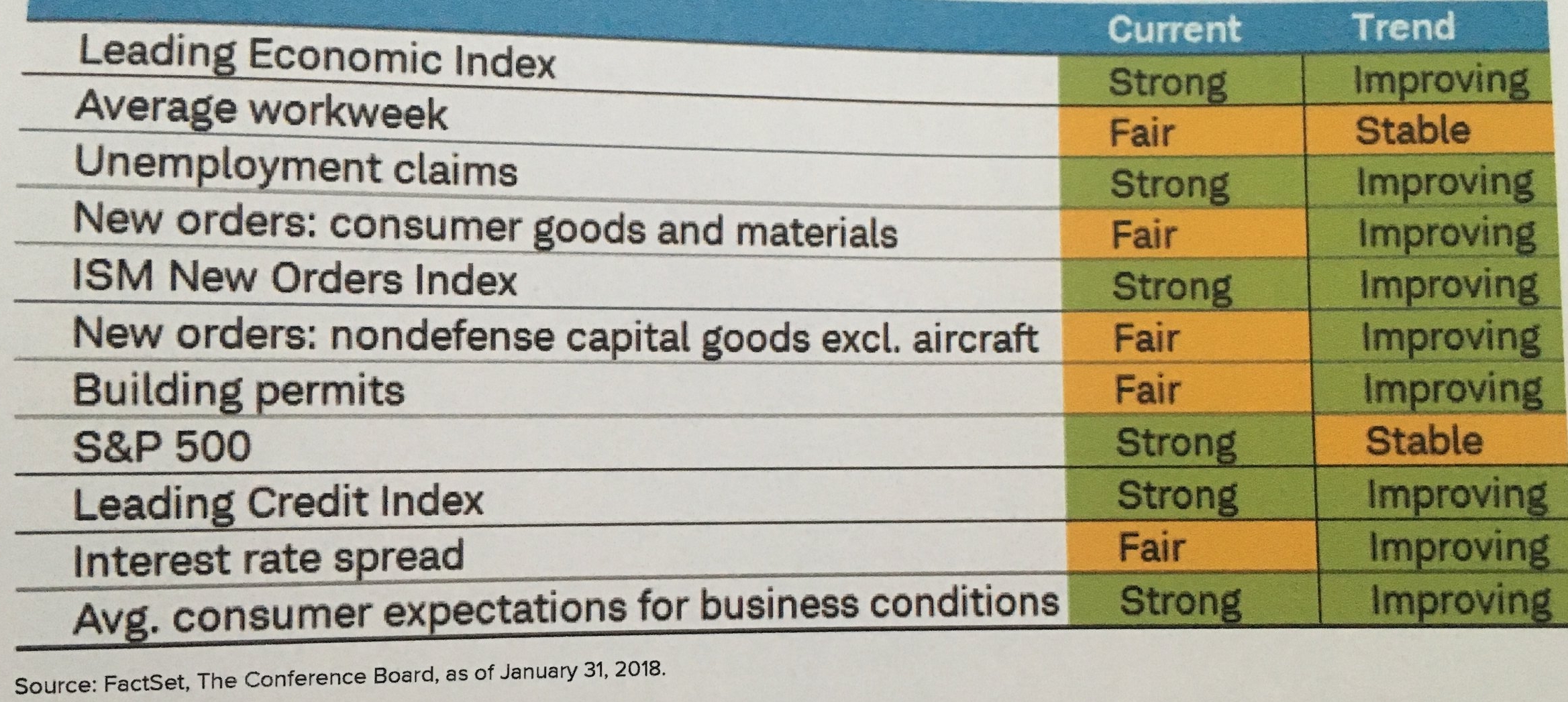

- Economic strength: Our preferred measure of economic growth is the index of Leading Economic Indicators. This aggregates several key metrics and tracks their cumulative levels. As you can see, it is trending up and reaching new highs.

Perhaps of more interest is the trend in each of those factors – we don’t worry if they are “good or bad” but rather if they are getting “better or worse.” At this time, none appear to be trending downward

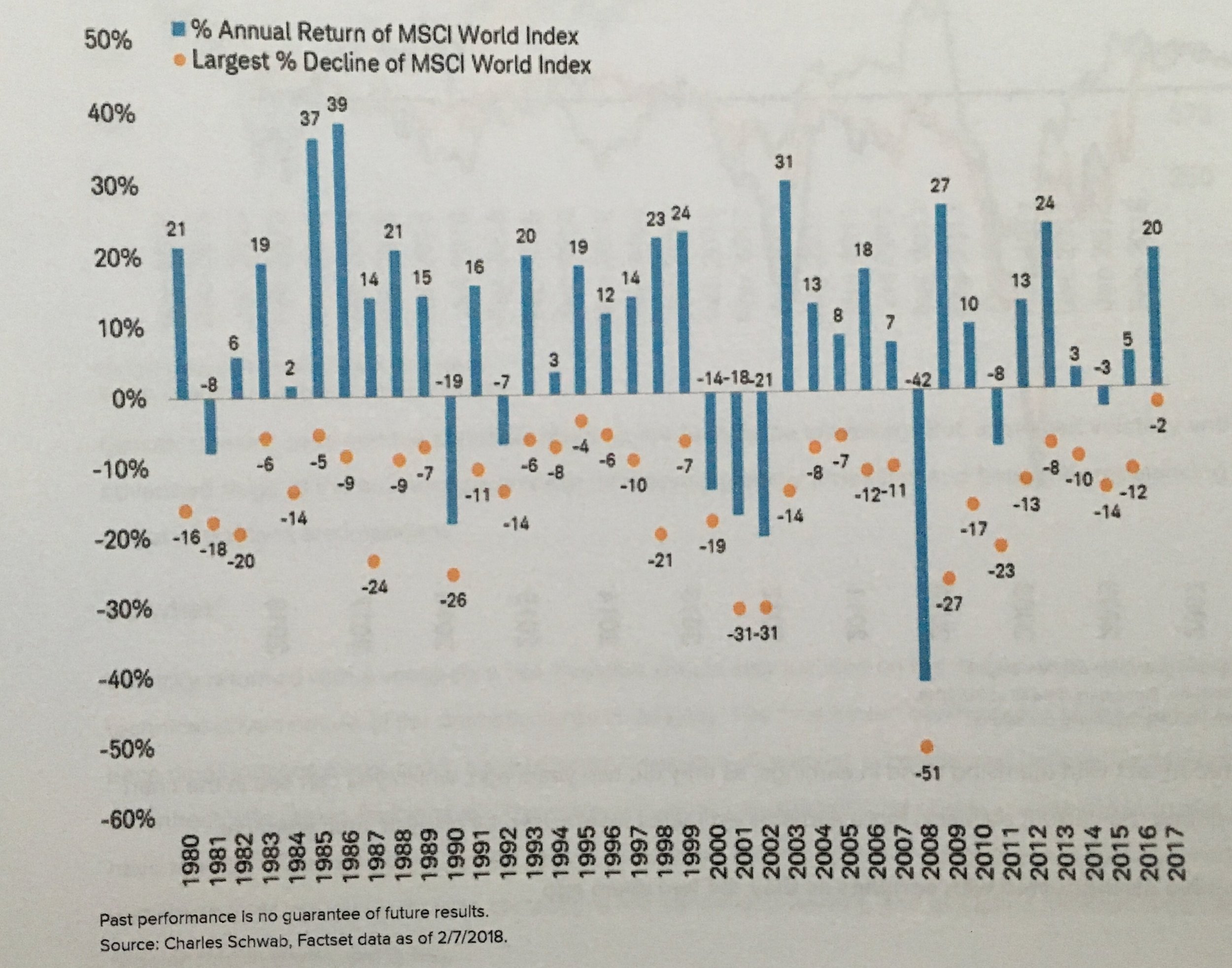

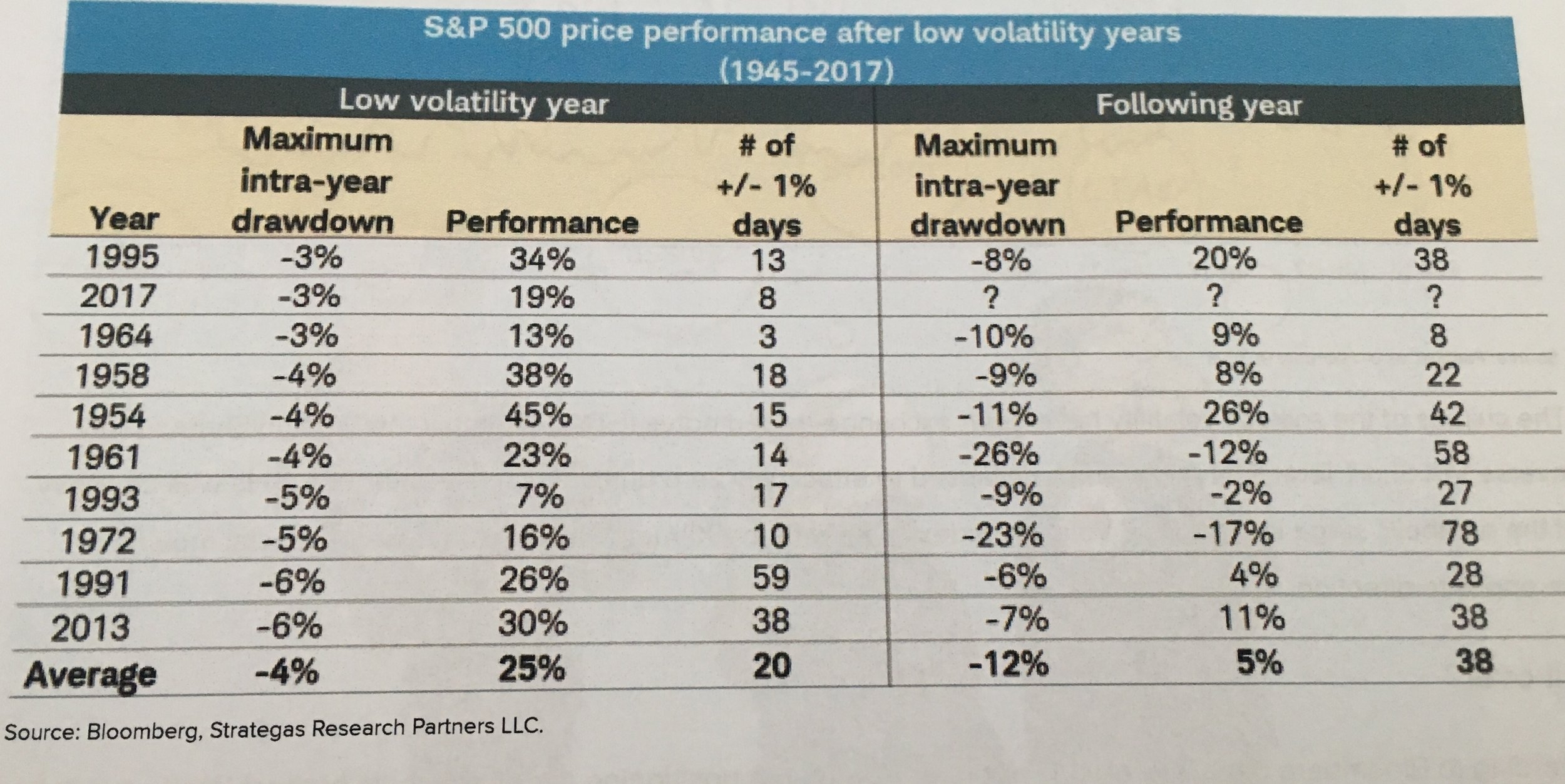

- The rhyming of history: While we cannot be certain that past results will repeat, we do know that history tends to track in line with the past (or, rhyme). Below charts show that both volatility and pullbacks are normal course in markets – and certainly don’t negate the possibility of positive returns

This chart shows the largest declines in the MSCI World index since 1980, as well as the largest percent decline in that same year. Lesson learned: Annual returns can still be overwhelming positive in a year with a material drawdown

This second chart shows has the S&P 500 does in years following low volatility years, like the one we just were blessed with. Lesson learned: Following year usually sees larger downward moves – but performance remains positive.

Of course, we don’t know what the future holds. Nonetheless, these charts provide some historical context to today’s reality.

The calm investing waters of 2017 were a treat, but now the tides have turned. Winds are picking up and the waves are getting steeper. But that’s no reason to abandon your investing voyage. We believe the increased gusts will act in your favor and help you reach your ultimate destination. To quote Warren Buffett’s annual letter, “in America, equity investors have the wind that their back.” We couldn’t agree more Warren, and we will see you out on the open seas.

Invest on,

Pam

Leave a Reply

You must be logged in to post a comment.

Leave a note