View from the Chair: Windermere’s Market Perspectives (August 2018)

August 2, 2018

2018 sits in stark contrast to 2017 when it comes to many things – including investing and the markets. After a steady climb in 2017, where almost nothing could stop the upward movement across virtually all asset classes, 2018 has been a much more challenging investment environment.

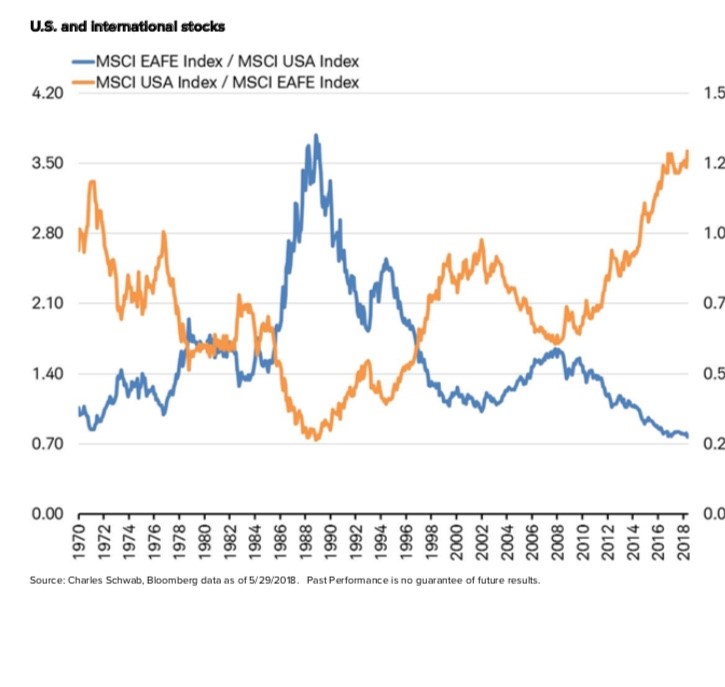

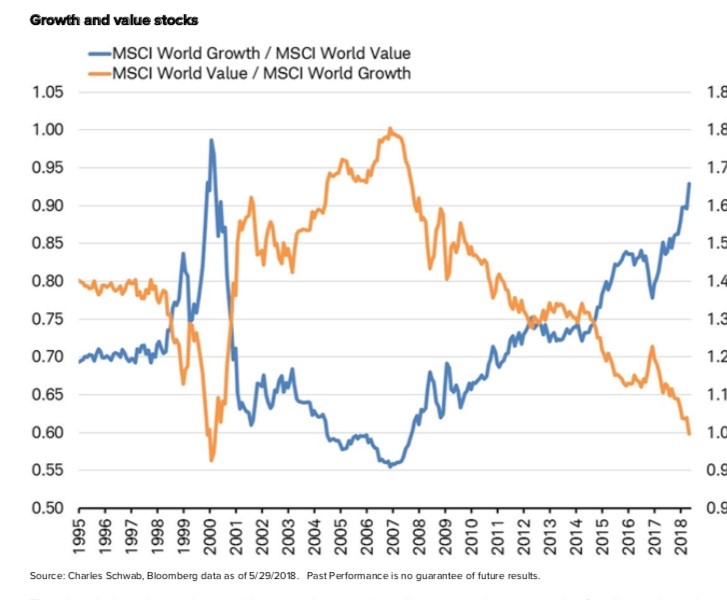

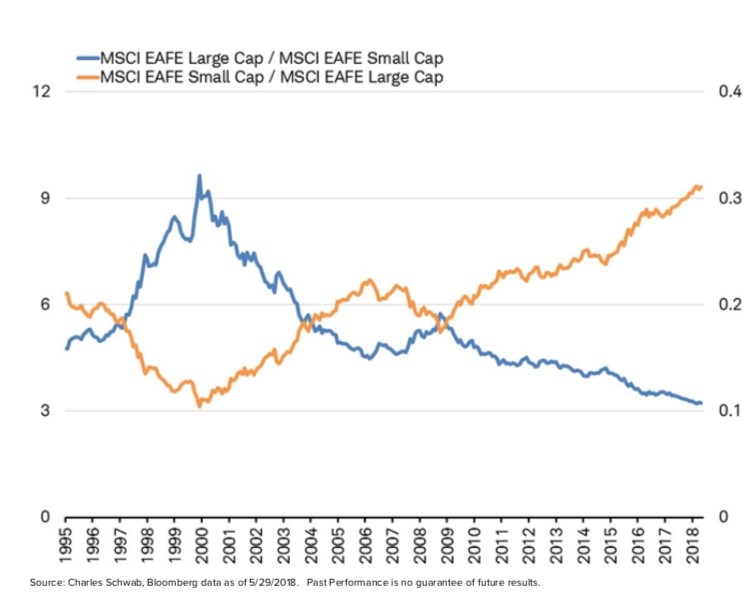

Emerging markets have faced headwinds from a rising US dollar. Developed markets have encountered a similar fate. All international markets have been reacting to trade war fears. Bond markets have traded mostly sideways in light of rising rates, somewhat offset by ongoing demand for US dollars (and treasuries). Broad-market US equity indexes have been the leading asset class for the year but upon closer look, the gains have been somewhat concentrated in certain segments (ie: growth and small cap).

It’s very easy in a market environment like this to question your investing approach. However, just because an approach underperforms in a given time period doesn’t mean that it is not the best approach for you and your long-term goals and risk parameters Investing is a non-linear process and it is entirely possible you will be on the “wrong side” of things at various points in time on your journey. So what do you do? Take this advice from a recent road sign I saw – “Stay in your Lane” It’s that simple. Give ample thought and energy to developing an investment plan that works for you and then stay in your lane.

We are doing just that with our portfolios. Here are a few characteristics that have, and always will, define our “lane” (as it relates to equity securities)

1.) Buy a businesses – remember what an equity security represents. It’s ownership in a business – a productive entity that is generating revenue, incurring expenses, hiring, innovating, and producing cash flow. We keep our focus on the business, the management teams that run them, the environment they operate in, and their growth outlook over a reasonable time horizon – not just on the daily ticker tape

2.) Price matters – the ultimate return you will earn on a given investment depends on many things, chief among them the purchase price. It’s easy to be drawn to a business that has a rising stock price and high growth rates. However, overpaying for a stock almost always guarantees a poor return in the end. You are buying a share of a business’ future earnings and cash flow – so doing work upfront to figure out what that is worth today is an essential exercise

3.) Focus forward – every investor has moments of “would’ve, could’ve, should’ve” – mostly as it relates to timing the market (I should have sold XYZ on this date, I could have bought into this company at it’s IPO, etc). The list is endless – and also mostly irrelevant. Learn the lesson, evaluate what you can do differently next time, and focus forward.

4.) Patience is a virtue – there is a different between a broken business and a broken stock. A stock may not perform as our research and analysis tells us it should. That alone is not a reason to abandon the position. Markets are efficient but they are not psychic and value can be present inside a business and not yet fully reflected in the share price. Understanding the businesses we own and analyzing their ability to generate future revenue and cash flow oftentimes lead us to remain patient and wait for our thesis to play out

5.) History may not repeat, but it rhymes – Markets move in patterns. It’s impossible to time these patterns but it’s usually highly likely that they will repeat themselves. Today, we have an investing bias towards large-cap businesses and are international and value focused. These are not the categories that have been outperforming (rather, it’s been small cap, US, and growth names that have led). However, we remain committed to our thinking and believe in time, the trends will once again reverse (as illustrated in the below charts from Charles Schwab & Co., Inc) (click on images and scroll thru)

There are many other items that define our lane but this gives you a good idea of how we look at markets and investing.

How would you define your lane? Are you able to stay in it, even given the challenging market conditions are find ourselves in? If not, keep adjusting and work towards that goal. The journey is definitely worth it.

Invest on,

Pam

Leave a Reply

You must be logged in to post a comment.

Leave a note