View from the Chair: Windermere’s Market Perspectives (February 2019)

February 6, 2019

There were few investors who were sorry to see 2018 go. Market movements in October thru December brought returns for the year negative and erased most annual gains, all while worrying investors with significant daily movements and seemingly endless selling pressure.

Why did these sharp downward moves occur? Markets are complex and there is no way to fully unpack material moves (in either direction). Keep in mind what markets are and how they are priced: they are a collection of securities that represent a claim to a future stream of cash flows – and they are valued based upon what the present value of those future cash flows is believed to be at any point in time.

It is our belief markets were pricing in worst case scenarios on four major items at the end of 2018 (US growth, interest rates, trade, and political instability (the shutdown)) – the combination of which brought down the anticipated future cash flows from investments (and therefore the prices and aggregate market values). Add to that thin trading volumes during the holidays and year-end tax selling, and it was a dire situation for almost all markets

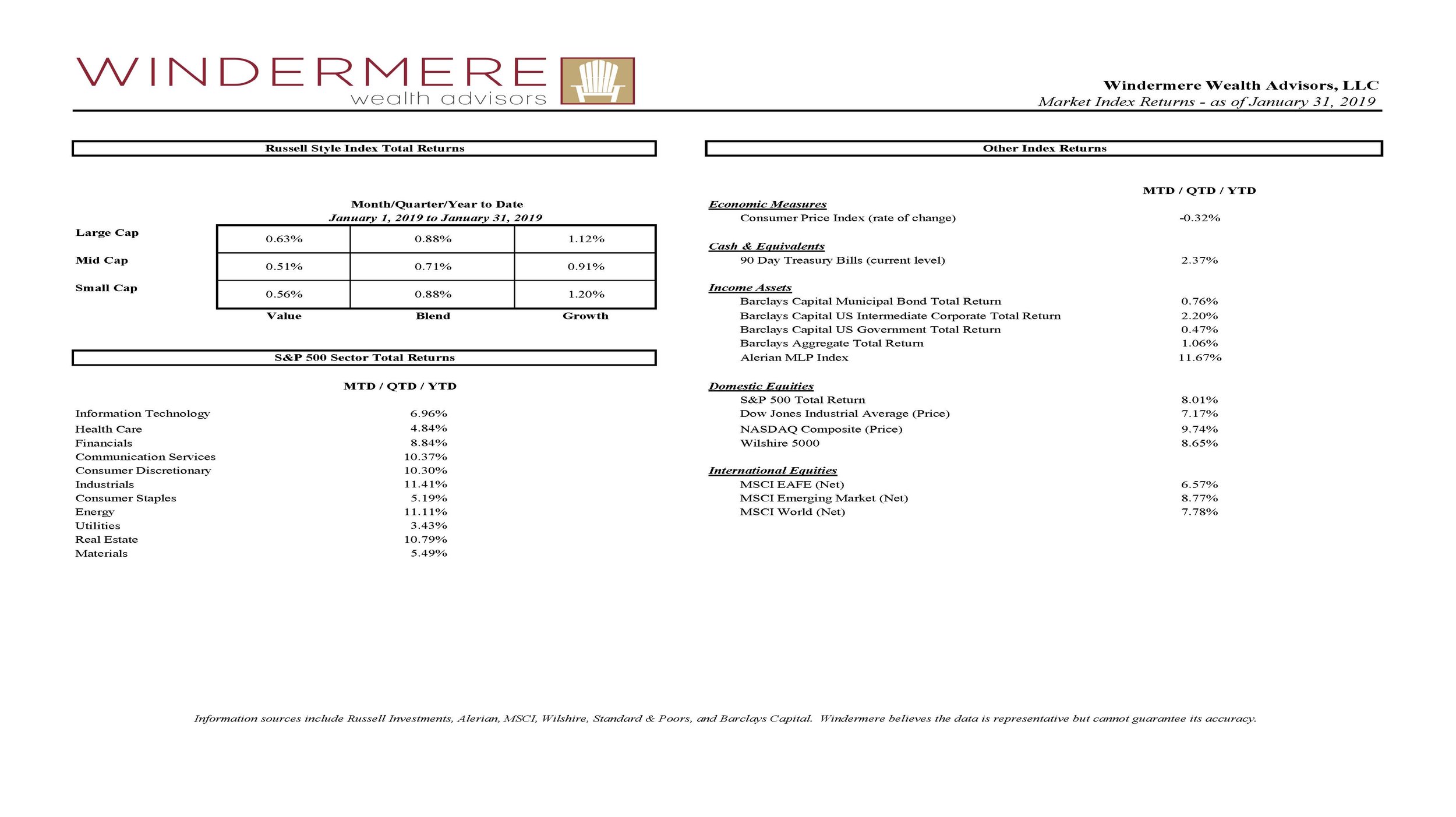

What’s happened in January? An improvement was seen on all four fronts, earnings continued to show strength and growth, and buyers returns – all of which has brought prices back up and returns materially positive for the month as shown below

Where will we go from here? As always, it’s impossible to predict the market’s next move but one thing is for sure: volatility will present itself time again and again (especially given where we are in the economic cycle). Here are a few strategies to keep in mind to help you stay calm and more importantly, stay invested should the material swings we saw in December reappear any time soon:

1.) Widen your lens – Investing is not meant to be a short-term journey. And odds are that you have been investing for several years at this point. While it’s easy to look at your returns from any one quarter or month, expand the time frame. Your return over a period of years or even decades are far more relevant. So if you must evaluate your returns in volatile periods, be sure to consider a longer time frame

2.) Revisit your goals – All investing should be done with intention. You should have a destination in mind – whether it be a targeted annual return or a needed withdrawal amount to fund retirement. When volatility arrives, evaluate the immediate (and known) impact on your goals. In all likelihood, the ability to meet your goals won’t be harmed by a short-term event and knowing that may help lessen your desire to react as well as your fears

3.) Stay in your Lane – People talk about all sort of things – investments included. You’re likely only to hear about their successes – the stock they owned that has doubled, their incredible gains, their unique investment opportunity. While other people’s wealth journeys may be interesting, they are not relevant to you. You don’t know the context, completeness, or accuracy of what they are telling you. Your journey and your facts are what matters. Just smile and acknowledge the conversation – and then return to your own lane

4.) Talk it out – Oftentimes, our own inner dialogue can be our worst enemy. If you have fears or questions when markets move swiftly, talk it out. Reach out to your financial advisor (you know where to find us) and walk thru everything you are thinking and feeling. A discussion and an empathetic ear may be just what you need

5.) Resist the urge to act– Time in the market is more important than timing the market. As illustrated by December and January, the sharpest down moves in the market tend to be followed by the sharpest moves up – and both can arrive when you least expect them to. The exact timing cannot be predicted and as a result, staying in the market and sticking to your long term target allocation is essential. If you feel the urge to act, do your best to stop yourself and stay the course

6.) Consider buying low – Market sell-offs many times present the best buying opportunities but unlike most other shopping experiences, investors hesitate to buy things on sale (for fear values could decline further). However, if you have a few stocks on a wish list and have done the work to determine the price you would be willing to pay for them, a sell-off may give you that chance. As Warren Buffett wisely says, “be greedy when others are fearful”

We know volatility is upsetting and hard to withstand. Try these strategies out next time the market moves sharply and hopefully they will help calm your nerves. We never said investing would be easy, but we certainly believe that it is worth it

Invest on,

Pam

Leave a Reply

You must be logged in to post a comment.

Leave a note