View from the Chair: Windermere’s Market Perspectives (June 2019)

June 9, 2019

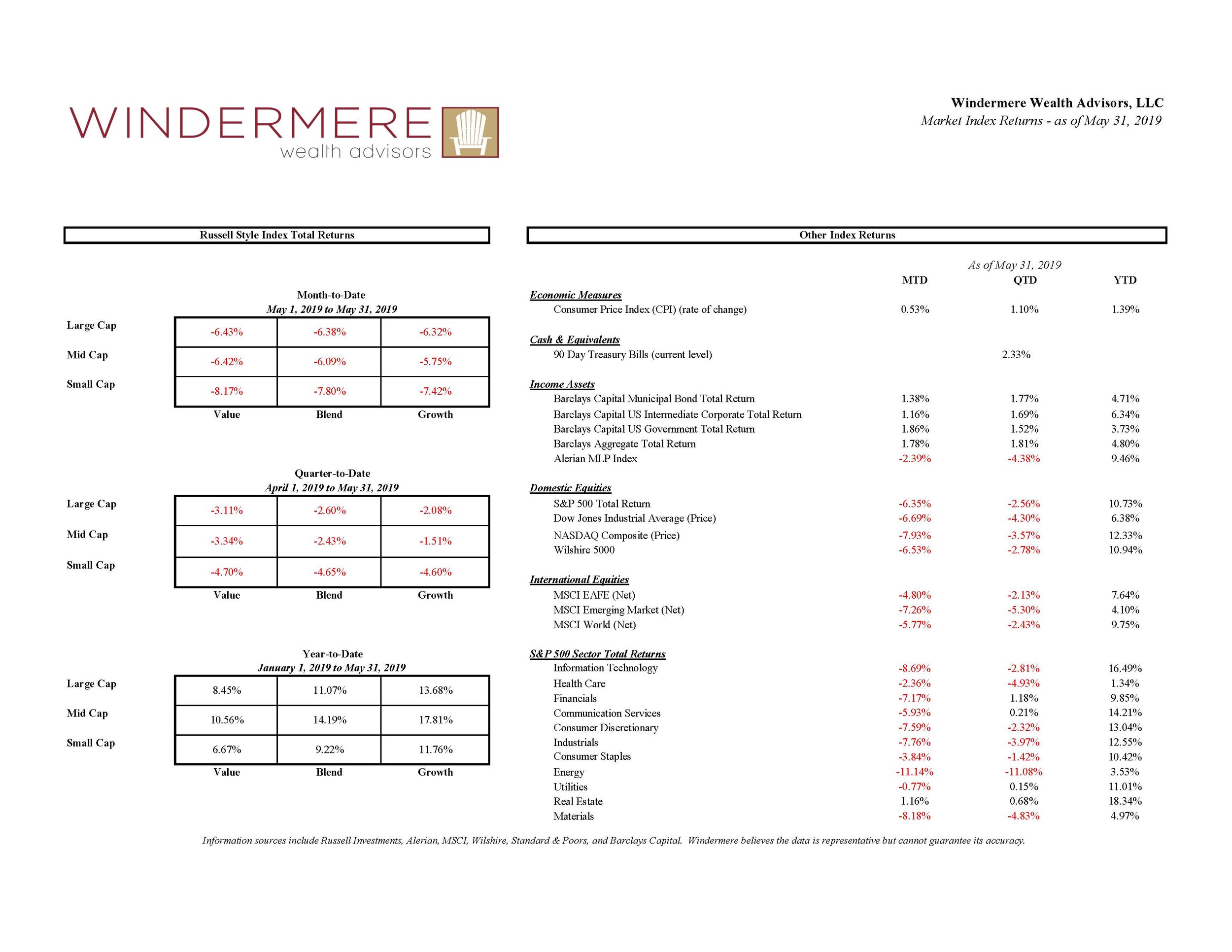

During the first four months of 2019, it seemed as if nothing could get in the way of markets. While uncertainty remained (tariffs, interest rates, economic strength, recession worries), markets ticked higher seemingly every day. In early May, that all changed. See below for market returns during May 2019

While it’s hard to know what caused markets to retreat, the declines appeared to begin with President Trump’s tweets that trade negotiations with China had stalled and that the planned tariffs were going to be implemented. this was a sufficient shock to cause buyers to retreat and sellers to materialize, driving prices down. Since that time, volatility has again returned, markets have pulled back from their highs, and once again, investors may be questioning whether they want to stay invested.

These downward moves never feel good – and sadly never get easier to stomach. However, when they do arise, we remind ourselves of an important adage – “it’s a marathon, not a sprint.”

We don’t view investing as a journey one should take for a month, a year, or even just a few years. We view it as a lifelong process that is ultimately guided by where you are trying to go (ie: simply put – what does your ideal future look like and what financial levels are needed to support that). If you have defined your destination and have a plan in place to reach it (ie: a diversified investment mix and a savings plan), all there is to do during times of market stress is to keep putting one foot in front of the other and follow your pre-determined road.

As you continue down the path, here are a few helpful reminders:

1.) Panic is not a strategy – business media and newspaper headlines will oftentimes incite panic in even the calmest investor. Resist this urge! Oftentimes, the exact moment we feel most encouraged to take action is the worst time to do just that

2.) Revisit your plan – we have worked alongside you to put plans in place to grow your wealth over time, while supporting any near-term liquidity needs. Again, think of assets classes in terms on liquidity buckets. If you have sufficient liquidity stores in your cash/fixed income buckets, short term volatility in equities is unlikely to have any near term impact on your day-to-day life or your long term plans

3.) Over time, investing is on your side – as this insightful chart from Blackrock shows, historically, the longer you are invested in the market, the lower the odds that you will lose wealth. While history may not repeat itself, it certainly has a tendency to rhyme

4.) Don’t miss a few days – this additional chart from Blackrock shows how missing a few major upside days in the markets over time can hurt the compounding of wealth. When will the next one occur? It’s impossible to know, which is why timing the market is so difficult

We know these sharp moves in markets can be unsettling. But when they occur, take a step back, revisit they few key reminders, and keep on running.

Invest on,

Pam

Leave a Reply

You must be logged in to post a comment.

Leave a note