View from the Chair: Windermere’s Market Perspectives (July 2019)

July 17, 2019

If you’re feeling a bit of motion sickness from the markets over the past eighteen months, you are not alone. Markets have been on a bit of a roller coaster – now returning to the same platform where we all got on the ride, with the market recently crossing over to all time highs. But in the meantime, investors have experienced sudden drops (December 2018), quick ascents (Q1 2019), and even a few loopty loops (May 2019).

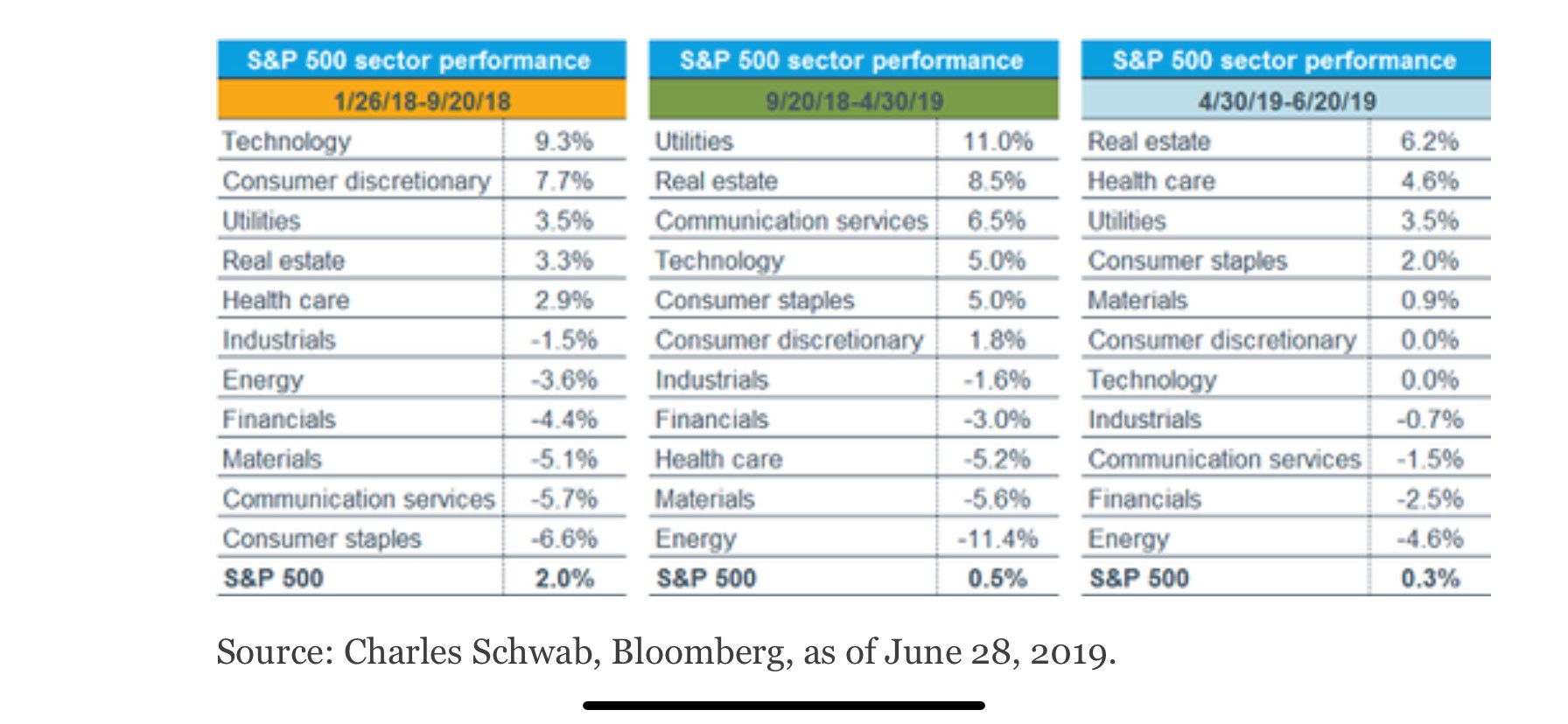

What’s been the best place to sit? This chart for Charles Schwab illustrates how each rally has been led by a different “car”, making it a bit difficult to ascertain where one should sit from here on out

How’s the ride been in 2019? Markets have been very strong in 2019, with several markets (such as the S&P and Dow Jones Industrial Average) reaching fresh highs in recent days. Below is a summary of market performance YTD

What will the ride look like from here? One thing markets have proven over the past month is that even the best predictions and thinking can be proven wrong. So, of course, our thinking is by no means a guarantee of what is yet to come. However, from where we sit, we remain constructive on a well-diversified portfolio with a slight bias towards equity securities. This is not to say there aren’t many risks that could disrupt markets in the short-term (ie: tariffs, geopolitical issues, upcoming election, recession potential). However, in a world where US interest rates sit near historic lows (and are expected to be lowered further later this year), it remains paramount for savers to incorporate some level of risk assets into their portfolio in order to achieve their desired growth. However, at all time highs, now may also be a wise time to review your actual vs. target allocation and adjust any imbalances/overweights

How can I stay on the ride? This is one of the hardest things for investors to do – stay seated no matter how rough the ride. It’s easy to want to flee (ie: go to cash) right after the drop, as it makes us feel like the downward movements will never stop. There is no quick-fix to fight this sensation, however, one tool we use is focusing on cash flow and liquidity needs. How do you do this?

First step – determine how much money you need your portfolio to “pay you” each year to achieve your goals/desired lifestyle. Second step – multiply that amount by 4-6 years (which is the likely duration of a recession, using 2008 as a guide). Note, if you are not yet living off your retirement but plan to within that time period, it may be worth including the years before retirement, plus this range.

Compare that result to the funds (in $) you have allocated to cash equivalents and fixed income (you could also include your annual dividend/interest income in this calculation as well). If you have at least that amount in these categories, in our view, the “ride” shouldn’t be of primary concern to you as you know that your near term needs will be met as your risk assets are allowed to keep growing (albeit perhaps not along a straight track). That is the price you pay for higher return potential over time. But provided you have sufficient liquidity and cash flow on hand, sit back and enjoy the ride (and maybe put a bit of cash to work after a swoon). (Note: everyone’s situation is different. Please work with your financial advisor to determine the allocation and approach that is appropriate for you)

What’s around the next turn? We’ll find out together. Stay buckled in and enjoy the ride. Investing is a privilege and should be viewed as such – even when the ride gets a little bumpy.

Invest on,

Pam

Leave a Reply

You must be logged in to post a comment.

Leave a note