View from the Chair: Windermere’s Market Perspectives (December 2020)

December 9, 2020

One silver lining of 2020 is that we hear from clients far more than we used too! If there ever was a year we all need to talk financial matters out, 2020 was it!

We are loving the frequent discussions, debates, and opportunities to work thru this challenging time together. We’ve heard some similar questions in recent weeks, so I thought I’d take the time to answer them here

I keep hearing about a K Shaped Recovery? What does that mean?

It’s been a bit of alphabet soup this year as news media and economists have attempted to explain the trajectory of the recession and corresponding recovery. There was debate about whether it was a V (downward move followed by a fast/equal sized upside move), an L (sharp downward move and a leveling off) and many others that included a Nike Swoosh and a W. However, I have to say the “K” shaped recovery is the most accurate depiction I’ve heard to date.

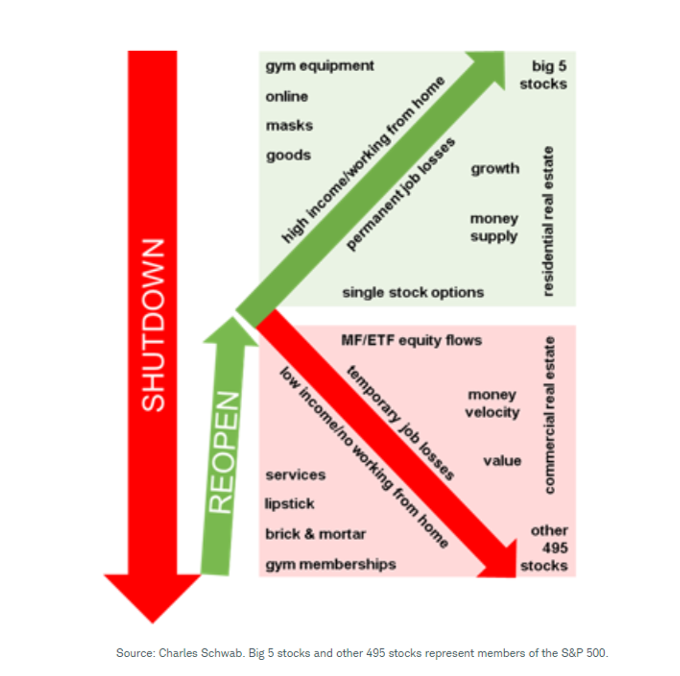

This illustration (from a recent Schwab presentation) explains it better than words can

The letter K is in fact the perfect representation of the fact that while virtually all parts of the economy fell immediately, since that time there have been clear “winners and losers.” The fortunate groups have recovered (and in some cases, are better off than before), while others are suffering. The disparity applies to many categories (some shown above and countless others). Hopefully, the bottom portion of the K will see a turnaround as we emerge from the pandemic, but it is likely to take some time and there may very well be permanent and lasting damage. Upcoming fiscal measures are likely to focus on this segment and likely can’t come soon enough

The stock market is disconnected from reality – how can it be doing so well when the virus news is so bad?

I hear some variation of this question daily – either from clients or in the news media. With virus cases rising, certain segments of the economy suffering (such as travel) and vaccines still months away from mass availability, how can the stock market be doing so well?

Few things to remember:

(1) Stock markets are forward indicators – Stock markets are not looking at (and pricing off of) today’s events. Instead, they are making a prediction of what will occur in the future and discounting those cash flows and earnings back at today’s interest rates. As future earnings/cash flows look bright out in 2021 and beyond as we emerge from this pandemic (this is the numerator) and interest rates stay low (this is the denominator), equity values tend to rise (calculated as numerator/denominator)

(2) Always about the alternatives – Every investor has a unique set of goals that in turn dictates the risk and return they are targeting. The selection of which investments they need to own to meet those goals will evolve over time and will depend on the risk/return profile of the various available alternatives (ie: cash, fixed income, equities, etc). With record fiscal and monetary responses (both in the US and globally), interest rates have once again reached historic lows. This can make owning fixed income challenging for many investors, as principal may erode if rates rise and coupons can’t offset that as the levels are so low. Low rates also make yields on cash negative, when considering inflation. As a result, some of the strength in stocks is likely from investors having to adjust their asset mix to meet their longer-term goals (as fixed income and cash alone simply won’t get them to their goals)

(3) Markets, where buyers and sellers meet – Not to over simplify things, but any market (even the stock market) is made up of buyers and sellers and follows supply and demand principles. There is always someone on the other side of a trade. When there are more buyers than sellers (more demand than supply), prices tend to rise as sellers need to be incented to sell. And when there are more sellers than buyers (remember March and April of 2020?), prices tend to fall. With that said, we see a few reasons why there is strong demand for equities: The realization of low rates in fixed income (and need to adjust asset mix), record high cash levels/savings rates during the pandemic entering the market, and the need of pension and endowment funds to match assets with liabilities (which are now higher as discount rates have fallen). And again, high demand tends to lead to prices drifting higher

What should I do before year-end?

Fortunately for you, as a Windermere client, we will be in touch with customized advice you may wish to act on before year-end. You can also review this checklist we put together!

That’s it for today’s question and answer session! All the best this holiday season and we will be back with another column in January 2021.

Invest on,

Pam

Leave a Reply

You must be logged in to post a comment.

Leave a note