View from the Chair: Windermere’s Market Perspectives (July 2020)

July 7, 2020

Here we are. Still crossing the figurative bridge (read earlier posts here and here) over a vast valley of uncertainty. We’ve come a long way in our journey, enduring global economic shutdown, skyrocketing unemployment, considerable strife and tragic loss of human life, and seemingly never ending uncertainty about what comes next.

Even though life seems to be progressing (albeit slowly) to a more normal state and economic activity is picking up, as I wrote about last month, when it comes to investing, it always has been and will always be, an ongoing journey.

As I said in that post, It will always simultaneously be something we have gotten thru and something we have yet to get thru.

We are still making our way through this downturn and recovery. We are still battling the illness worldwide. We are still navigating our own fears about our health and safety. Simply put – we are still on the bridge.

Let’s take a short pause in our journey to see where we’ve been, where we are, and what lies ahead

Where we’ve been

-

The National Bureau of Economic Research declared (in early June) that the recession began in February 2020, ending the longest expansion in American history and finally answering the question “when will the next recession arrive?”

-

This recession was clearly event driven, as the corona virus forced shutdowns in almost every major country around the world, including the US.

-

The shock to the market was rapid and severe, with equity markets falling 30% in a matter of weeks and interest rates reaching historic lows.

-

The response by the US government – and arguably more importantly, the US Federal Reserve Bank – was equally swift and immense.

-

As the realization of the fiscal and monetary response settled in and investors regained confidence, markets began a whipsaw rebound off the lows. As of June 30, 2020, the S&P 500 is now down just 3% on the year and the Nasdaq reaching new highs (up 12% YTD)

Where we are

We’ve lived thru a full market cycle (which usually takes years, if not decades) in a matter of months. This is not a “normal” time. Investors we’ve talked to are either feeling emboldened or confused (and in many cases, a little bit of both). It is a time unlike any other.

If we’ve learned anything from the past few months, it is that we never really knew what was coming next. We may have thought we did and applied past history and professional knowledge – but in reality, no one can say with 100% certainty what the future holds.

However, as investors, our job remains to assess the environment, focus forward, and take action. Here are some things we are observing and keeping in mind from where we stand today:

-

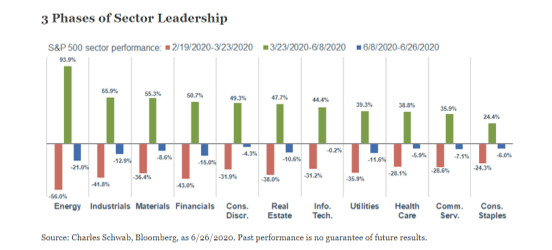

Disparity among sectors – As illustrated in this chart from Charles Schwab & Co., Inc, sector leadership has varied greatly during the recovery, depending upon which time period you focus in on

-

Cyclical leadership? – In our view, the next leg up in the market will be carried by the traditionally cyclical sectors that have all but been forgotten in this recovery rally (think financials, industrials, materials). That recovery may not be immediate as it will likely not occur until earnings come back, but we do see sector leadership shifting to these cyclical categories (as has been the case in all recovery periods in the past)

-

Consider a barbell – As we’ve written, we are utilizing a barbell approach to markets – having exposure to sectors/names/asset classes that have done well (and will likely continue to do well) in a “COVID world” – and have an almost equal weight to cyclical/”bounce back” sectors/names/asset classes that will likely lead in a recovery period. Why have both? As stated above, now more than ever, we can’t be certain of the outcome or duration of this event. We need to benefit from both realities for the time being

-

Gambling or investing? – If you’ve followed the business news, you’ve likely heard about the shocking level of new retail accounts and the volume of trading in seemingly speculative names (such as Hertz upon declaring bankruptcy). This has led to some unusual trading activity in certain names, as well as a general belief that many are using the stock market as a form of gambling (with sports betting and casinos off the table at the moment.) This is worrisome to say the least. Be careful out there!

-

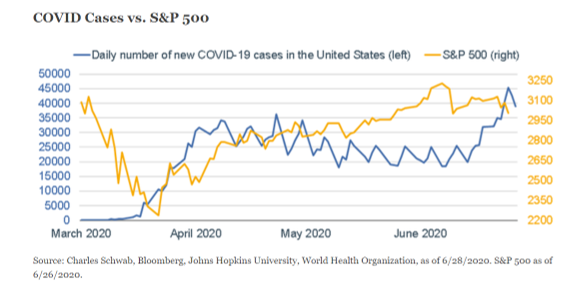

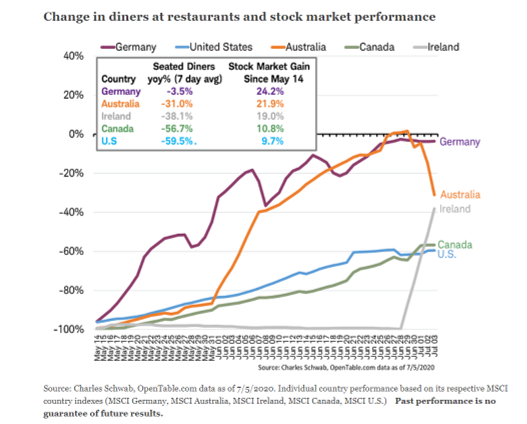

Settle in for more volatility – News can change minute by minute in today’s world. We’re living in the middle of a pandemic, an election year, and a time of great civil unrest. As shown in below Schwab charts, markets can correlate with many headlines, including new COVID cases or even restaurant openings. The message is clear – stay alert and stay patient. It’s going to be a bumpy ride!

Where we are going

We will reach the other side of this.

It may not seem like it now, given the recent news flow on increasing cases and outbreaks – but a time will come when the virus is under control. It’s just a matter of when. And as markets are forward looking, it is highly likely that the price response to us reaching the other side of the bridge will be priced in before we get there. So the most important thing to do – stay the course.

I know it isn’t easy but there are a few things you can do to pass the time. At the risk of repeating myself, here are some actions to keep in mind as you continue on your journey.

1.) Revisit your target allocation. Return expectations have changed for asset classes. Does your target allocation (and implied returns by asset class) allow you to meet your longer term goals?

2.) Rebalance. Often! We suggest doing this much more frequently (as markets remain volatile and can rise multiple % in a matter of hours/days). Add into weakness and sell into strength. Be sure to watch weights of individual names as well

3.) Be honest. Look back at your reaction to the past few months. Have you been stressed and worried? Did you sell everything at the bottom? Or have you been able to weather the storm? No matter what your reaction (all are justified and uniquely yours), it’s worth studying it and adjusting your investment approach moving forward

4.) What else? Consider available investing alternatives in context of your goals (ie: while cash is “safe”,” will earning 0.10% on savings allow you to reach your goals?)

5.) Go back to basics – review your budget, seek to increase savings or improve earnings level, save at regular intervals at all different market points (via employer plan or your own automated savings), review your debt holdings and see if better interest rates are available.

6.) Focus on what you can control – your chosen advisor, your goals and plan, your curation of media, your thoughts, your savings level, and many more. Tune out what you cannot

7) Focus Forward – markets are forward looking – you should be too. Don’t focus on what has occurred but rather what the future will look like. Don’t look at what has worked up until now. Give some thought towards what may work in the future

8.) Truth – Remind yourself of things we know to be true

9.) Put time to good use – have a vacation cancelled or plans changed? Use this “extra” time to revisit financial matters you’ve been neglecting (estate planning, tax planning, financial planning) – the list is endless!

10.) Don’t quit – No matter what, don’t halt your journey. After all, we didn’t come this far to only come this far

See you on the bridge – I’m right there, walking alongside you.

Invest on,

Pam

Leave a Reply

You must be logged in to post a comment.

Leave a note