View from the Chair: Windermere Market Perspectives (September 2020)

September 9, 2020

“Are we there yet?”

When I was a kid, within about 20 minutes of any road trip, I would inevitably shout this question from the back of the station wagon.

As we enter our sixth month of “life since COVID-19,” I’d venture to guess we are all asking ourselves this question in many areas of life..with “there” being a place in time characterized by the stable ground, soothing familiarity, free movement, and precious reality we all once took for granted.

The answer is likely the same as my parents repeated to me – “Nope!” We aren’t “there” yet, but we have made progress (towards reaching something that while not the same as it was, will at least bear a resemblance).

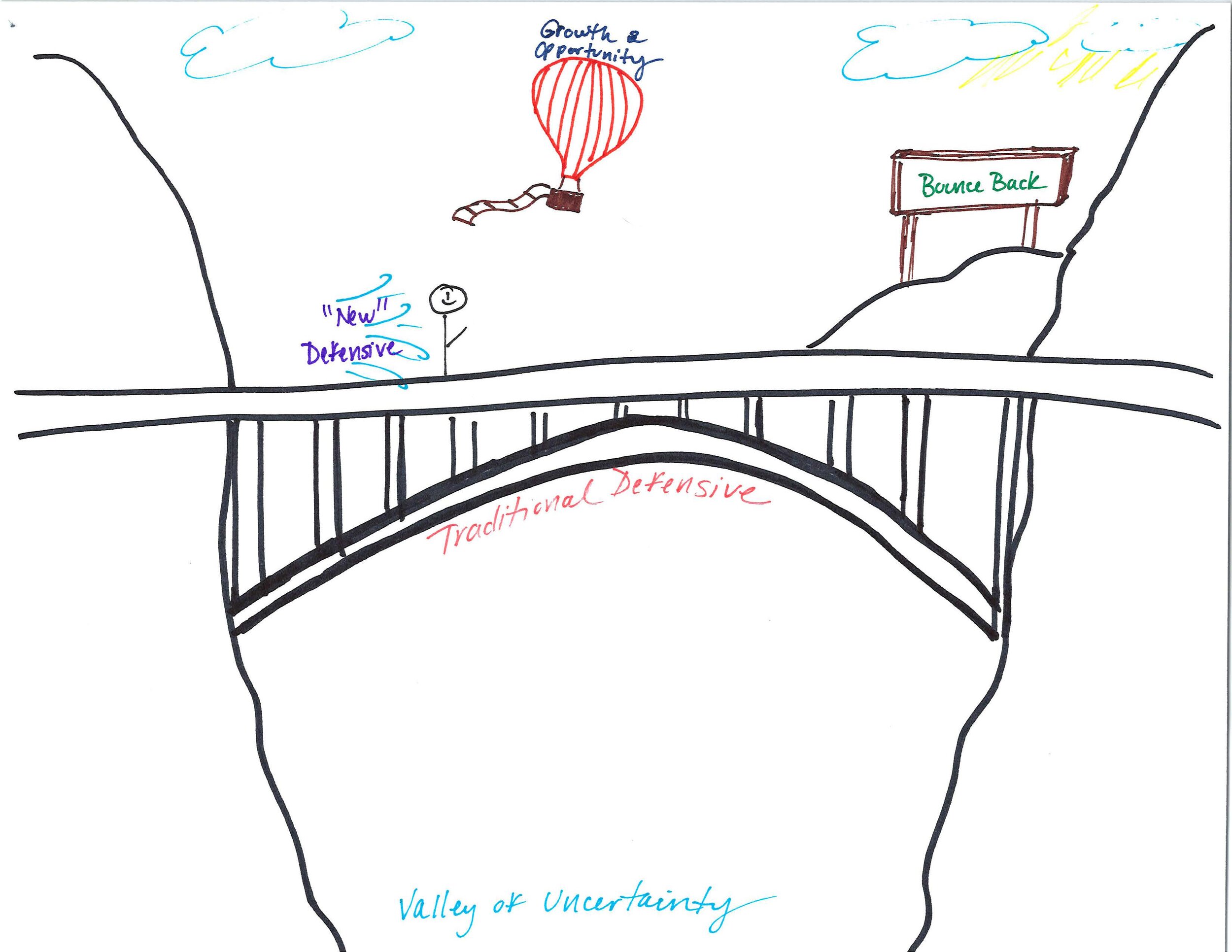

The same applies to investing in the times of COVID. If you remember, I introduced my art skills (ha!) in a May blog post, where I presented this illustration to explain how we were viewing investing during this time. Now seems like a perfect time for an update on the journey – framed with questions you may also hear during a roadtrip

*Where are we? – Still on the bridge. We continue to make our way across the valley of uncertainty. It’s true – things appear far more “certain” than they did back in March when this began or even in May when I sketched this illustration. We’ve benefited from strong fiscal stimulus, assertive monetary reactions, re openings, strong earnings reports from many companies/sectors, and ongoing scientific progress. However, we are still crossing the valley. Further stimulus talks have stalled, concerns over civil unrest and the election are rising, and new cases are not falling as fast as we would like. Uncertainty remains and the virus is not yet contained

*What should we pack? – We continue to believe that a “barbell” approach remains appropriate. The New Defensive category (think technology companies with strong balance sheets and exponential earnings growth) have been an ongoing tailwind (even with sell off in early part of September). And traditional defensive (such as cash, bonds, and consumer staples) have also helped investors keep their footing. However, we also believe that exposure to “bounce back” companies and sectors is appropriate. We’ve started to see some rotation and expect that to continue. We’ve been using strength from “new defensive”/defensive to add to the bounceback names as we continue on the journey

*Who are all these people? – Many people have started their investing journey during these times. The market “chatter” is stronger than ever. News of stocks “always going up,” wild movements on no news (like stock splits), record options trading by retail investors, and massive growth in online equity trading have all led to a certain level of reported mania when it comes to the stock markets. Always remember media’s job is to attract your attention. But there’s some truth – there are a lot more people on the bridge – many who may not be very well-equipped for the journey. Don’t worry about them. Know where you are going, focus on what you know to be true, and keep moving forward

*Which way are we going? – Forward. Always forward. It is very tempting to look over your shoulder and second-guess what you did or didn’t do. “Why didn’t I put cash in at the end of March? Why did I ask to take cash out? Why didn’t I buy xyz stock?” You can’t change past actions – learn from them, assess where you are at today, and move forward. Always

*Is it going to rain? You can see the sun in this illustration, but also some clouds. That is intentional. There will be days when everything is “clear skies” but then, the storm will also come. Stop trying to predict when “the rain” (ie: a market pullback) will come and simply prepare for it. Many are busy trying to predict rain – whether it be a spike in cases, closing of businesses or universities, failure of a vaccine, or the upcoming election. While interesting to wager a guess on these matters, it’s far easier (and productive) to prepare yourself for any weather. Keep your emergency cash fund fully funded, add new cash in a systematic way, maintain portfolio diversification, monitor concentrations, work with a trusted advisor, and focus on forward motion

*Are we there yet? – Bad news – no, we are not yet past the turmoil specific to COVID-19. While some markets and stocks have reached all-time highs and this could mark the shortest bear market and recession on record, we have a ways to go to get thru this time. I for one will feel like we are close to the other side when we see further scientific progress and an ongoing decline in new cases.

Now for the good news – it doesn’t really matter when we get across this bridge – as we are never really “there” when it comes to investing. The minute we reach the other side of this valley, we will encounter something else – whether it’s a mountain or a flat plain of an individual bump in the road, something else is inevitably coming. That’s the point – our journey continues. We’re not meant to reach the end but rather evolve and adapt and most importantly – keep on moving through our investing journey.

Invest on,

Pam

Leave a Reply

You must be logged in to post a comment.

Leave a note