View from the Chair: Windermere’s Market Perspectives (January 2021)

February 3, 2021

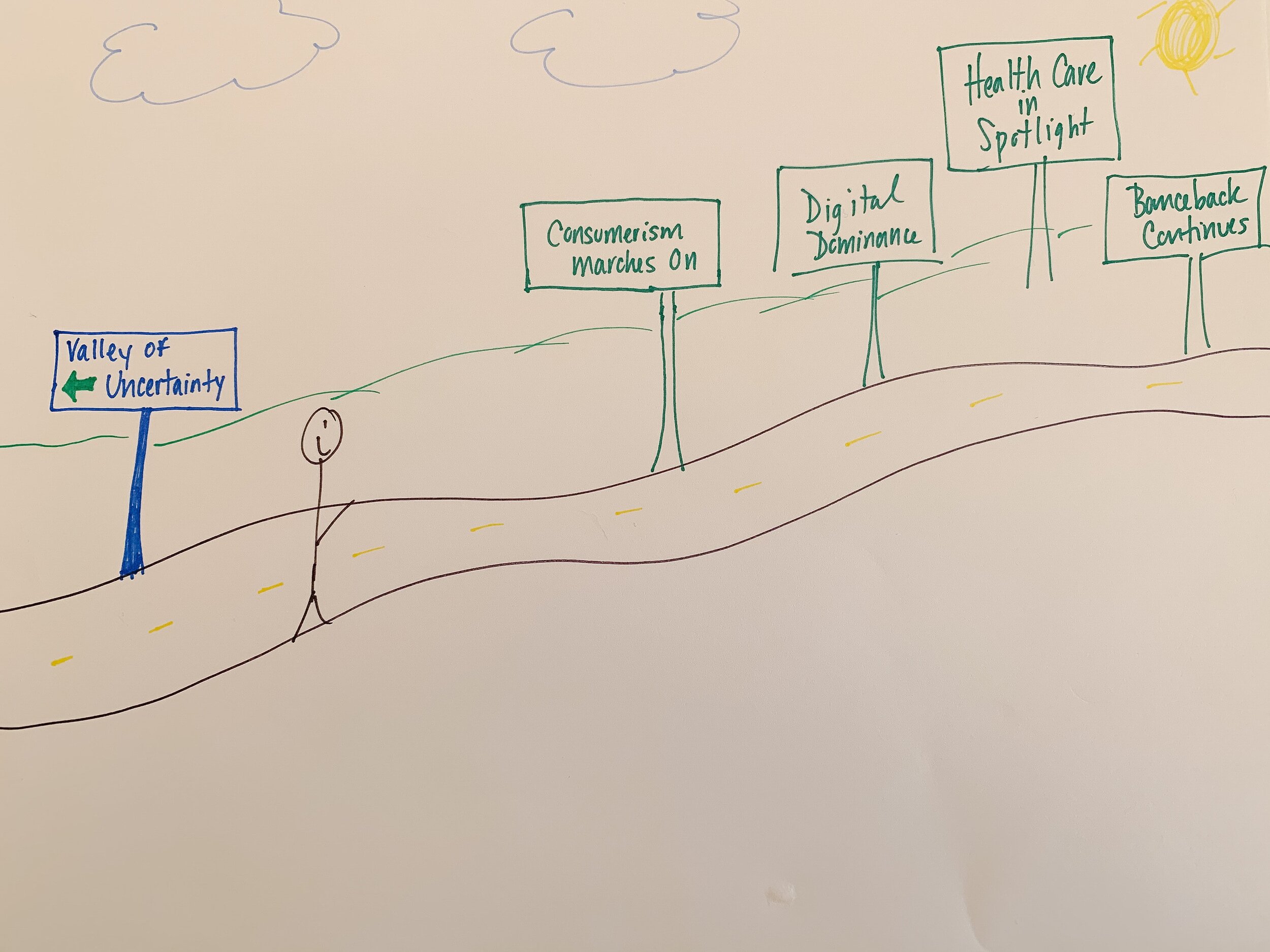

During 2020, I wrote frequently about the investing landscape. I even drew a picture to illustrate what we were facing as we crossed the “Valley of Uncertainty” (you can read the blog posts from May, June, July, and September)

So where is our investor now? I was anxious to put my artistic skills to work yet again, so here is a snapshot of where we believe we are as 2021 gets underway. (Yes, I realize it’s a good thing I’m not a professional artist, but it’s the underlying themes that count!)

As you can see above, the valley of uncertainty is behind us. Thanks in large part to the government’s response (both in the US and around the globe), fiscal and monetary actions helped build a sound foundation below investors’ feet and almost all sectors and segments of markets posted positive returns for 2020.

As we enter 2021, we still believe there is a steep hill ahead for investors – COVID remains a harsh reality and it has become a race between the vaccine and the new more transmissible variants. We finally know the results of the election and the markets will adjust to having a democratic majority. Interest rates are stubbornly low and inflation is present, raising concerns around the ability to earn any level of real return on fixed income. Equity valuations appear stretched in certain areas of the market but in many others, valuations appear far more reasonable in context of the other available returns (ie: Equity risk premium levels).

Given that landscape, what is our investor supposed to do?

Focus forward and heed the advice of the road signs (each of which described a theme we are adhering to in our portfolios as we embark on our 2021 journey)

1.) Consumerism marches on – one of the surprising brightspots in 2020 was the strength of the consumer. While we acknowledge that some level of unemployment remains (particularly in leisure and hospitality sectors), the majority of Americans are in a better place than they were a year ago. Record levels of stimulus, in the form or direct payments, higher unemployment, and business assistance, has put considerable amounts of cash in consumers hands. The majority of these funds have been saved as we’ve seen consumer cash grow to record levels and credit card balances decline. The consumer has liquidity and pent up demand. We see this as a tailwind for 2021 and beyond

2.) Digital Dominance – the technology sector has led the past decade of investing and its leadership was never more evident than it was in 2020. Many technology companies have a double-sided benefit to the long term compounding of wealth – they generate considerable amounts of free cash flow (as they have high growth rates, high margins and low costs) and they have the ability to scale without much added costs. For instance, it’s far easier for a software as a service business to grow its customer base (sell license to new customer) than it is for a traditional brick and mortar retailer to do so (build more stores to expand geographically)

3.) Health Care in Spotlight – for many years, we have remained underweight this sector as regulatory pressures loomed. Even though democrats control government (and that party has historically been tougher on health care, drug pricing, etc), we see opportunity in this sector. As health care companies have been the ones leading the charge to help the nation emerge from COVID 19, it’s unlikely there will be mounting pressure on these businesses any time soon. In addition, it was a considerable embarrassment to the US government to be caught flat footed last spring in terms of PPE supply on hand in the US and we foresee corrective action to build up that supply in near future. Finally, the businesses we like in this sector generate considerable amounts of free cash flow, grow that cash flow at a reasonable clip each year and often times pay a nice dividend yield – all factors that allow these equities to serve as reasonable bond proxies in the low rate world

4.) Bounceback continues – The economic recovery trade has been in full swing since the fall when vaccine news began to emerge. We do still see selected opportunities in this area that will evolve as we get closer and closer to a return to (new) normal

The road signs are far more encouraging than they were in 2020. And yet, the challenge remains the same – focus forward, adhere to the road signs, stay invested, and keep putting one foot in front of the other.

Invest on,

Pam

Leave a Reply

You must be logged in to post a comment.

Leave a note