Client Question: 2026 Tax Announcements

October 15, 2025

It may seem far too soon to worry about 2026 taxes (many just filed 2024 taxes after all!) That may be what prompted a client to ask if there really was news last week regarding 2026 taxes. Turns out there were in fact some announcements made that are good to know – never too early to plan!

The One Big Beautiful Bill Act (passed in July 2025) made the 2017 tax cuts – that were scheduled to expire at the end of this year – permanent and also added some new rules that will take effect in 2026. The news last week doesn’t change any of the OBBA items. In fact, it was pretty harmless and actually works in tax payers favor. Each year, the IRS adjusts more than 60 tax provisions for inflation, which includes upward adjustments to the tax brackets, standard deductions, and other provisions.

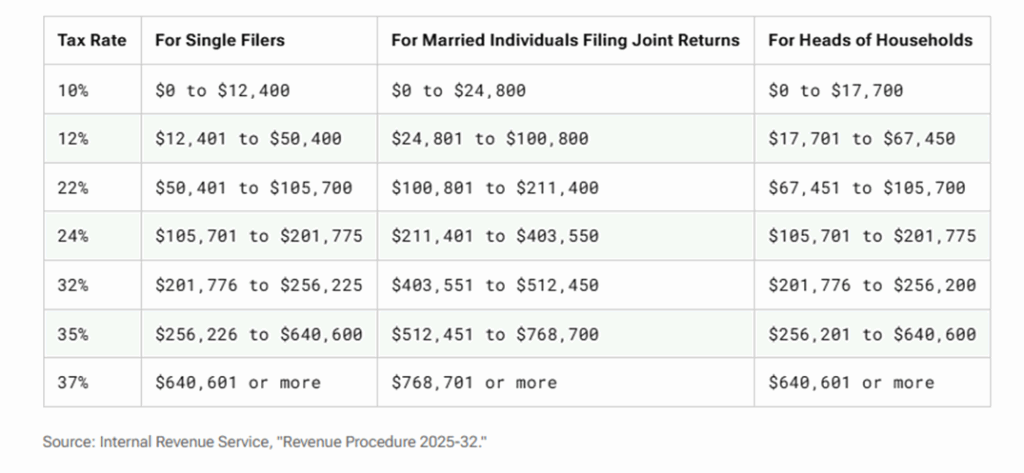

Perhaps most importantly are that changes to the tax brackets. As you well know, the federal income tax system has seven rates, all of which apply to a different income strata known as brackets. Due to inflation, the brackets have all been increased

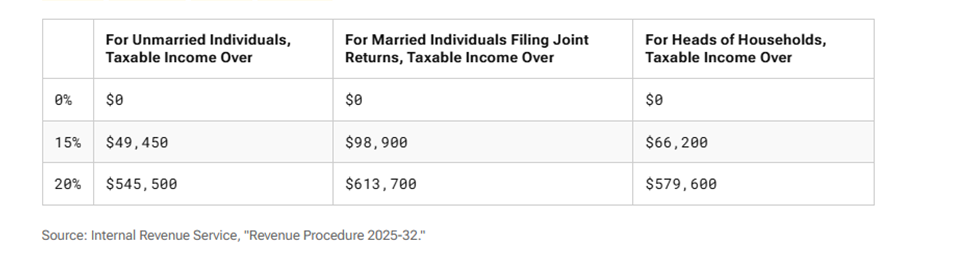

Capital gains are also taxed at varying rates and those brackets also increased

The standard deduction will also be higher in 2026 ($350 higher for single, $700 higher for joint versus 2025).

A whole host of other numerical tax provisions (including AMT exemptions, QBI phase outs and earned income credits) were adjusted for inflation.

See full summary here and happy tax planning!

Leave a note