Beneath the Surface: Inflation

July 29, 2022

It’s easy to get stuck on the headlines these days – especially when it comes to inflation. Turn on the tv, listen to a podcast, open your email – and odds are you will see some sort of jarring financial headline concerning inflation. Even a drive past the gas station can bring the topic front and center!

There is no doubt – prices are rising and we are all feeling it in some area of our financial lives. Is there any hope of prices declining? If you focus solely on the headlines, you may not be very optimistic. However, if you look beneath the surface, you may just be pleasantly surprised

As we’ve mentioned in the past, we subscribe to various research services, one of which is Fundstrat. They have been providing some very helpful data concerning inflation in recent weeks. They argue (and I tend to agree) that inflation and its direction and rate of change from here is arguably one of the most important factors for markets. As a result, they are following it very closely and I thought I’d share two recent illustrations that help add some context to the headlines.

Various Data Points

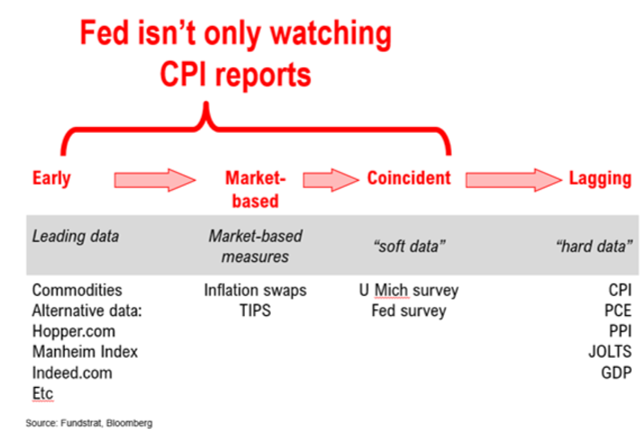

In this first chart, FS Insights outlines the various ways inflation is tracked and in what sequence the data appears. On the far left, you can see the leading data (ie: the places where inflation is first noticeable in the economy). A few of these include commodity prices (such as lumber, precious metals, and grains) and job postings.

After those early indications appear, the market tries to make sense of the trends and makes its own bets concerning inflation. These market measures are visible thru items such as the implied future inflation being priced in by the TIPS market (TIPS are inflation adjusted treasuries and the difference between the yield on TIPS and regular treasuries (referred to as the breakeven rate) is the market’s inflation expectation).

After inflation makes it way thru early data and markets react, it can then start to appear in soft data, which includes sentiment driven/qualitative measures such as various consumer surveys. And finally, the lagging (ie: last place it shows up) data includes the quantitative measures that we are all familiar with including CPI and GDP data.

Each of these data points are useful and are meaningful measures of inflation. However, if you stop and assess what data is being picked up in the headlines you read/see on TV when inflation is being discussed, you may see a potential problem.

The hard data is what dominates the news cycle – ie: it is what has bubbled up above the surface. CPI rose x%, GDP fell y%, and on and on. However, as we will show you below, the headlines may be very different if all of the metrics (and their trend lines) were taken into consideration.

Follow the Trends

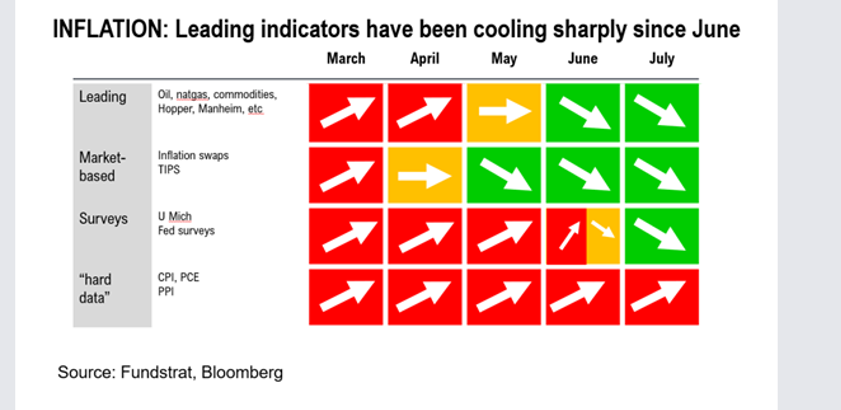

The next chart I wanted to share shows how each of these inflation data buckets (leading/market/soft/hard) are trending in the past few months. Remember – markets care far more about the trend (ie: better or worse) than the level (ie: good or bad)

As you can see above, the early data is already rolling over. Commodity prices have collapsed in many key areas – including energy. That has already started to show up in the market based data, with breakeven rates falling to ~2.5% across most maturities. Survey data is still a bit challenged but improvements are being observed. And yet the hard data has yet to abate – and may not for a month or more. Remember, those are lagging indicators so their change will follow..it just takes time.

It’s our belief that markets – and the Federal Reserve – are starting to observe deflation and are encouraged that we will get prices under control.

Time will tell – but in the meantime, as we look to understand where markets go from here, rest assured we will keep diving beneath the surface

Leave a Reply

You must be logged in to post a comment.

Leave a note