WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

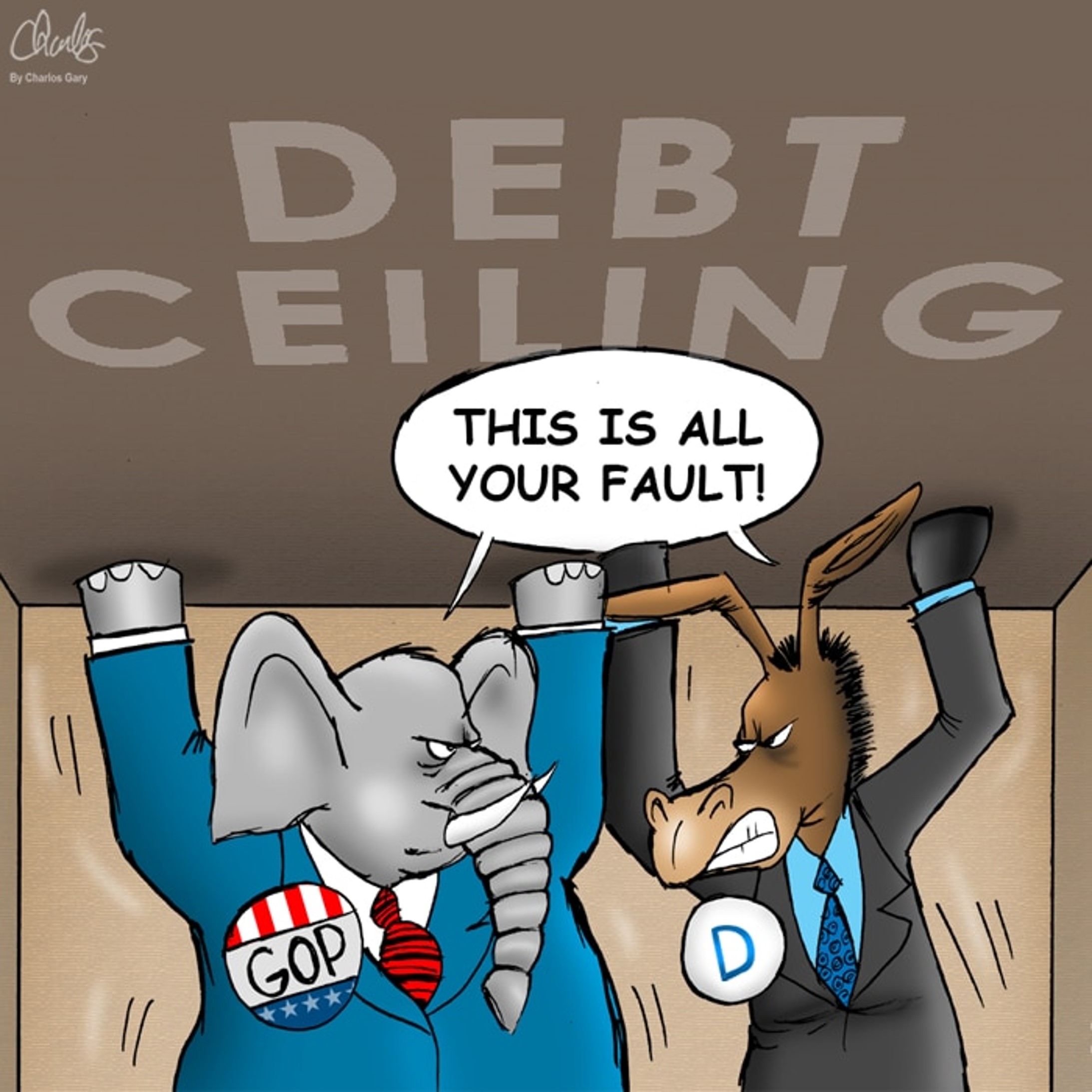

2023 is quickly becoming the year in which I discuss topics I never imagined would come up with such frequency, if at all… topics such as bank failures (see March 2023 publications) and now the potential of a US default. But in life it seems we should expect the unexpected! The United States is a […]

May 25, 2023

read more

Undoubtedly, our clients are free to do what they choose with their invested funds. However, it is not uncommon for them to seek my advice when it comes to withdrawals – especially those that are above and beyond their planned/recurring distributions. Taking funds out of savings runs contrary to what our actions have been most […]

May 24, 2023

read more

I onboarded a new client this week, and within minutes of looking at his pre-existing Roth IRA and tax returns for the given years, I realized he had made improper contributions to his account (due to exceeding the income limit). While he had an advisor helping him, that individual did not confirm my new client’s […]

May 18, 2023

read more

I receive a weekly newsletter from Jesse Itzler, a serial entrepreneur and speaker who has a unique and compelling take on many topics. In a recent newsletter, he took readers thru a quick exercise to illustrate an innate human instinct. I’m about to put my own spin on this same exercise to reiterate the point […]

May 18, 2023

read more

***** Most clients know how much I respect Warren Buffett and Charlie Munger, so it goes without saying that I tuned into the annual meeting this past weekend. A client asked what I thought of the meeting and after that brief discussion, I thought it was worth summarizing five top lessons I gathered (with a […]

May 11, 2023

read more

Here we are again – another month, another set of inflation readings. April’s reports were both very encouraging. The Consumer Price Index (CPI) report for April was released this week, and it showed clear progress in the ongoing battle against inflation. CPI rose 0.4% in April and 4.9% year over year – both 0.1% lower […]

May 11, 2023

read more

In reviewing a portfolio with clients this week, we were discussing a particular holding that was under water (valued at less than they paid for it). We had a good discussion about how to approach positions in an unrealized loss status and I thought it would be worth sharing Investing in public markets is a […]

May 4, 2023

read more

Here we go again. Earlier this week, as expected, the Federal Open Market Committee (FOMC) raised the fed funds rate by 25 basis points to a range of 5.0-5.25%. This is the tenth increase in this rate cycle (that started just over a year ago) and brings rates (from zero) to levels last seen before […]

May 4, 2023

read more

Every once in a while, I have a topic come up in multiple client conversations in a given week – and this week that happened with life insurance. I’m taking that as a sign that it’s a good time to cover a few considerations with this topic! Please note that I’m not going to address […]

April 27, 2023

read more

Being from Milwaukee, I likely shouldn’t admit this (shhhhh, don’t tell anyone!) – but I don’t watch a lot of Bucks basketball. Nothing personal against the Bucks, but NBA just isn’t on my usual radar. However, once playoff time rolls around, I can’t help but get swept up in the action and this year was […]

April 27, 2023