WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

Inflation seems to come up in every client conversation these days – rightfully so! This week it was an extra hot topic with Thursday’s latest CPI release for September 2022. Let’s cover some of the highlights What do I need to know about September’s inflation report? The September Consumer Price Index (CPI – or “CP-High” […]

October 13, 2022

read more

No, this isn’t a sing-along to the classic 80’s song but rather a question that I’m sure many investors (perhaps yourself included) find themselves asking after another rough quarter. Markets had a tumultuous end to Q3, as rates rose and equities sold off (read more about that dynamic in this week’s client question). In combination […]

October 6, 2022

read more

It’s hard to escape the constant chatter about rising interest rates lately, so it was only natural for a client to ask about the interplay between interest rates and asset prices. Interest rates are an essential driver of asset prices. You don’t have to take it from me – here’s a quote from famed investor […]

October 6, 2022

read more

We took a lot of road trips when I was a child. Much to my parent’s chagrin, I would usually ask (at least a few times per trip) the age old question – “are we there yet?” I wasn’t trying to be annoying, I promise! I was simply tired of sitting still, tired of waiting […]

September 29, 2022

read more

A client reached out this week to confirm what seemed like news that was too good to be true (especially in a year when it seems all prices are going up). Are Medicare premiums for Part B really going down in 2023? We’re happy to report the answer is yes! Read on to learn more. […]

September 29, 2022

read more

On Wednesday, the US Federal Reserve issued yet another increase in the Federal Fund Rate, bringing it to 3-3.25%. (Note: you can read more detail on the meeting and the implied rate path here) I listened to the press conference from Federal Reserve Chair Jerome Powell – and one phrase kept coming into my mind […]

September 22, 2022

read more

When in a meeting recently, I was explaining to a client a quick way to think about varying rates of return – the Rule of 72. The client wasn’t familiar with it – so I thought a few of you may also wish to learn more about this simple but effective formula. It’s called the […]

September 22, 2022

read more

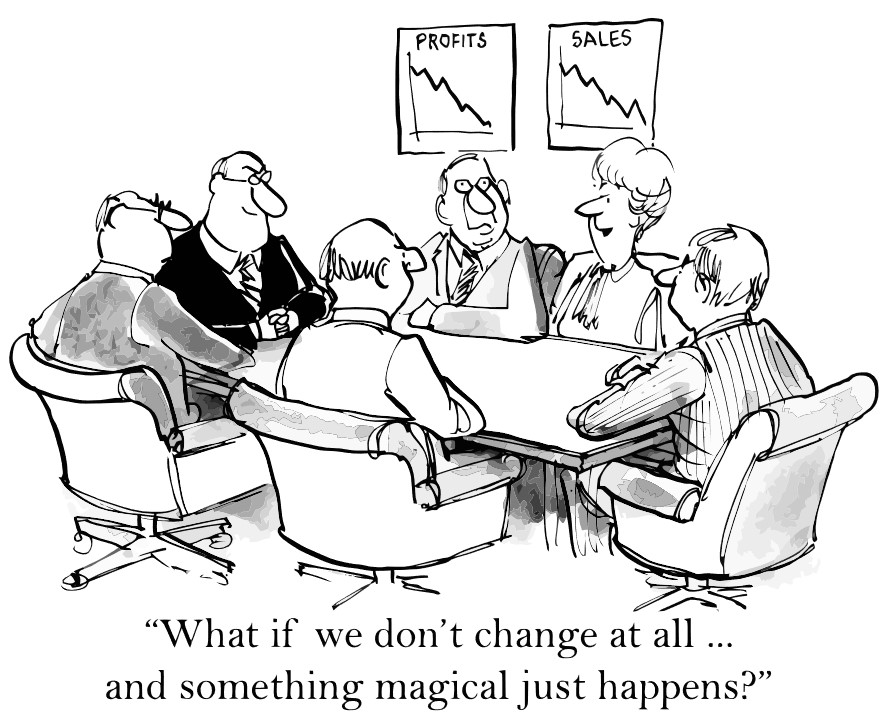

As I watched the recent inflation release on Tuesday (and the subsequent jarring market decline), a common phrase kept coming into my mind over and over – “change is hard.” How many times have I said or heard that saying in my lifetime? At least a few hundred – maybe more. Why do I always […]

September 14, 2022

read more

A silver lining of recent interest rate increases is the ability to earn some level of interest on cash balances. When reviewing the various options with a client recently, she asked what exactly a money market fund was and whether there were any risks associated with this investment vehicle. Let’s take a closer look at […]

September 14, 2022

read more

It’s officially back to school season. The streets are once again filled with school buses and my social media feeds contain pictures of smiling kids on their front porches, all ready for their first day. I always loved school. Not necessarily all of the logistics and social dynamics – but the learning element. Our school […]

September 8, 2022