WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

On February 29th (happy leap day!), the Federal Reserve’s preferred inflation measure – Personal Consumption Expenditures (known as Core PCE) was released for the month of January 2024. (Note: Core PCE excludes food and energy, which can be very volatile.) Core PCE increased 0.4% for the month and 2.8% year-over-year, exactly in line with expectations […]

February 29, 2024

read more

I fully appreciate how much industry jargon there is in the financial world, so I do my best to not use it. Finances are confusing enough in plain English right?! However, when talking to a client this week, I accidentally used a jargon phrase and was asked to stop and clarify. The phrase was “clipping […]

February 29, 2024

read more

The Federal Open Market Committee released the minutes from their latest meeting this week. As with all meetings, these recorded details of the actual conservations given market participants a bit more color regarding what the interest-rate setting body is thinking. These minutes covered the proceedings from January 30-31, 2024. There were a few interesting takeaways […]

February 22, 2024

read more

At least once a month, I have a client ask me about a cyber security related question (setting up two-factor authentication, best practices regarding wi-fi use, password issues, etc). It’s a great topic to discuss and sadly, it is also one that is becoming increasingly important with each passing minute. Our custodian, Charles Schwab, does […]

February 22, 2024

read more

This week, the Consumer Price Index (CPI) for January 2024 was released. The popular inflation report came in ahead of expectations, showing an increase in inflation during the month. CPI rose 0.39% in January, 0.09% more than expected. On a year-over-year basis, the index was up 3.1% (lower than December’s 3.4% but higher than 2.9% […]

February 15, 2024

read more

I’ve been hearing from a few clients this week asking when they will receive their 1099s from Schwab (the custodian we work with at Windermere). With tax season in full swing, I thought these reminders may be helpful for a wider audience What is a 1099? A 1099 is a tax form that reports non-employment […]

February 15, 2024

read more

A few weeks ago, a client told me that the movie “Dumb Money” was now available on Netflix. I watched the movie this past weekend, which portrays the still shocking events surrounding the surge of Game Stop stock in early 2021. The movie (while a bit crass and dramatic – it is a movie after […]

February 8, 2024

read more

I talked with two clients last week about their home equity lines of credit (HELOCs). These can be very helpful forms for available debt to have in place so I thought it was worth discussing in more detail What is a home equity line? A home equity line of credit (or a HELOC as it […]

February 8, 2024

read more

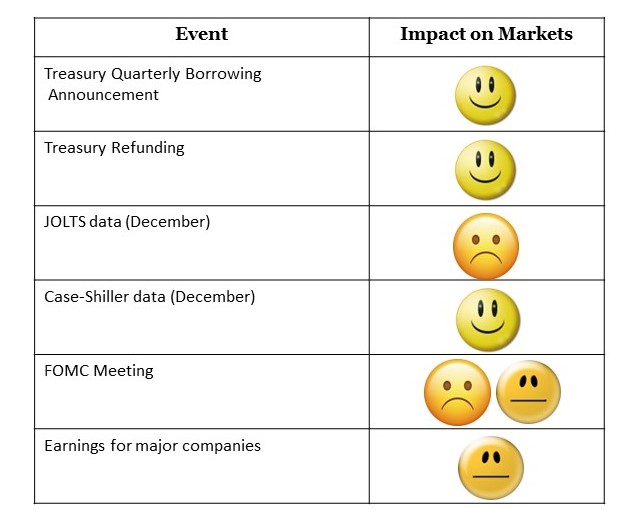

If you are a loyal reader of this weekly column, you are keenly aware of just how much there is to know and remember when it comes to your financial journey. The minute you think you’re caught up, you learn of another task you need to address! On this week’s list of things you need […]

February 1, 2024

read more

Ahh January. This month always feels like it lasts forever doesn’t it? The post holiday season let-down, the cold weather, winter storms, 31 days long.. you get the idea! Yet it is a very important month as it can the set the tone for the following eleven months. It turns out this is very much […]

February 1, 2024